The price of Bitcoin can still hit $100,000.

Bitcoin's potential to hit $100,000 continues to be a topic of intense interest among investors. Various market dynamics and economic indicators suggest that this ambitious target is still within reach.

Experts share insights on what it takes for Bitcoin to reach this milestone.

The path to $100,0000 Bitcoin

Felix Mohr, co-founder of Mohr Wolfe, spoke to BeInCrypto about Bitcoin's potential, highlighting the growing demand and rising open interest (OI). Recently, Bitcoin futures OI rose by $2.02 billion in three days.

“This surge in buying interest in Bitcoin is no accident. Investors have made it clear they expect two rate cuts by the US Federal Reserve by the end of the year.

Indeed, investor sentiment has been largely underwritten by speculation surrounding the Federal Reserve's monetary policy. A Reuters poll pointed to the possibility of a slowdown in September, though there is little or no chance of a slowdown.

About two-thirds of economists in a Reuters poll from May 31 to June 5 forecast the first cut in September, in a range of 5.00%-5.25%. According to a Reuters report, it was the same conclusion as last month's poll.

Historically, Bitcoin has benefited from a bullish stock market, which can be boosted by Fed rate cuts. However, Federal Reserve Chairman Jerome Powell's caution and economic indicators further complicate the picture.

The Consumer Price Index (CPI) increased by 3.4% last year, while the Core CPI increased by 3.9%. The producer price index (PPI) also beat expectations, rising 2.2 percent annually. These figures point to persistent inflation that could prevent the Fed from aggressive rate cuts.

“Amid the volatility of sub-economic data, the SP500 is at highs, indicating potential for a reversal. Bitcoin and traditional markets have historically moved. A correction in traditional markets could destroy Bitcoin's price,” Moore told BeInCrypto.

Read more: How to protect yourself from inflation using cryptocurrency

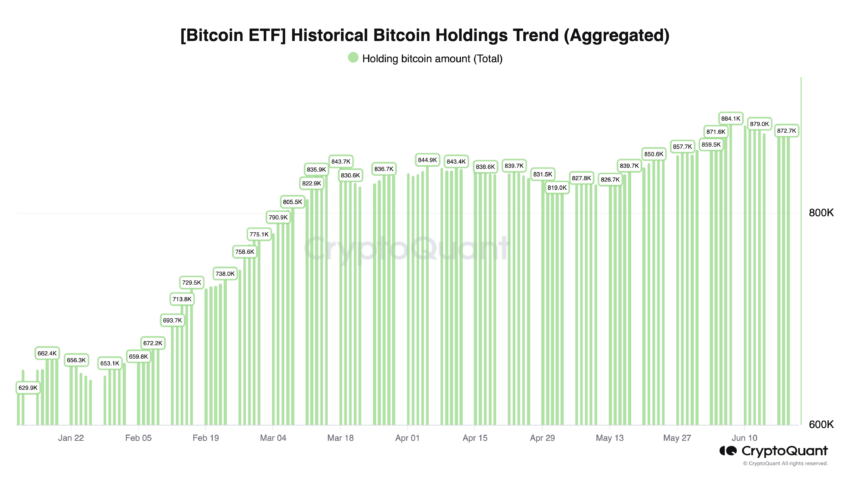

However, Bitcoin's direction is also influenced by institutional demand. The approval of Bitcoin exchange-traded funds (ETFs) by the SEC is a big boost.

Awaiting approvals of Ethereum ETFs by major financial institutions this year could lead to significant price increases.

In mid-March, Bitcoin surpassed its all-time high to establish a new high near $74,000. The move to $100,000 will resume at the end of the year, of course if the Fed cuts rates twice,” Moore said.

Such optimism is supported by Bernstein's research. The firm predicts that Bitcoin will reach $200,000 in 2025, $500,000 in 2029, and $1 million in 2033.

Bernstein analysts argue that Bitcoin ETFs are poised for widespread adoption, having seen a retail-led initial allocation as major wirehouses and private banks prepare to offer these investment products.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

They argue that this institutional trade acts as a “Trojan horse” for wider adoption, potentially turning Bitcoin into a mainstream asset class. Therefore, Bitcoin's path to $100,000 and beyond is within reach, dependent on balanced economic policies and continued institutional demand.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.