This billionaire predicted Bitcoin to rally in Q2 2024.

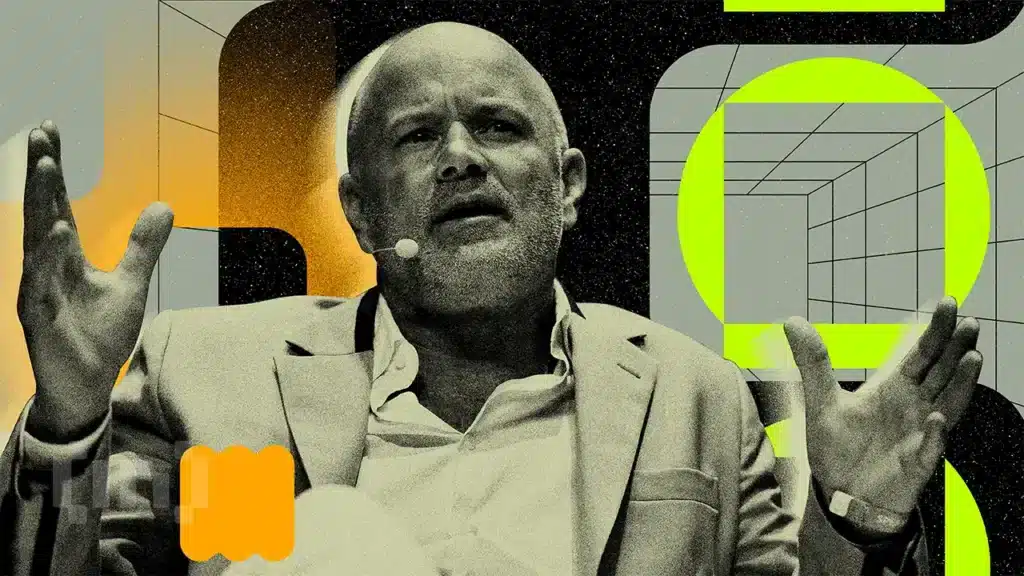

Michael Novogratz, the respected founder of Galaxy Digital Holdings, has announced that Bitcoin may consolidate within a certain price range in the near future.

During a conference call following the company's first quarter financial statement, he offered insights into the cryptocurrency's direction.

What could result from a Bitcoin crash?

Novogratz highlighted the integration of cryptocurrency into traditional finance to maintain the value of Bitcoin in this region.

“We're in a consolidation phase in crypto. Bitcoin, Ethereum and everything is consolidating, what does that mean? Maybe somewhere between $55,000 and $75,000 until the next set of market events, the next set of market events will push us higher,” Novogratz said at the conference.

This expected stability comes after an impressive bull run led by significant market catalysts such as the launch of the US spot Bitcoin currency and the reduction event. The latter is a code modification that slows down new bitcoin withdrawals, historically used as bullish triggers.

Following these events, the market experienced a period of stagnation. This is largely due to the weakening of optimism about possible rate cuts by the Federal Reserve, influenced by strong economic indicators. Since the end of February, the price of Bitcoin has fluctuated between $56,500 and $73,700.

We had a lot of tailwinds in Q4 and Q1. I think that's certainly where we're going to be for this quarter, maybe next quarter to Ham, the Fed will start to cut rates because the economy is finally slowing down or for, we're going to go through the election and I think the election will bring clarity in a way. Novogratz said.

Read more: Half a story of Bitcoin: Everything you need to know

In addition, the political environment can affect the market. Standard Chartered analyst Jeffrey Kendrick noted that Donald Trump's re-election would result in less stringent crypto regulations compared to those under President Joe Biden. Such a policy change could encourage international treasury holders to explore alternative financial assets such as Bitcoin, potentially pushing its value higher.

In March, Trump himself suggested a more relaxed regulatory regime, diverging from his previous preference for a traditional currency. Although Trump himself has not bought bitcoin, he recognizes its growing role in business.

“Bitcoin and cryptocurrencies have been used a lot, and I'm not sure I want to take them at this point,” he commented.

Meanwhile, Galaxy Digital reported a strong first quarter, with net income rising to $421.7 million, a significant increase compared to the previous period. The company's mining operations also grew significantly, generating a record $31.5 million in revenue.

Read more: Best Crypto Mining Stocks to Buy or Watch Now

This represents a 69% growth from the previous quarter due to the expansion of mining capacity. Galaxy business revenue rose to $66 million, up 78 percent.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.