There is a $42 billion plan by Bitcoin Holdings.

In its Q3 earnings report, MicroStrategy announced a $42 billion capital raising initiative targeting Bitcoin (BTC) acquisitions over the next three years.

This marks one of the largest BTC investment plans ever undertaken by a public company.

MicroStrategy's Q3 Earnings: What Investors Need to Know

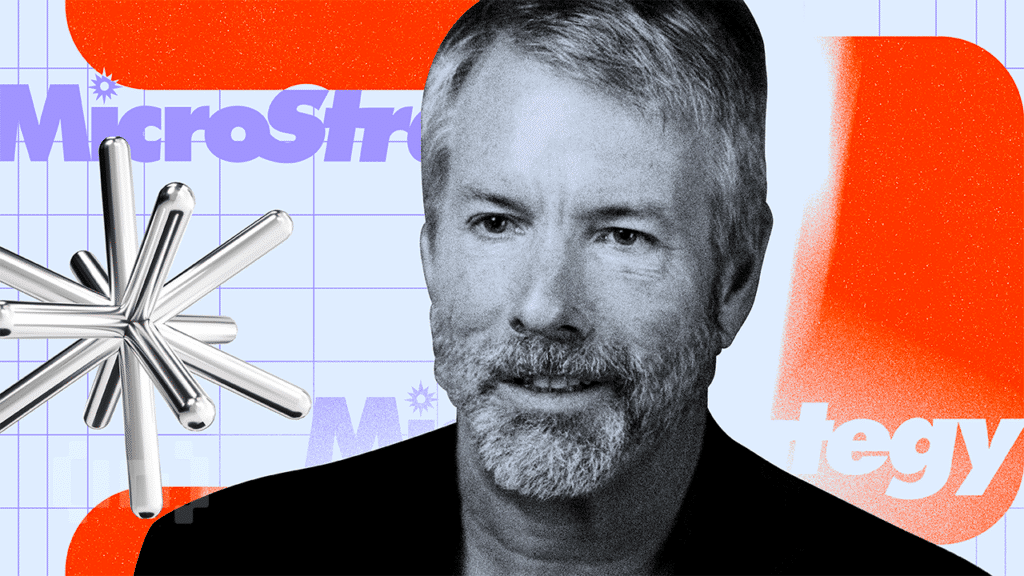

Executive Chairman Michael Saylor and CEO Fong Le revealed MicroStrategy's “21/21 Plan” during MicroStrategy's Q3 2024 earnings call. Their goal is to acquire a significant amount of Bitcoin between 2025 and 2027. According to Saylor, this aggressive strategy will solidify Bitcoin as “digital capital,” adding that it could redefine corporate treasury strategies and financial markets.

“We are announcing a strategic goal of raising $42 billion in capital over the next 3 years, which includes $21 billion in equity and $21 billion in fixed income securities, which we call our 21/21 plan. Read on.”

The fund will primarily target Bitcoin acquisitions as part of MicroStrategy's three-year capital markets strategy. Most recently, the company made a $21 billion market capitalization (ATM) equity offering, the largest of its kind in financial history.

Read more: Who will have the most Bitcoins in 2024?

Known for its steadfast commitment to Bitcoin, the company has 252,220 BTC worth more than $18 billion. This follows the Q3 purchase of 25,889 Bitcoins worth $1.6 billion at an average price of $60,839. However, the company reported a 10.34% decline in revenue, down to $116.07 million for Q3.

Despite the fallout, Saylor emphasized that MicroStrategy's future lies in its Bitcoin-centric approach. As “the world's first and largest Bitcoin treasury company”, it considers maintaining an intelligent leverage strategy. In particular, the aim is to protect the long-term share price while building financial products rooted in Bitcoin.

MicroStrategy targets a 6-10% annual “Bitcoin yield” – a metric that compares Bitcoin holdings to mixed stocks. This plan reflects the company's vision to go beyond simply holding bitcoins and develop a market for bitcoin-backed securities.

“Bitcoin is the best use of income, perhaps in the history of capital markets… We buy and hold Bitcoin indefinitely, exclusively, securely. If you're expecting us to sell out, to sell it out, to move up, if you want us to break up, go somewhere else,” Salor said.

Microstrategy's adoption of Bitcoin-based capital products could set the stage for digital asset-based financing. Meanwhile, Robinhood also released its Q3 earnings. As BeInCrypto reports, the results highlight a systematic expansion in crypto-related offerings.

This aligns with MicroStrategy's ambitions for digital assets. With net deposits exceeding $10 billion for the third consecutive quarter, Robinhood's assets under custody reached a record $152 billion.

Meanwhile, revenue grew 36 percent year over year to $637 million. Given Robinhood's entry into forecast markets, this could increase significantly in Q4.. This development coincides with the 2024 US election cycle and is one of the most interesting expansions.

“Looking forward, we are energized by our ongoing growth and believe we are well-positioned to drive strong earnings and free cash flow per share over time, driven by 20% plus net deposit growth, diversified business models and a 90% fixed cost base,” Robinho CFO Jason Warnick said.

Read more: How to use Polymarket in the United States: A step-by-step guide

The new feature allows users to trade based on the potential outcomes of the options, which can generate additional profits, given the growing public interest in speculative markets.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.