This is to be expected.

With the Bitcoin halving on the horizon, cryptocurrency investors are looking at potential market moves that historically signal the start of a new bull market.

As one stands 60 days ahead of the critical period in April 2024, a glance at Bitcoin's past reveals a pattern. Pre-half price corrections heralded significant rallies the day after the half.

Bitcoin price adjustment before reduction

In the year Bitcoin trend analysis since its inception in 2009 highlights a recurring theme. In fact, a prominent price dip precedes each halving, setting the stage for the next market rally.

For example, in 2012 saw a staggering 50.78% drop in Bitcoin's value just a few months before it was halved. However, Bitcoin has since climbed to new highs. Similar patterns were observed in 2016 and 2020, with falls of 40.37% and 63.09% of pre-half corrections, respectively, with strong recoveries after the half.

In the year At the beginning of 2024, Bitcoin experienced a 21.17% growth, fueling speculations of an impending bullish market. However, if historical patterns are any indication, the market may brace itself for a correction, which could lead to a dip below $45,000.

Read more: Bitcoin Half Cycles and Investment Strategies: What You Need to Know

The Crypto Bull market begins its post-halving

The importance of these half events cannot be overstated. In the year Following the halvings in 2012, 2016 and 2020, Bitcoin has seen impressive gains of 11,000%, 3,072% and 700%.

These periods of bullishness lasted between 365 and 549 days, representing the highest half of the impact on market volatility.

If the upcoming bull market mirrors past expectations, expectations may set up the next Bitcoin market around April or October 2025.

Why sell BTC after 18 months of decline

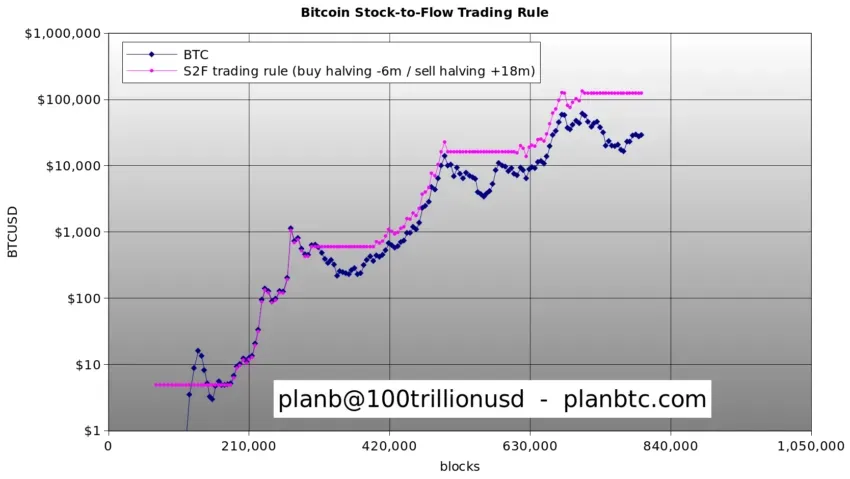

Between these cycles, Plan B's “stock-to-flow trading rule” provides a strategic approach to navigating the Bitcoin market. Advocating for purchases six months before the halving and sales 18 months after, this strategy aims to take advantage of the predictable cyclical nature of Bitcoin prices.

Plan B emphasizes that while this is not a predictive model, it outperforms historical Bitcoin price trends, suggesting a 4X Bitcoin price increase in the current cycle.

“Bitcoin is at $30,000, so the strategy [anticipates a] 4X the price of Bitcoin. We are waiting for the next buy signal and we already know that the halving will be around April 2024, so it will be around October six months before that. [Bitcoin will] Enter the market and stay there for two more years until October 2025, 24 months from now,” Plan B said.

Read more: Bitcoin price prediction for 2024/2025/2030

The estimation of the next bull market is based on the analysis of Bitcoin's historical price movements and strategic trading models such as Plan Bis. With an early bull market level identified, the stage is set for significant price increases after April 2024.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.