The Federal Reserve did not cut interest rates in March.

BlackRock CEO Rick Reeder shares insights on the Federal Reserve's interest rate plans. Rieder suggests a cautious Fed approach, possibly delaying rate cuts beyond March.

Amid fluctuating economic forecasts, BlackRock's Global Chief Investment Officer of Fixed Income offers a different perspective on the Federal Reserve's upcoming decisions.

BlackRock's CIO suggests the Fed will keep interest rates unchanged in March

Rieder believes that the March rate cut is overdue despite the shift to neutral monetary policy. “I still think March is early,” Reeder said, pointing to the current state of the U.S. economy. In the fourth quarter of 2023, the economy will show strong growth with a growth rate of 3.3 percent.

“I think we need some data to show some more real slippage in the economy for the Fed to go in March,” Reeder said.

Strong employment figures and retail sales suggest the economic landscape is stronger than expected. Even if inflation recedes from 2022, Reeder believes the Fed will expect more data. This is to ensure that inflation is on a continuous downward trajectory.

Read more: How to protect yourself from inflation using cryptocurrency

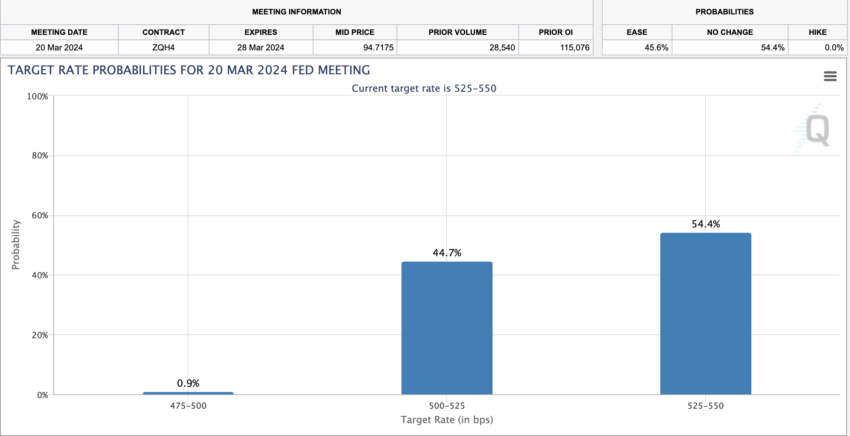

Rieder's analysis suggests strategic patience on the part of the Fed, which is favored to begin rate cuts in May, which could be adjusted by 25 basis points each month. In line with Rieder's sentiment, a snapshot from CME Group shows a 54.4% chance the Fed will keep interest rates unchanged in March.

Contrasting Rider's outlook, Goldman Sachs Group economist David Mericle expects early rate cuts, predicting a March start based on sufficient inflation. Mericle's forecast, detailed in a Jan. 29 research note, calls for a total of five rate cuts by 2024.

Read more: Top 12 Crypto Companies to Watch in 2024

“We expect a March cut primarily because the improvement in inflation is already substantial. If Fed officials see even modest downsides to economic activity and the labor market or inflation, that could strengthen the case for a late rate cut,” Mericle said.

Rieder's insights underscore the Fed's cautious approach amid complex economic dynamics. The coming months will be critical for the direction of US monetary policy and its impact on stocks and crypto markets.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.