The bull market hasn’t started yet.

Bitcoin is currently at a critical juncture, raising questions about the true state of the financial system. Recent data reveals a complex picture characterized by increasing sales activity and changing ownership patterns.

This analysis shows why, despite some bullish signs, Bitcoin has yet to fully embrace true bull market status.

The real ‘Bitcoin Bull Market' hasn't started yet.

According to blockchain analytics firm IntoTheBlock, Bitcoin has seen its sixth consecutive week entering Central Exchanges (CEXs). As of December, nearly $2 billion in net deposits have been recorded. This trend is commonly interpreted as a sign of BTC selling activity.

On closer inspection, Bitcoin ownership appears to be changing. In fact, the average holding time of recently traded Bitcoin coins has set a record high. This trend indicates that long-term holders are starting to move their assets, which reduces their Bitcoin holdings.

Interestingly, addresses with more than 1,000 BTC increased their holdings, while those with less than 1,000 BTC decreased in January. On the other hand, the balance held by short holders has been increasing since October 2023, a trend typically associated with bull markets.

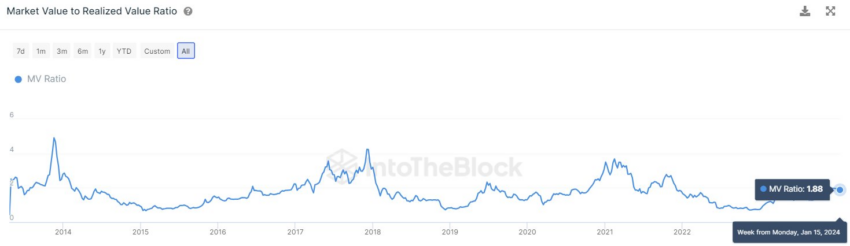

Still, the current market situation doesn't reflect the major features of the past, according to IntoTheBlock.

“Compared to previous bull markets, the lack of volume, the limited reduction in the balance of long-term holders, and a very modest MVRV ratio of 1.88, indicates that Bitcoin may be experiencing a temporary problem and is yet to enter a true bull-market region,” said an analyst at IntoTheBlock.

Read more: Who will have the most Bitcoins in 2024?

Juan Pellicer, senior researcher at IntoTheBlock, told BeInCrypto that caution is needed in interpreting these trends. He pointed out that Bitcoin has not experienced a significant pullback in six months.

Such a trend may indicate that the recent downward movement may be a natural market correction.

“As long as we see a steady spread of assets from long-term holders to short-term holders, MVRV ratios above 2.5 and significant increases in transactions and volume, it is too early to call the end of the asset boom. Bull market,” Pellicer said.

This misperception of current market dynamics highlights the need for in-depth analysis in the cryptocurrency market.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.