The Chinese company SOS has bought 50 million dollars worth of Bitcoin

The board of directors of Chinese data mining firm SOS Limited has approved a $50 million investment in Bitcoin. The decision was shared in the company's official press release on November 27.

SOS plans to use several business strategies for this investment. This includes quantitative trading, direct investment and arbitrage strategies.

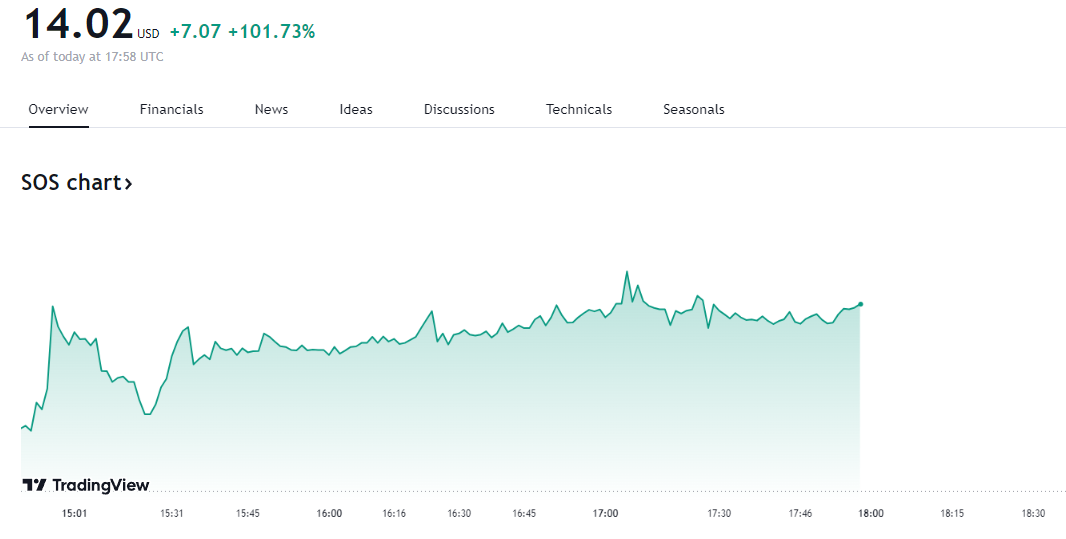

SOS stock surged 100% following Bitcoin buying.

This announcement is because Bitcoin has started to recover from its previous liquidity. BTC fell below $91,000 yesterday, the lowest in a week. However, the bullish cycle gained momentum as the largest cryptocurrency surged to $96,000 today.

Following this news, SOS Ltd's share price jumped nearly 100% on Wednesday, November 27th. The recent rise of cryptocurrency has increased participation from investors worldwide. SOS Limited's purchase of Bitcoin fits with the enthusiasm around digital assets.

The company sees Bitcoin as a key digital asset of strategic importance globally. SOS Limited supports the idea that Bitcoin can play an important role in global reserve strategies.

“We believe this investment plan will enhance the company's overall competitiveness and profitability in the digital asset investment sector,” said SOS Chairman and CEO Yandai Wang.

Public companies are very bullish on BTC.

Meanwhile, in recent months, Bitcoin purchases have been increasing at publicly traded companies. Earlier this week, MicroStrategy completed another round of Bitcoin purchases worth $5.4 billion. This is the third consecutive BTC purchase from Michael Saylor's company in November alone.

So far this year, the company has earned more than $16 billion in BTC, making it the largest Bitcoin holder in the industry.

Bitcoin's recent highs have also influenced the performance of Microstrategy stocks. MSTR is up 450% YTD, becoming one of the top 100 public companies in the US.

Also, crypto miner Marathon Digital recently raised $1 billion in convertible senior notes. As BeenCrypto previously reported, the lion's share of this fund will be used to buy more bitcoins.

Although Bitcoin has reached $99,000 in the current cycle, these major companies seem to be overestimated in the long-term value of BTC. Earlier this week, Pantera Capital announced that He predicted that the cryptocurrency will reach $740,000 by 2028.

The firm previously estimated that Bitcoin would be around $117,000 by August 2025, and we're not far from that mark.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.