The RDNT token is up 20% following Radiant Capital’s new liquidity plan.

Key receivers

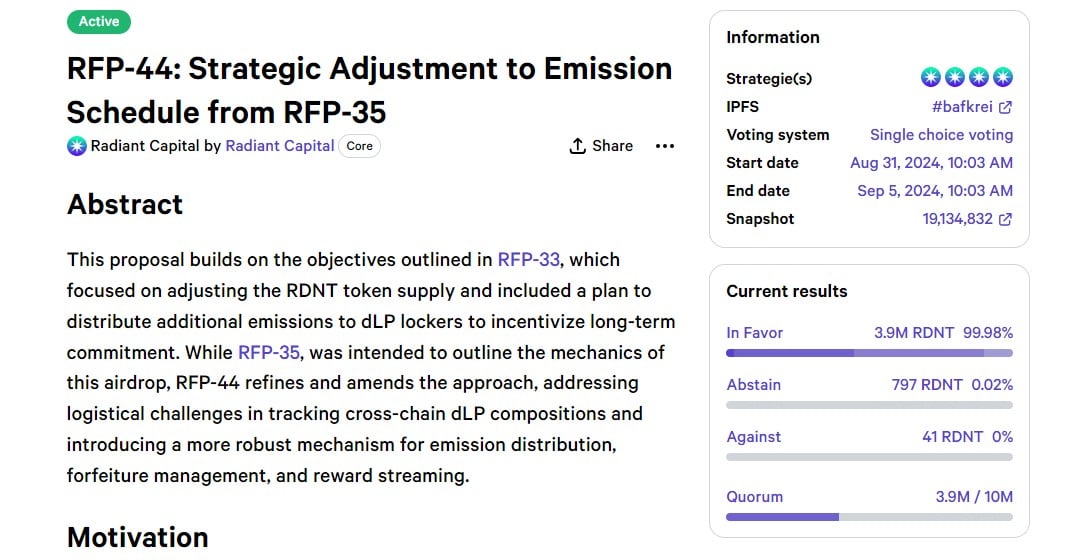

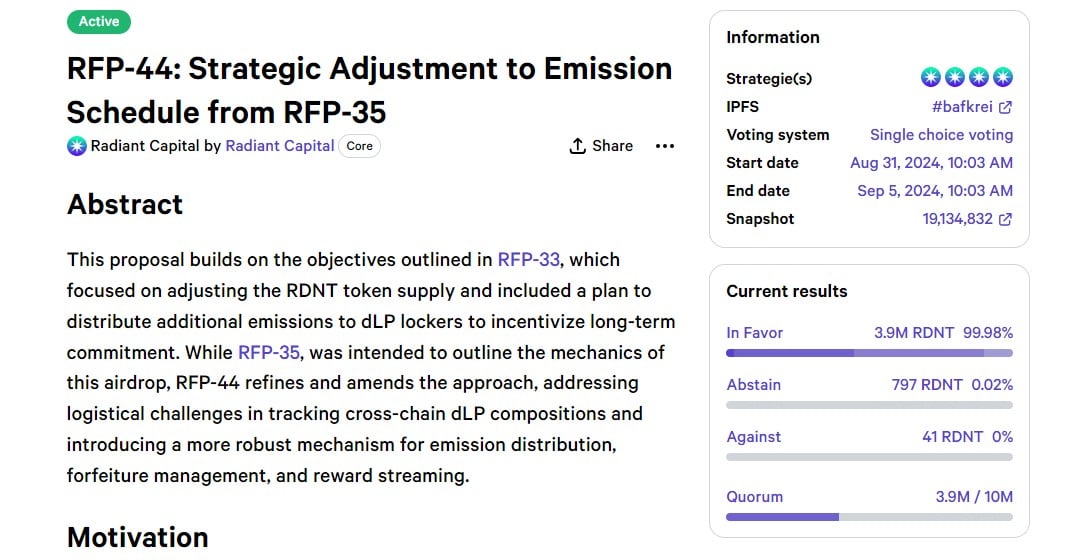

Radiant Capital's proposal RFP-44 aims to facilitate RDNT token issuance and cross-chain circulation. The proposal includes a weekly balance and a 24-hour grace period for RDNT holders.

Share this article

Radiant Capital's RDNT token is up 20% following the launch of a proposal aimed at streamlining the emission schedule and increasing cross-chain liquidity.

Radiant Capital recently submitted an RFP-44 to refine the distribution strategies originally set out in the RFP-35. Instead of using qLP as a basis for determining airdrop allocation, it proposes to use qRDNT, which represents the total locked RDNT in the user's cross-chain portfolio.

As part of RFP-44, 25% of the future RDNT token supply, totaling 125 million RDNT tokens, will be allocated to users who lock in their tokens. The strategy is designed to encourage token holders to participate in locking up their assets, thereby increasing liquidity and stability in the ecosystem.

The proposal also seeks to implement a chain-agnostic approach to tracking the locked-in RDNT and uses a weekly balance and release mechanism for fair distribution of emissions. In addition, it introduces a 24-hour grace period, allowing users to unlock their position and maintain their qRDNT status, preventing it from being lost.

The team said the Radiant app will be updated to display qRDNT balances, alert users about re-adjustment deadlines and provide information on weekly price balances.

As noted, the voting period for this proposal runs from August 31, 2024 to September 5, 2024, and current results show overwhelming support.

Implementation of RFP-44 is expected to increase Radiant Capital's operational efficiency and user engagement without incurring additional costs.

Following the introduction of the proposal, the RDNT token rose from $0.078 to $0.095, representing a 20% increase, according to CoinGecko. The price has since settled around $0.093.

Share this article