The US labor market will see growth in June, as will the crypto market

The U.S. Bureau of Labor Statistics reported Friday that employers added 206,000 jobs in June. The unemployment rate rose slightly to 4.1%, above estimates of 4.0%, while average hourly earnings remained flat at 0.3% monthly.

Although this indicates a healthy growth in the US labor market, there is a muted reaction in the crypto markets.

Estimates of new jobs created rhythm analysts

The U.S. economy added 206,000 jobs in June, according to the Bureau of Labor Statistics. While this represented a 6% decline from the 218,000 jobs added in May, it beat analysts' forecasts for around 190,000 new positions.

In that month, unemployment rose slightly to 4.1%, a 2% increase from the target of 4.0%. Holding at 4%, June's unemployment rate indicated that the number of unemployed people as a percentage of the labor force was stable.

Additionally, average hourly earnings rose 0.3 percent in June, matching forecasts. This reflects steady, albeit slow, wage growth for American workers.

Crypto markets failed to respond

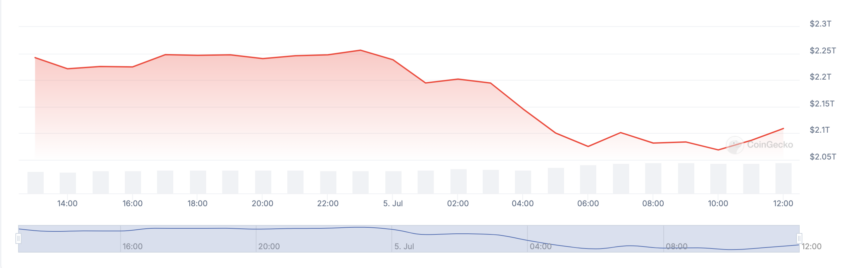

While the report indicated that the US labor market continued to experience positive momentum, the cryptocurrency market failed to respond. As of this writing, the global cryptocurrency market capitalization has fallen by 6% over the past 24 hours, still in a downward spiral.

The price of the leading cryptocurrency Bitcoin (BTC) fell by 3% during that period. At the time of publication, BTC is trading at $55,249.

The price action, assessed on the hourly chart, confirms that business activity has slowed despite the positive outlook reported for non-farm payrolls.

As of this writing, the coin's Relative Strength Index (RSI) is 40.76, just below the 50-neutral zone. This indicator measures the overbought and oversold market conditions of the asset. At 42.49, BTC's RSI shows that selling pressure is currently dwarfing buying activity.

If this trend continues, the coin's price could drop even further, potentially dropping by $54,553 to exchange hands.

Read More: Bitcoin Price Prediction 2024/2025/2030

However, if the sentiment turns from bearish to bullish, the price of the coin could rise to $55,427.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.