The Fed will keep interest rates at a 23-year high, likely to cut in September.

Key receivers

Fed Rate Matches Expectations, Bitcoin Price Shows Least Fast Reaction The market is expecting a drop in September prices, which can boost crypto investment sentiment.

Share this article

The Federal Reserve announced today that it will keep interest rates unchanged, keeping the federal funds rate at 5.25% to 5.5%. This decision is broadly in line with market expectations and reflects the Fed's continued prudent monetary policy amid volatile economic conditions.

“Recent indicators show that economic activity continues to expand at a strong pace. Job opportunities have stabilized, and the unemployment rate has risen but remains low. Inflation has eased over the past year, but has risen modestly. In recent months, there has been some further improvement in the Committee's 2 percent inflation target,” he said. The Federal Reserve said in a statement.

Implications for crypto markets

The decision came against a backdrop of moderate inflation, with the US consumer price index (CPI) rising 3.3 percent year-on-year in June. This economic indicator has had a positive impact on the crypto markets, suggesting a relationship between inflation and the performance of digital assets.

For the crypto market, especially Bitcoin, the Fed's decision carries a lot of weight. While the immediate impact of a rate hike may be limited, the long-term implications of the Fed's monetary policy stance are likely to be significant. Historically, periods of low interest rates have been favorable for risk assets, including the category crypto, because of how such assets reduce borrowing costs and, by implication, encourage investment in non-traditional assets.

The crypto market's reaction to the Fed's decision will be closely watched, especially in light of recent events. Just days before the FOMC meeting, $2 billion worth of Bitcoin moves from a DOJ body introduced uncertainty. This government action, coupled with the Fed's decision, highlights the complex interplay between regulatory actions, monetary policy, and crypto market dynamics.

Post-FOMC market movements

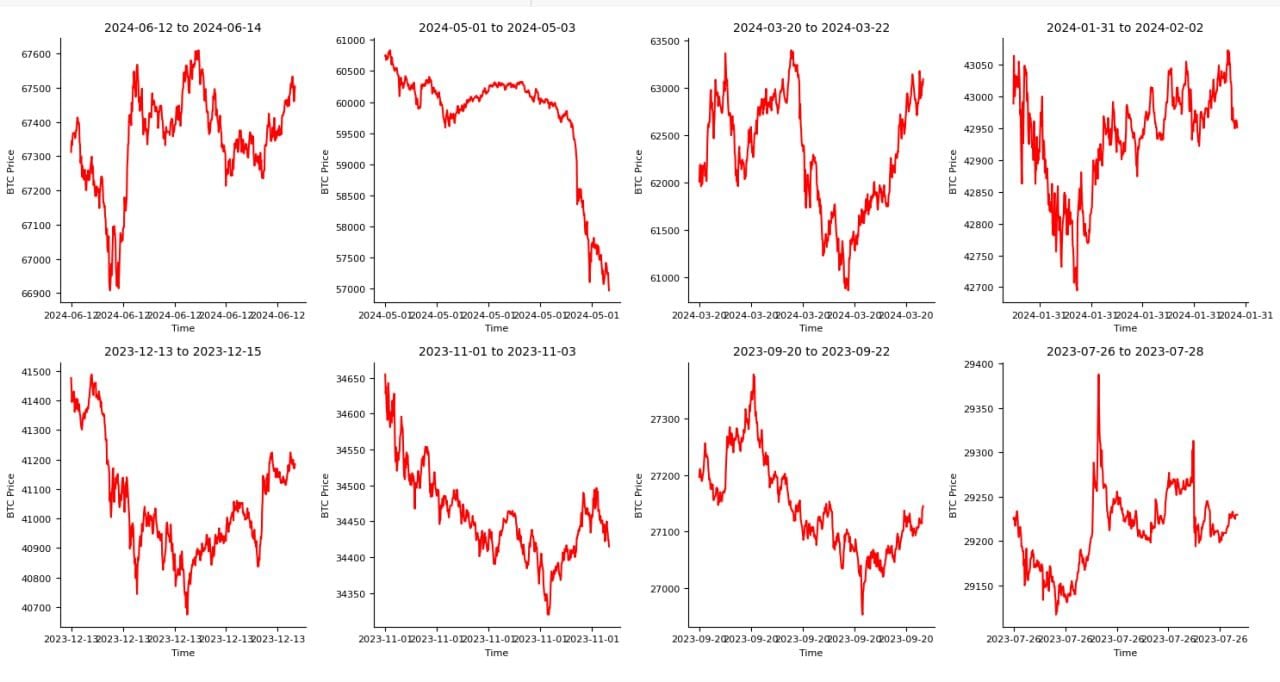

The following chart shows the price movement of Bitcoin in the 48 hours following the last eight FOMC decisions.

Each chart shows Bitcoin (BTC) price fluctuations over three-day intervals between July 2023 and June 2024. The charts show high price volatility over short periods of time, showing peaks and troughs that indicate rapid market volatility. For example, from July 26 to July 28, 2023, there is a significant increase followed by a rapid decline, reflecting high levels of trading activity or external influences affecting the market.

Price trends vary across different time periods, with some periods such as January 31 to February 2, 2024 showing several sharp fluctuations while others such as November 1 to November 3, 2023 show a steady downward trend. These differences indicate the sensitivity of Bitcoin prices to market conditions and possibly news events or economic conditions that affect investor sentiment.

Macro-level economic changes that affect crypto markets

Looking ahead, several macroeconomic factors will continue to influence traditional and crypto markets. These include ongoing inflation trends, global economic recovery patterns and changes in monetary policy by other major central banks. The different approaches of the Bank of Japan and the Bank of England, which are set to announce their own decisions this week, underscore the global nature of these economic issues.

The relationship between inflation and crypto markets remains a topic of intense interest. While Bitcoin is often considered a hedge against inflation, its performance in various inflationary environments has been mixed.

The Fed's approach to controlling inflation through interest rate policies could greatly influence this narrative, influencing investor sentiment toward crypto as a store of value or hedge against inflation.

Share this article

![]()