The crypto crash wiped out $1.7 billion in gains, sending bitcoin down to $94,000.

Key receivers

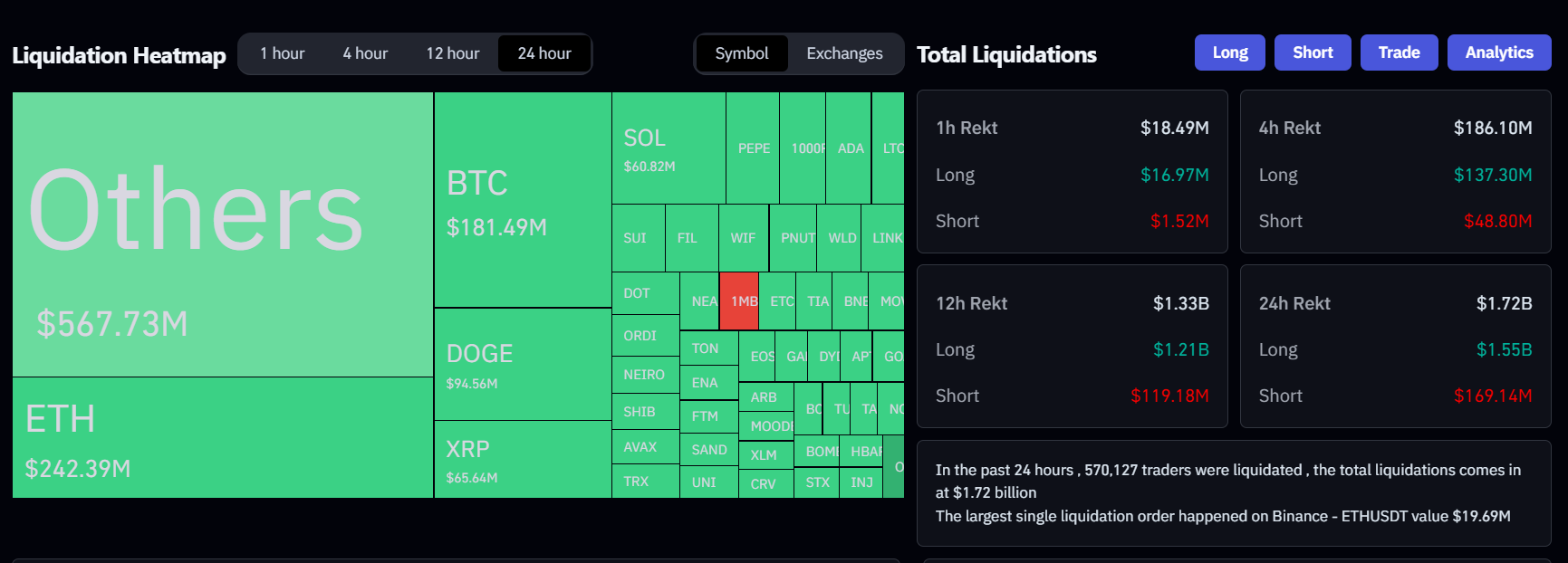

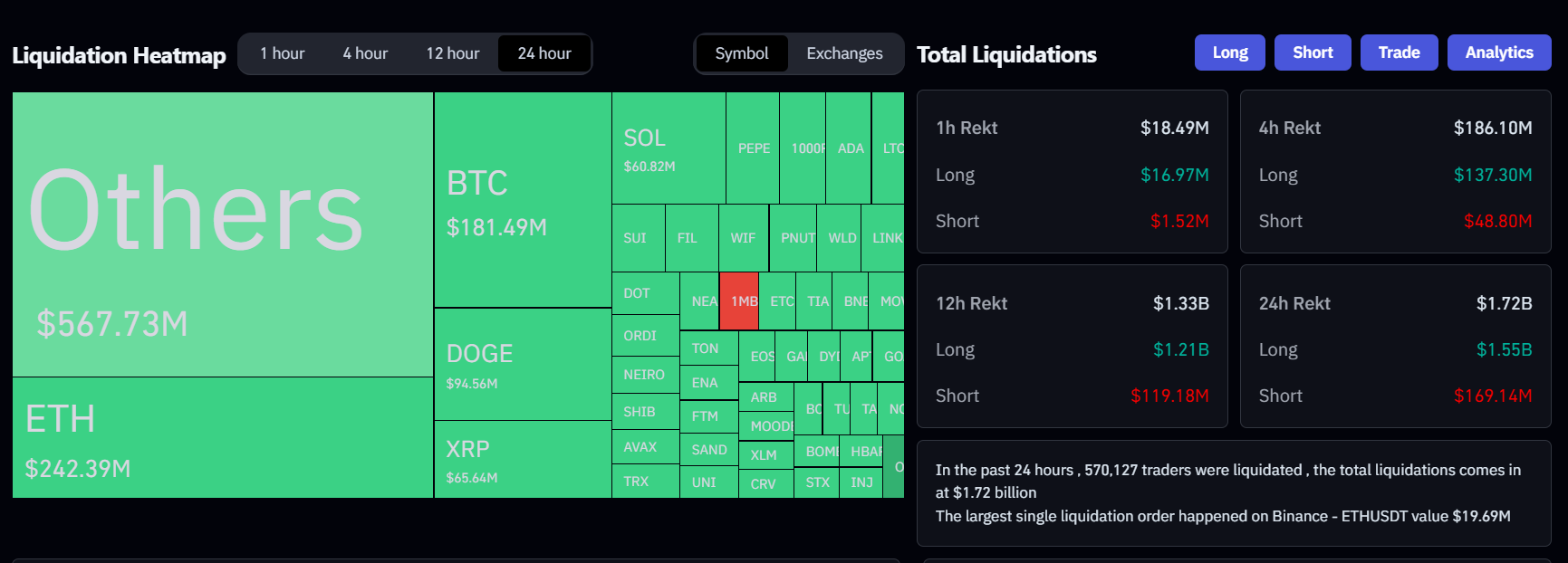

The crypto market crash resulted in $1.7 billion in leverage in 24 hours. Although there are concerns about the impact of quantum computing on crypto security, the current concerns are minimal.

Share this article

A sharp correction in the crypto market triggered $1.7 billion in liquidity in 24 hours, with Bitcoin falling more than $100,000 to $94,100 and Ethereum falling 8% below $3,800, according to data from Coinglass.

The sell-off in the market led to $168 million in short-term liquidations and $1.5 billion in long positions, a 7.5 percent drop in the overall crypto market value.

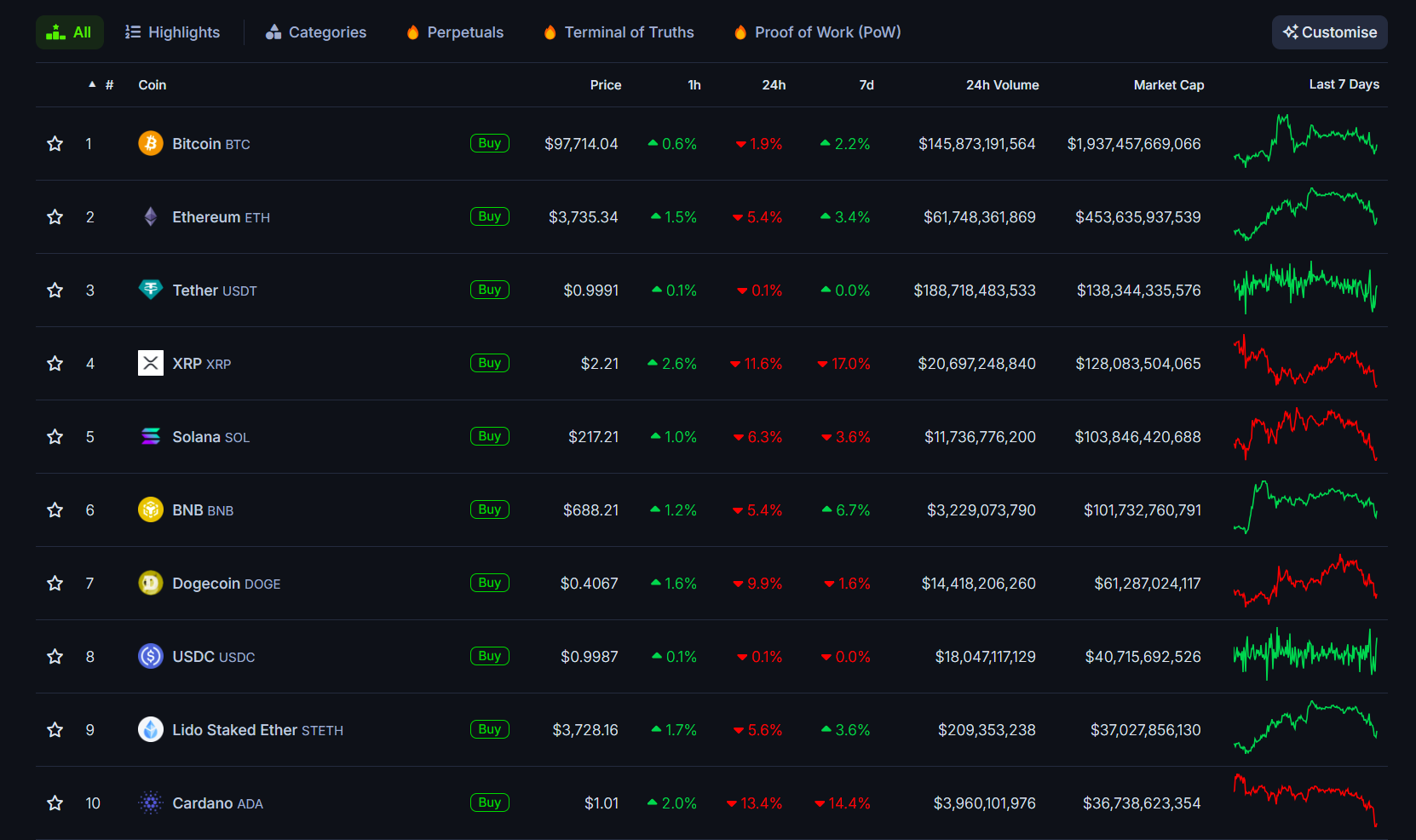

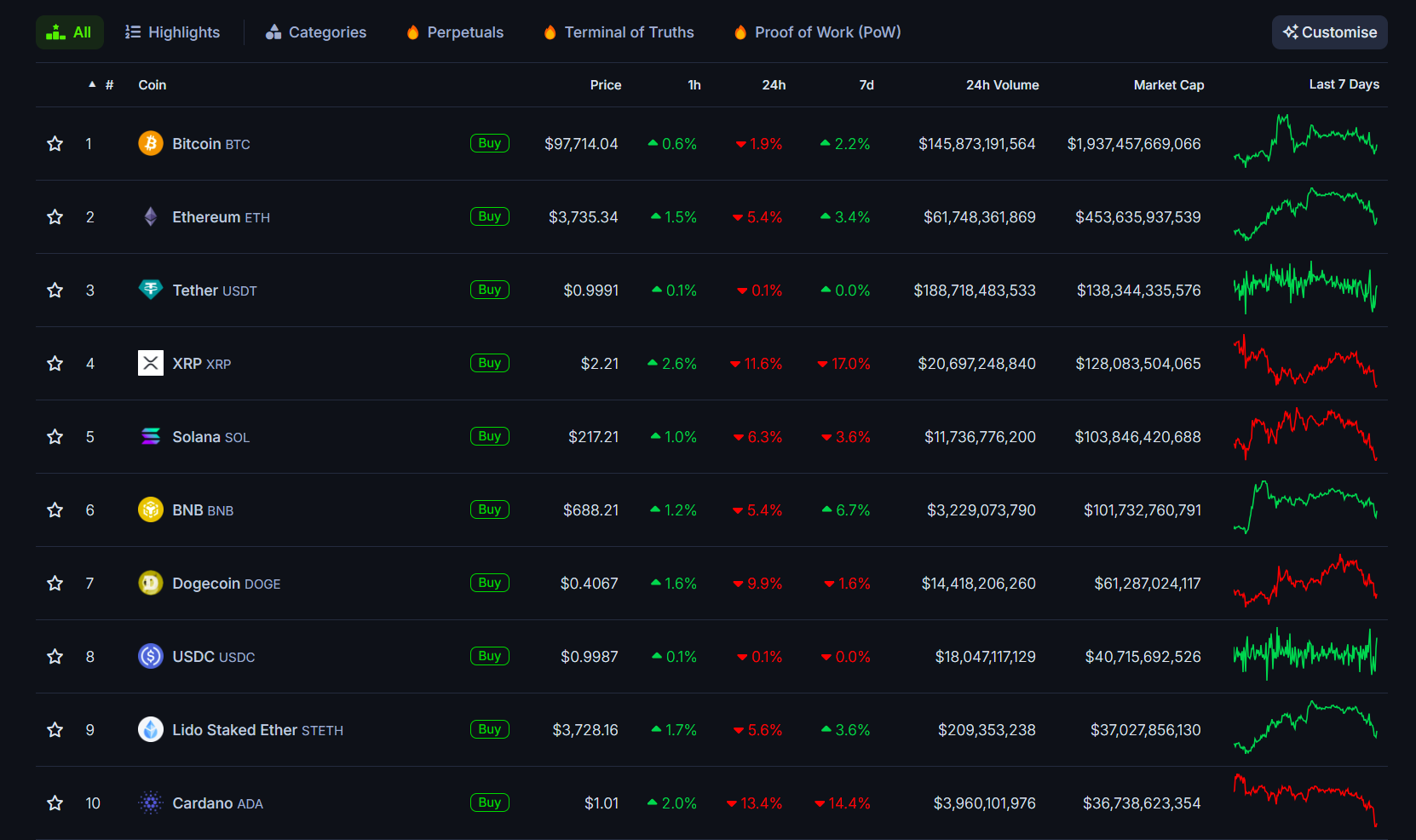

Bitcoin has partially recovered from its recent dip, now trading at $97,800, but is down 2% in the past 24 hours. The rest of the crypto market, however, is still under pressure. Most altcoins are down at least 10% in a single day.

Among the top 10 crypto assets by market value, Ripple (XRP), Dogecoin (DOGE) and Cardano (ADA) bore the brunt of the losses. XRP fell by 11 percent, DOGE by 10 percent, and ADA by 13 percent.

Although no single event has been identified as the cause of Monday's pullback, crypto traders speculate that a combination of factors, including Google's “Willow” quantum computing chip and recent bitcoin transfers from Bhutan, may have played a role.

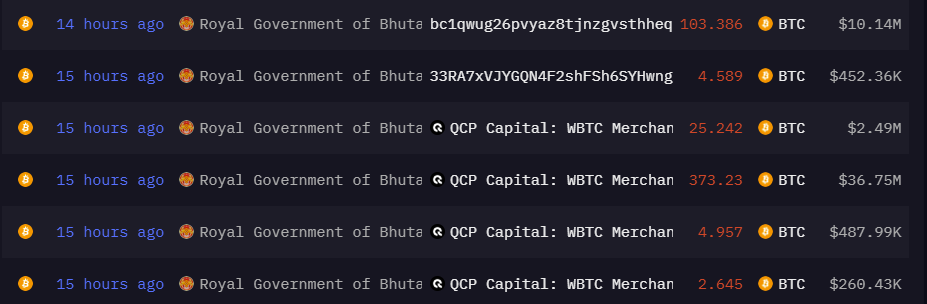

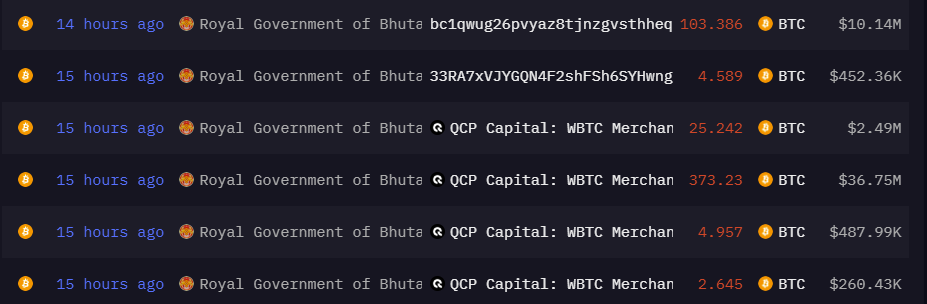

Bhutan moves 406 BTC to QCP Capital

A wallet controlled by royal Bhutan transferred 406 bitcoins to Singapore-based digital asset trading firm QCP Capital earlier today, according to data from Arkham Intelligence.

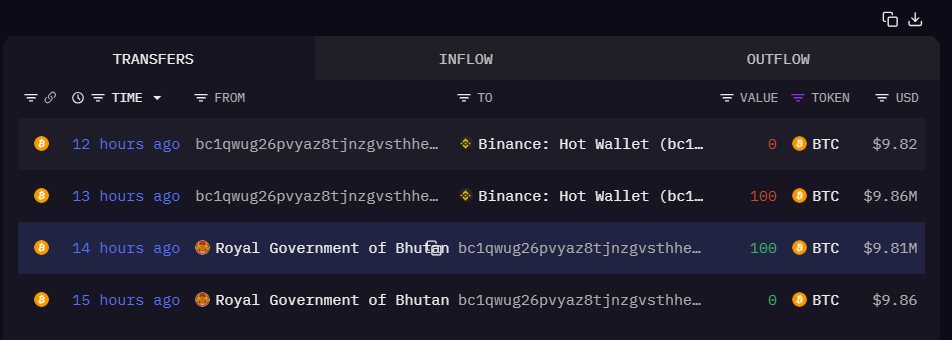

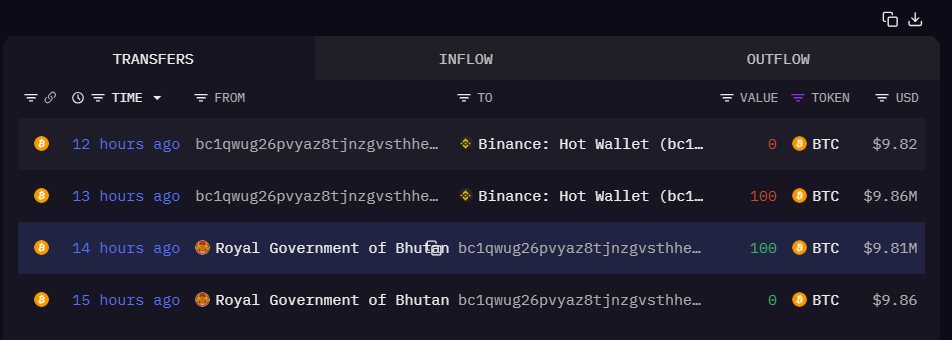

The transfer is split into several smaller transactions. Following these, Bhutan made another bitcoin transfer worth $19 million to an unknown address starting with “bc1qwug2”. These funds are transferred to the Binance hot wallet.

The reasoning behind the government's wallet move is unclear. Last month, Bhutan reportedly sold 367 bitcoins for $33.5 million on Binance. Following the move, the price of Bitcoin fell below $90,000.

Despite the recent selloff, Bhutan remains one of the top five state investors globally, with a current holding of 11,688 bitcoins, worth nearly $1.1 billion. Unlike other countries that buy Bitcoin through asset seizures, Bhutan uses hydroelectric resources to mine Bitcoin.

Google's quantum discovery

On Monday, Google released a new quantum chip called ‘Willow'. According to Hartmut Neven, founder and head of Google's Quantum AI, the chip can complete tasks in less than five minutes that would take the fastest supercomputers about 10 septillion years.

Developed by Google Quantum AI and demonstrating excellent error correction capabilities with qubits, this discovery points to scalable quantum computing.

Several members of the crypto community have expressed concern that the chip could pose a threat to Bitcoin's security.As computing power increases, hackers may be able to crack the encryption that protects crypto wallets and exchanges.

“An estimated $3.6 trillion in cryptocurrency assets are vulnerable to hacking by quantum computers or will soon be,” one community member wrote.

RE PE investment fund manager AJ Manaser said “My theory is that #Bitcoin will eventually be hacked, making it worthless.” “This new quantum chip has done in 5 minutes what today's supercomputers would take 10^25 years to do. What does that kind of computing power do to encryption? It will kill him.”

However, many suggest that while quantum computing is advancing rapidly, it is not yet at the point where it poses a serious threat to Bitcoin's security.

“Estimates suggest that breaking the Bitcoin encryption would require a quantum computer with approximately 13 million qubits to decrypt it in a 24-hour period. In contrast, Google's Willow chip, while a significant improvement, has 105 qubits. We have a ways to go,” explained Kevin Rose, partner at True Ventures.

Bitcoin entrepreneur and activist Ben Sigman says that breaking ECDSA 256, a form of Bitcoin encryption, would require a quantum computer with millions of qubits, far beyond Willow's current capabilities.

“SHA-256: Even harder – requires a different approach (Grover's algorithm) and millions of physical qubits to create a real threat,” he added. “Bitcoin's cryptography SAFU remains…for now.”

Share this article