The crypto market saw $1.2 billion in liquidity amid inflation.

Almost $1.25 billion dollars has left the crypto market in the last 24 hours, as the market dropped by 10%.

Bitcoin fell below $96,000, with meme coins posting their biggest losses on Thursday.

Inflation forecasts have led to major corrections in the Crypto market.

According to Coinglass data, Bitcoin saw more than $45 million in liquidation today, while Ethereum saw nearly $30 million. This major correction came after the Federal Reserve cut interest rates by 25 basis points on Wednesday.

Lower interest rates are usually a boon for crypto, as low rates indicate looser monetary policy. However, it was the Fed's 2025 forecast that influenced the market. Jerome Powell said that the Federal Reserve predicts high inflation and two interest rate cuts next year.

While this liquidity is high, the impact on the stock market is more severe. Nearly $1.5 trillion was wiped from the US market. These heavy liquids are leading the risk of a bullish cycle.

“Hey guys, a big thank you to everyone now that the bull market is officially over. I will be deleting and shutting down all crypto related socials,” one influencer posted on X (formerly Twitter).

However, the prevailing view of most analysts seems to indicate that today's liquidity is only a short-term outflow.

“Bitcoin market sentiment. It's the same story every time, and it never changes. Markets are not designed for the masses to win. Corrections are a natural part of bull markets,” wrote the famous analyst ‘Titan of Crypto'.

Other analysts, like Philacon, say these outflows generally occur at the end of the year when the market enters a cooling period. Bullish sentiment was predicted to return after December 17 and last until the first week of January.

Meanwhile, some analysts predict an altcoin season. Increased liquidity for Bitcoin will erode its dominance in the coming months and create more scope for major altcoins such as Ethereum and Solana.

“If you think the altcoin season is over, you should know this: The total altcoin market cap (excluding BTC & ETH) sits at around $1.05 trillion. It's hitting the highest altcoin market cap since November 2021. The last time something similar happened.” It was in February 2021, when the altcoin market cap tested its high since Jan 2018,” Lark said. Davis wrote.

While the Fed's forecast had a significant impact on the market today, it's important to understand that Bitcoin is still up nearly 130% this year. After all, many developments in the crypto industry outpace these macroeconomic factors.

Michael Saylor's MicroStrategy, which owns nearly 2% of the Bitcoin supply, has made a series of purchases since November. The firm bought $3 billion of BTC in December, but its holdings fell by more than $100,000.

Also, other public companies such as MARA and Riot Platforms followed similar Bitcoin acquisition strategies this month. There are also regulatory changes to look forward to. International lawmakers in various countries advocate for Bitcoin reserves.

Thus, while macroeconomic factors show temporary signs of depression, the long-term outlook for 2025 remains bleak.

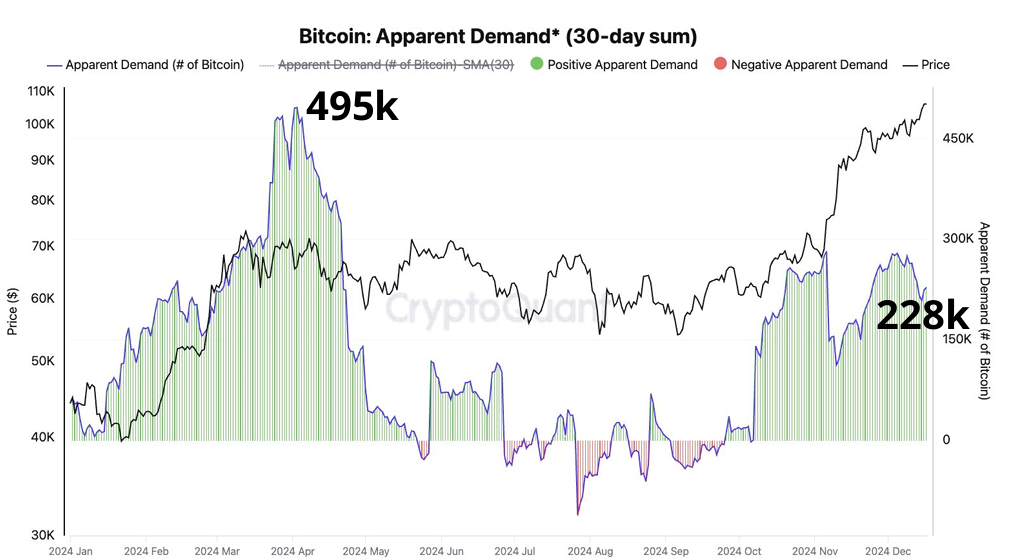

A declining supply signal is a potential Bitcoin supply shock

Another reason we think Bitcoin will continue to be bullish is the supply and demand ratio.

According to data from CryptoQuant, the Bitcoin market is showing signs of a supply shock as the supply of BTC available for sale continues to dwindle. Demand for Bitcoin is increasing, adding 495,000 Bitcoins every month.

Meanwhile, the stable coin market hit $200 billion, indicating fresh liquidity. Optimism surrounding pro-crypto policies and potential initiatives in the US will fuel demand.

On the other hand, sell-side liquidity dropped to 3.397 million bitcoins, the lowest since 2020, including exchanges, miners and OTC desks. The inventory ratio, a measure of how well current supply can meet demand, fell to 6.6 months from 41 months in October, underscoring the tight market conditions.

Therefore, this supply shock, along with macroeconomic factors, may be the key cause of today's liquidity.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.