These crypto venture capitalists reveal the secrets to raising capital

Creating a compelling voice for a crypto project is essential to attract the attention of venture capitalists (VCs), who sift through hundreds of proposals every week.

Still, invaluable insights can be learned about what VCs look for in crypto startups. These include blueprinting, focusing on timing, transparency, market awareness, team composition, and community engagement to help entrepreneurs improve their processes.

Building the perfect space

Morningstar Ventures founder and CEO Danilo Carlucci told BeinCrypto that time is of the essence. Startups should only engage VCs when they have a Proof of Concept (PoC) that demonstrates the viability and potential of their product or service. This stage is critical to get initial interest and feedback from investors.

It then uses this feedback to refine its minimum viable product (MVP), allowing startups to demonstrate tangible achievements and metrics, making a stronger case for investment. According to Carlucci, the correct timing and repetition of these steps, validated by quantifiable success measures, will significantly affect the project's Future Diluted Valuation (FDV).

“Timing is a very difficult thing to perfect. But if startups get their project phase right and iterate, they can raise a lot of money, ultimately impacting their FDV,” Carlucci said.

He also emphasized the importance of clarity and transparency in the voice. Successful pitches succinctly describe the problem being solved, the specifics of the solution, and the strategic use of capital. Above all, clear go-to-market strategies and user acquisition plans are especially compelling.

Read more: Crypto Marketing Truth: Advertising Can't Buy Results

Projects identified with a well-defined Unique Selling Proposition (USP) supported by market and competitive analysis. Incorporating on-chain metrics and market trends further enhances a project's appeal by clearly demonstrating its potential.

“We've all heard it before. It is good when it is reduced. Although it seems simple, we value clear and concise sounds. Keep it short and sweet! I strongly believe that VCs not only read hundreds of pitches per week, but the less time it takes to explain your project, the better,” advises Carlucci.

Similarly, Samuel Huber, CEO of Landvat and Matera Protocol, told BEncrypto that startups should focus on hard metrics. These include profitability, burn rate and capital efficiency, which are now very important to investors. Even with the current enthusiasm in the crypto market, the wider economy will continue to take a cautious approach.

The focus on generating real income cannot be overstated. In the flow of market cycles, where bull markets prioritize growth at the expense of strong business fundamentals, bear markets shift their focus to fundamental metrics like earnings.

“Entrepreneurs need to shift their focus to the metrics that investors value. Indeed, crypto startups need to demonstrate their ability to generate real revenue. Instead of emphasizing decentralization, they need to focus on demonstrating viable business models,” Huber explained.

The road to funding is fraught with challenges. “There is funding for startups with unproven business models and poor performance,” Huber said. He emphasized the importance of showing actual business metrics rather than estimates. This requires a strong focus on building a strong business that stands out in bear markets.

Tokenomics and the dream team

Moreover, the team behind the project is an important factor for VCs. Carlucci emphasizes that VCs invest in people as much as ideas. Thus, a group's history, complementarity, and vision are explored. The team's openness to collaboration and feedback and a proactive approach greatly influence VC investment decisions.

In this regard, most VCs look for teams with strong experience and extensive experience in the field.

“The team is everything! No matter the technology, the design or the idea, most VCs invest in people. So the team and the founder's vision are critical,” Carlucci said.

Tokenomics and crypto narrative trends play a crucial role in attracting investment. Projects must design tokonomics that align the VCs' needs with the project's long-term vision, ensuring their commitment to the project's success. Likewise, entrepreneurs should align their projects with existing crypto narratives, striving to position themselves as leaders in these spaces.

Despite the concerns in the crypto industry, Carlucci suggests that a well-defined USP and comprehensive market analysis can address potential risks and demonstrate a startup's understanding and preparedness for challenges. Meanwhile, Huber emphasized the importance of utility and adaptability.

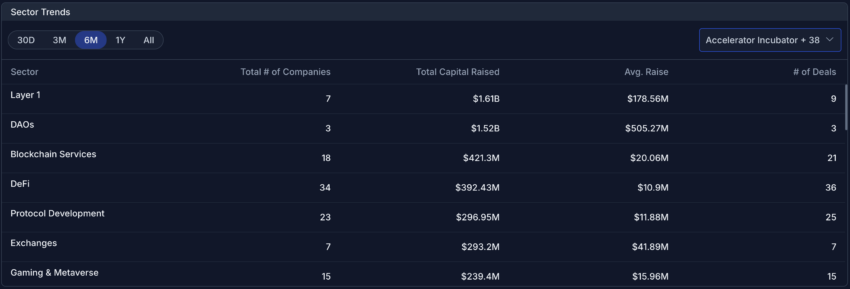

“In general, projects in the infrastructure sector are very attractive to investors because of their wide utility potential. While applications certainly create value, infrastructure projects influenced by narrative trends such as NFTs, Metaverse, DeFi, RWA, or the creative economy provide a basis for others to leverage, thereby It increases their resilience,” added Huber.

Trust is also an important factor in investment decisions. VCs prefer to back founders they know and trust, which shows the importance of building a strong company and networking to build credibility. In Huber's view, the journey to get VC money in the crypto market is as much about showing strength and innovation as it is about navigating investor expectations and market dynamics.

Indeed, Carlucci emphasized the importance of choosing the right VC partners. Startups should seek strategic partners that offer more than just capital, such as user access, networking opportunities, and industry expertise.

Read more: GSD Capital Review: A Guide to AI-Powered Hedge Funds

By focusing on time, transparency, team dynamics, tokennomics and strategic partnerships, startups increase their chances of attracting the necessary funding to move their projects forward. Adherence to these principles is helpful in obtaining venture capital financing in the crypto market.

Disclaimer

Following Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is committed to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its employees. Readers should independently verify information and consult with a professional before making decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.