The United States sees a decrease in stablecoin activity

Blockchain intelligence firm Chinalysis recently reported a decline in stablecoin trading volume in the United States.

“While U.S. entities initially helped legalize and seed the stablecoin market, many crypto users are pursuing Stalkcoin-related trading platforms and issuers headquartered abroad,” the report said.

The United States is losing the stablecoin market to foreign countries.

According to Chainalysis, stablecoins have been responsible for more than 50% of on-chain transaction volume on centralized exchanges in recent times.

The report said.

More than half of the chain's transaction volume between June 2023 and July 2022 took place on the chain, according to Chinese data.

However, during this period, most of the stablecoin revenues of the 50 largest crypto services were transferred overseas from services licensed in the US.

“As of June, 54.6% of Stablecoin revenue went to the top 50 services on unlicensed exchanges in the United States.”

Read more: What are Algorithmic Stablecoins?

The United States Government's Growing Concern for Stablecoin Regulation

However, the report highlights that most stable coins are pegged to the US dollar. Additionally, the US government points to the need for careful regulatory efforts:

“More than 90% of Statcoin activity takes place in statcoins pegged to the US dollar. US regulators are keen to exercise some regulatory authority over stablecoins as USD-denominated reserves play a central role in these assets.”

Meanwhile, Jason Somceto, head of North American public policy at Chinalysis, noted that regulating stablecoins presents some complications, but these issues are expected to be resolved in the near future.

“These disputes are solvable and should be resolved soon in the interest of international competition and the necessary regulation.”

This comes on the heels of the US House Financial Services Committee publishing a draft of the Storycoin bill on April 15th. The legislation suggests a number of changes, including a moratorium on algorithmic stablecoins and giving the Federal Reserve Bank control over stablecoins from non-bank companies.

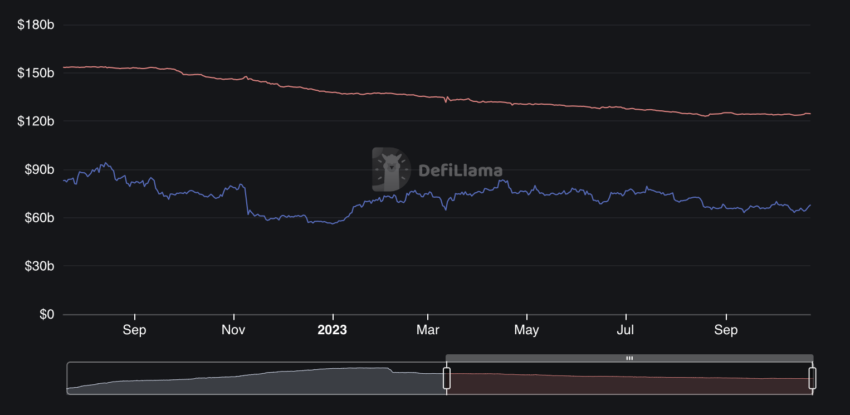

According to Defillama, the total market value of the fixed coin currently stands at $124.56 billion. Meanwhile, USDT has the highest share at 67.6%.

On September 22, BeenCrypto reported that the market capitalization of stablecoins in September fell to $124 billion. This was the lowest level since August 2021.

However, among the 118 stablecoins, BUSD and FRAX made the biggest drop among the top 10 by market capitalization.

BUSD's market cap fell 19.2 percent to $2.5 billion. Meanwhile, FRAX showed a decrease of 16.7%, which reduced the market value to 670 million dollars.

Read more: What is Stablecoin? Beginner's guide

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content.