The price of Bitcoin (BTC) forms six silver candles in a row

Bitcoin (BTC) price has produced six bullish weekly candles since the upward movement began in October.

BTC price has traded in a balanced triangle pattern since November. Will the uptrend open or weaken?

Bitcoin reaches new highs every year

The technical analysis of the weekly time frame shows that the price of BTC has increased rapidly since the beginning of October. At this time, the price has fallen below the resistance trend line that has been active for 530 days.

BTC hit a new annual high of $38,437 on November 24 before falling slightly.

An interesting development about the upward movement is that BTC has formed six consecutive bullish weekly candlesticks.

This last happened in October 2020 (highlighted), when the previous bullish cycle began.

Market traders use Relative Strength Index (RSI) as a momentum indicator to identify overbought or oversold conditions and decide whether to accumulate or sell the asset.

A reading above 50 and an upward trend indicates that bulls still have an advantage, while readings below 50 indicate the opposite.

RSI is rising but in overbought territory (green icon). Interestingly, the previous time the RSI was at this level (black icon) was in October 2020.

Read more: 9 Best AI Crypto Trading Bots to Maximize Your Profits

What do analysts say?

Cryptocurrency traders and analysts at X believe that the price of BTC will increase soon.

JJCycles is bullish for both fundamental and technical reasons. he said.

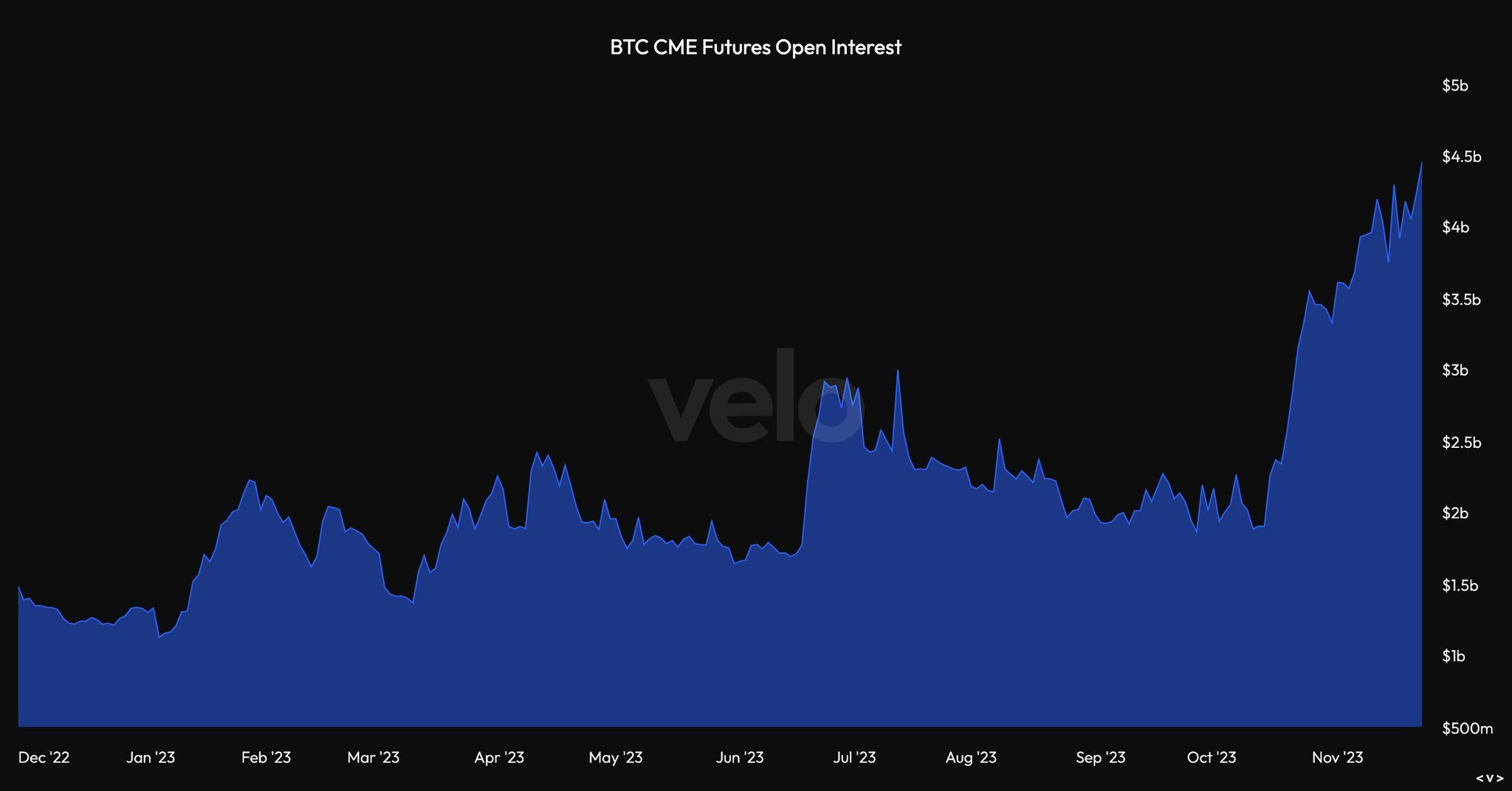

What if the CME (US institutions) opened longs to wait for the imminent #Bitcoin ETF approval? Open interest has definitely increased on CME over the past two weeks.

Currently, open interest on the CME is close to $4.5 billion.

He believes the ongoing bullish stock will resolve to the upside. Bob Lucas is of the same opinion, suggesting that an explosive move will take the price out of a 30+ day downtrend.

Unlike the other two traders, CredibleCrypto BTC suggests that an initial decline is expected before eventually resuming its previous climb.

Read more: Best upcoming airdrop in 2023

BTC Price Prediction: Will Price Finally Reach $40,000?

Elliott Wave (EW) theory incorporates recurring long-term price patterns and investor psychology to determine the direction of a trend.

The most predictable count suggests that BTC is in wave three of the five-wave rally (white) that began in September. Wave three has been extended.

The sub-wave count is in black, which indicates that BTC is in sub-wave four. The tuning sub-wave is triangular, the most common design for this wave.

If BTC breaks out of this triangle, it could rise by 10% to the next resistance at $41,000. The target is achieved by raising the height of the triangle to the breaking point.

Despite this BTC price forecast, a breakout from the triangle could lead to a 6% decline at the close support of $35,000.

Click here for BeInCrypto's latest crypto market analysis.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions.