The NASDAQ Regrimess of “More than $272 million

NASDAQ charged Ton Strategic Company with violating stock approval rules in connection with the acquisition of 272 million Toncon and related private placement financing.

The company is considered to be listed on the exchange after the regulators decide that the violations were inadvertent rather than the attempts to recover.

Until August 2025, he received a formal letter from Topring to investigate the following in the transaction structure.

The staff of NASDAQ is supported by the leadership of NASDAQ ALCHINAN CHARCHININ CHARSCHIRE, who took the rules during the personal investment of 558 million dollars during the period of personal investment.

Two violations related to the purchase of Tonicone

The complaint concerns two separate violations under NASDAQ listing rules 5635(a) and 5635(b).

The first violation of the company's August 7 private placement raised the capital of the funders at $ 58.7 million per unit at $ 9.51.

NASDAQ has determined that this transaction will result in a change of control through the non-liquid partners of Executive Capital.

The second breach involved a $272.7 million Toncon purchase agreement executed by the company on July 31.

Because 48 to 78% of private placements will recover money from digital asset acquisition, many companies' pre-financing share count represents the grids, Nasak's previous approval is in kind 5635 (a).

The company relies on advisors who are familiar with the rules of the transaction.

NASDAQ announced the closing of the private placement of Tonicon's purchase.

A large amount of financial support for representation of digital assets will be obtained before the company holds 20% or more of the voting power in relation to asset purchases.

The company received a sanction, it will be provided in the future

NASDAQ has been called NASA Quant, which is not subject to the “Ton strategy” and has suddenly refined the rules based on employees with company management.

The controller was a commitment to work with the commitment that he made to work with the commitment that he made in relation to the relationship that he made in the future.

29 kg in October. No further action is required from the company following the exclusion of the end of the investigation.

Ton Strategy has accepted the decision of the employees and closed the case with the shares continuing to realize business from Titek Ton.

The main mirrors of the strategic cruise

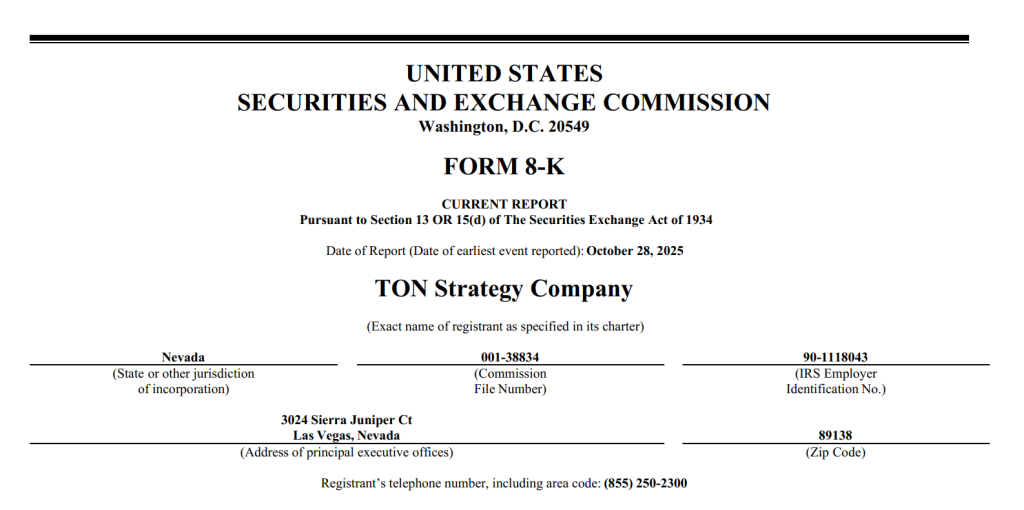

The company, formerly known as Verb Technologies, followed a publicly-reviewed TIN strategy to disrupt First America as a major treasury asset.

At the time of the announcement, the investor will share 193.38% in the investment called the strategy of integrating the doll while lowering it by 3.3%.

Up to 5% of Tonkon is targeted for the fuel of distributed market capital, while 77% of liquid assets are planned to be kept in capital.

The strategy consists of creating through the To network salary titles, through the Ten network display titles where they expect cash-flow-positive returns over time.

This approach registers the institutional approval framework of the sponsoring institution that accumulates more than 60,000 when it is more than 260,000 through separate notes of 500 million dollars.

The digital asset treasury model has gained momentum on several networks beyond Bitcoin-Cultric strategies.

The Pransstath ToM LEE company, BBM's immersion technologies, has a value of more than 3 million billion dollars and is stored on more than 379 billion dollars in treasury and more than 3 million in treasury.

When the company started stocking in July when they were close to $2,500, they finally started stocking 5% later.

Ton strategies to take advantage of the deep integration of the cameras in the open network token space with Telegram, painted as a masterful companion for Mindi-apps and valuable assets.

Closing news news analysed, cryptographic predictions

![[Live] Crypto News Today: Latest Updates For Nov. 25, 2025 – Bitcoin Holds Above $87K In Broad Market Rebound; Glassnode Flags Oversold Conditions With Early Signs Of Recovery](https://coinsnewsdesk.com/wp-content/uploads/2025/11/Latest-updates-for-N-Novel-25-2025-300x200.jpg)