The value of the ADA on the pressure of the formation of the death cross

Cardano (ADA) price is showing an increasing bearish pace on several technical indicators as the ninth largest cryptocurrency by market cap faces mounting pressure. ADA has fallen 12% in the last seven days and more than 4% in the last 24 hours, with a market value of 33 billion dollars, although it has retained its position as a top-10 cryptocurrency in ninth place.

Several technical indicators suggest that the downward pressure is likely to continue, with ADX strengthening bearish momentum and whale stocks remaining below recent highs. The potential for a death cross in the AMA lines adds to the gloomy outlook, although key support levels may provide temporary relief.

Cardano Downtrend is intensifying.

Cardano's Average Directional Index (ADX) rose from 14.2 to 22.3 in two days, showing significant consolidation.

This sharp rise in ADX, which measures trend strength regardless of direction on the 0-100 scale, indicates that the current trend is strengthening as it moves from a weak trend zone (below 20) to a developing trend zone (20-25).

With the ADA price in a downward trend and the ADX rising above 20, this indicates that the bear momentum is strengthening. ADX's breakout from weak (14.2) to moderate trend strength (22.3) confirms increased selling pressure as price declines.

However, since the ADX has yet to break above 25 (a strong trend limit), the downtrend may still be in its early stages of development.

ADA whales are recovering.

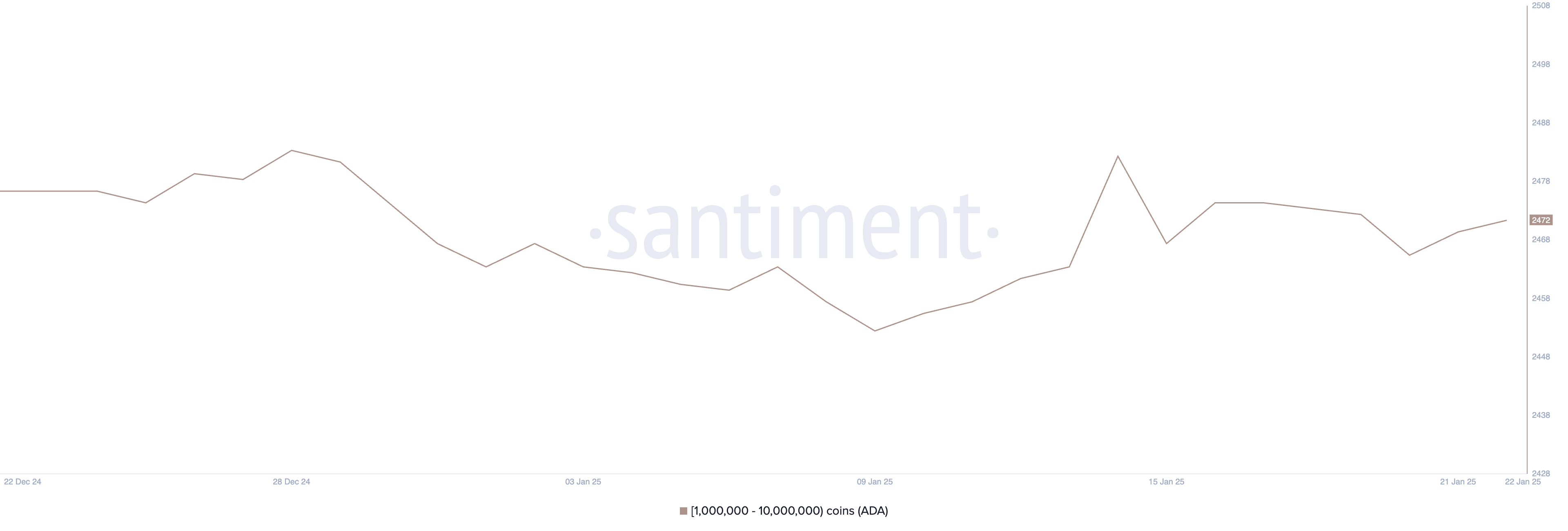

The number of Cardano Well addresses between 1 and 10 million ADA increased slightly from 2,466 to 2,472 over the past three days, although it remained below the January 14 peak of 2,483 addresses.

Whale stock patterns often provide insight into potential price movements. These large owners can greatly influence the market with their trading decisions and typically have sophisticated market analysis that informs their positions.

Current whale metrics present a mixed signal for the ADA's price outlook. The number is below mid-January levels, though the recent wave of whale addresses suggests some renewed accumulative interest at current prices.

This position of the whales, which is slightly bullish but remains below recent highs, may indicate cautious accumulation rather than strong confidence, suggesting that large holders are testing the current price level rather than showing aggressive buying sentiment.

ADA Price Forecast: Another 20% Correction?

Cardano's Exponential Moving Average (EMA) lines suggest an imminent death cross, with short-term averages likely to cross below the long-term.

This bearish technical pattern could trigger possible support tests at $0.87, $0.829 and $0.76, representing a 20% downside risk for Cardano's price.

A bullish reversal should first overcome resistance at $1.03. Additional leveraged targets are available at $1.11 and $1.16, providing a 21% upside to Cardano's price.

However, the looming death cross suggests that any upward movement may face significant resistance until the EMA lines show a bullish correction.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.