The price of ORDI is leading the charge of BRC-20 against the struggle of Bitcoin

ORDI, which operates on the Bitcoin network in the Odinal protocol, is one of the top earners in the market today. This is at a time when the price of BTC is struggling to hold on to the $60,000 mark.

The difference in performance suggests that ORDI may differ from BTC despite sharing a strong correlation. What could be fueling this?

No Bitcoin, no problem for ORDI.

ORDI, the first BRC-20 token, received much attention following its launch in March 2023. Built on Bitcoin's blockchain, ORDI's price has closely tracked BTC's movements. For example, when BTC rose to its peak in March 2024, ORDI also peaked, reaching $96.31.

However, ORDI is not the only BRC-20 to show such performance. 1000SATS (SATS) is experiencing similar trends. So far, ORDI's price is $30.83, up 8.20% in the last 24 hours.

Read more: Top 5 BRC-20 systems to trade in 2024

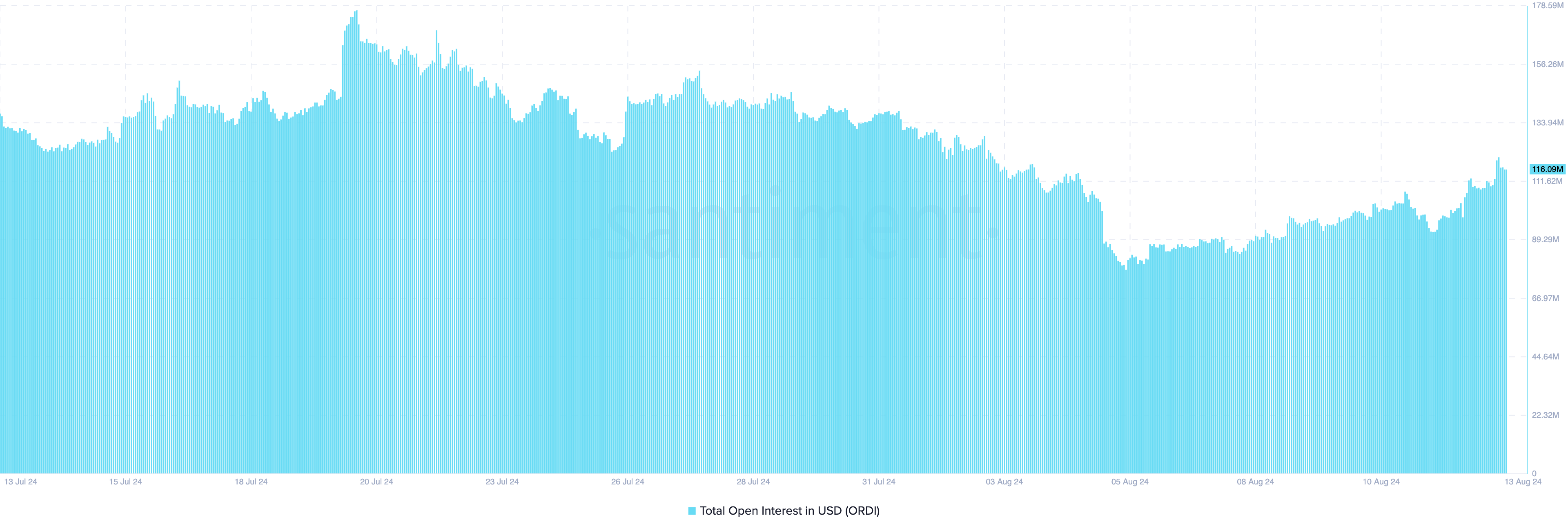

Alongside the price, open interest (OI) has also increased. Open interest represents the value of outstanding contracts in the derivative market. An increase in OI indicates an increase in speculative activity related to the cryptocurrency, while a decrease indicates a decrease in net positions.

From a trading perspective, if OI increases with ORDI value, the upward trend is likely to continue. However, if traders begin to close their positions, the result of a decrease in OI may weaken the ongoing trend.

In ORDI's case, open interest appears to be struggling to sustain its recent move, suggesting that growth may stall if traders do not continue to increase net positions.

ORDI Price Prediction: $36 or $26? Buyers choose

Despite the fall in OI, the daily chart shows the formation of a falling wedge for the factor. A falling wedge is a flashing technical pattern, which indicates that the downtrend has lost momentum. Characterized by two steep slopes, high confirmation appears once buyers enter the market.

However, the Money Flow Index (MFI) remains below the neutral line despite the recent increase. This shows that some traders are buying ORDI, but the pressure may not be enough to sustain the increase.

If the cash flows increase, the price of ORDI may close at $36.10 at high level resistance. However, reduced buying pressure could devalue the study, possibly pushing it down to $26.75.

Read more: ORDI (ORDI) Price Forecast 2024/2025/2030

Also, market participants may need to be cautious about Bitcoin. If ORDI returns to re-correlation with BTC, the coin's movement could have a significant impact on the crypto's next direction.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.