These 2 lower signals indicate the end of the Bitcoin correction

Recently, the price of Bitcoin fell below $39,000 for the first time since December 3, 2023. This significant drop below $39,000 was mainly due to Grayscale Bitcoin Trust (GBTC) selling its holdings. Despite this, two key factors indicate that Bitcoin's correction phase may be over.

The Bitcoin market is showing signs of stability after a long period of decline.

The unrealized profit margin of short-term bitcoin holdings is close to zero

First, the behavior of short-term holders is an important indicator. Their unknown profit margin is approaching zero. However, a proven market bottom is typically indicated when these margins reach -10%. According to CryptoQuant, the current price support is between $39,000 and $37,000. This data suggests market stability soon.

Read more: Bitcoin price prediction for 2024/2025/2030

Greyscale's sales pressure continues to decline.

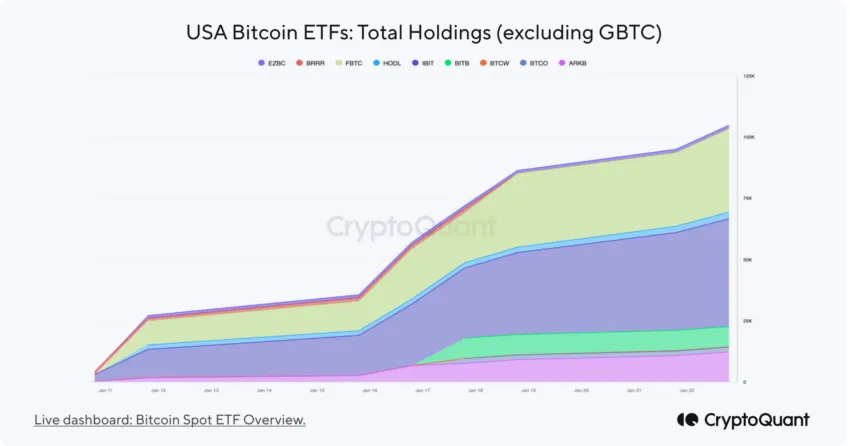

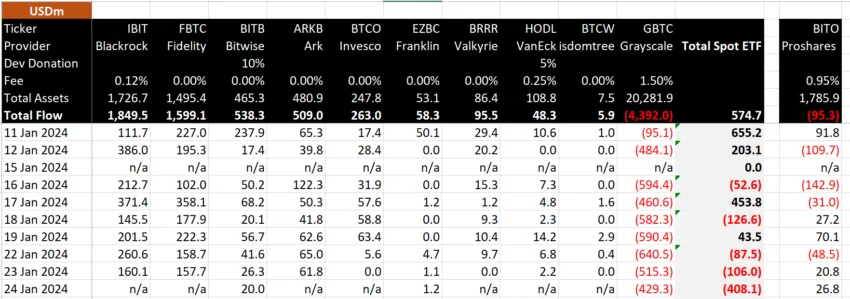

Additionally, there has been growth in total bitcoin holdings in US exchange-traded funds (ETFs). Despite the cost of GBTC, other ETFs now hold around 104,000 Bitcoins.

Total holdings by US ETFs have reached 641,000 bitcoins since the January 11 launch. This includes GBTC's 537,000 Bitcoins, compared to 619,000 in ETFs at launch.

Read more: What is a Bitcoin ETF?

The total holdings of GBTC decreased to 537,000 Bitcoins, a drop of 82,000. This reduction has affected the current price pressures in the market.

Finally, GBTC's selling pressure is waning. BitMEX research data shows a decline in GBTC outflows. On January 23, outflows were down nearly 19 percent from the previous day, totaling $515.3 million. The following day, the decline continued, dropping another 16% to $429.3 million.

“GBTC's flow was only ‘$425 million' today, the lowest hemorrhage since day one and seems to be trending. That's still a pretty big number, says Bloomberg analyst Eric Balchunas.

This decrease in selling pressure is an important indicator for market analysts and investors, which may indicate a market reversal. In conclusion, despite the volatile nature of Bitcoin and various external pressures, these two factors indicate that the correction phase may be over.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.