This is why Bitcoin is becoming so central.

Kadan Stadelman, CTO of Comodo, who expressed his concerns to BeInCrypto about the increasing centralization in the network, is at risk of Bitcoin's ethics as a decentralized cryptocurrency.

This fundamental shift could redefine Bitcoin's role in the financial landscape.

A huge mining powerhouse

In the year Since its inception by Satoshi Nakamoto in 2009, Bitcoin has been hailed as a pioneering force of financial autonomy and freedom freed from the control of centralized financial institutions. However, recent developments suggest a departure from this ideal, leading to what Stadelman calls the “central paradox” of Bitcoin.

One of the significant signs of this trend is the concentration of mining power in a few mining pools. Foundry USA and Antpool now control over 50% of the total Bitcoin hashrate. This focus is even more pronounced when one considers that more than 80% of the mining power is held by just five pools.

Such dominance by a few undermines the decentralized nature that Bitcoin is supposed to exemplify.

The influence of government and regulatory bodies complicates the picture. For example, the North American blockchain pool not only meets but exceeds the US government's Office of Foreign Assets Control (OFAC) compliance requirements.

Read more: Crypto Regulation: What are the Pros and Cons?

This compliance introduces a level of government oversight and regulation that was previously absent, which undermined Bitcoin's promise of decentralization.

“In short, a small number of miners control a large amount of wealth, which undermines the decentralized ethos that Bitcoin upholds. This situation calls into question the egalitarian nature that Bitcoin is said to represent and opens up a discussion on the real users of this digital currency,” Stadelman told BeinCrypto.

American institutions are controlled

Stadelman believes the growing involvement of major financial institutions in Bitcoin mining represents another shift toward centralization.

BlackRock owns 6.71% in two prominent Bitcoin mining companies, Marathon Digital Holdings and 6.61% in Riot Blockchain, bringing its investment to $383 million. Fidelity Group has been actively mining Bitcoin since 2014. On the other hand, Vanguard holds 17.9 million shares in Riot Platforms and 17.5 million shares in Marathon Digital.

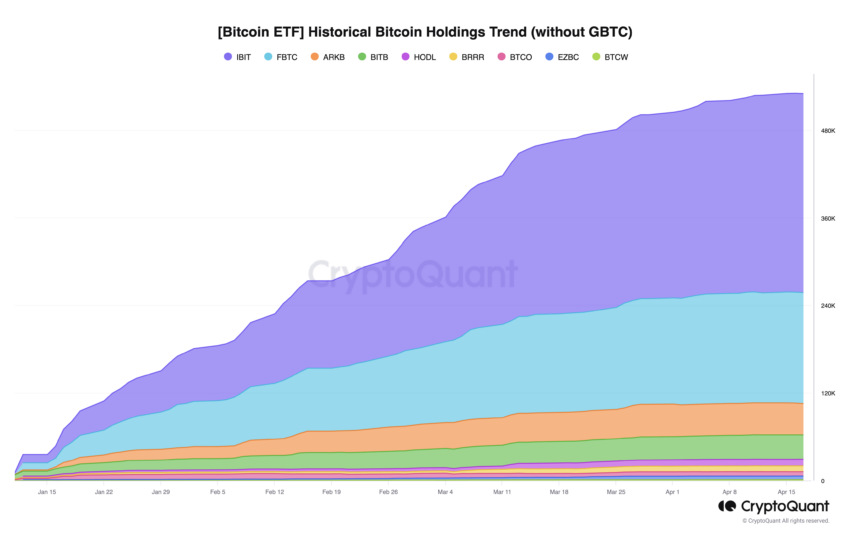

This is not just a financial investment. In January, BlackRock integrated Bitcoin into the mainstream financial market by filing documents with the SEC to include an additional Bitcoin exchange-traded fund (ETF). This new financial instrument now manages 272,800 BTC worth $17.20 billion.

This figure does not even include holdings of similar products managed by other parties.

“The influence of these financial giants on Bitcoin mining operations could lead to a situation where decision-making and control over the network is in the hands of a few, rather than being spread across a diverse group of participants,” Stadelman added. .

The crux of the problem lies in the stark contrast between Bitcoin's current state and its original purpose. Bitcoin's original vision was to operate as a decentralized network independent of traditional financial systems. However, increasing centralization may bring it closer to systems it intends to bypass.

Read more: 5 best platforms to buy Bitcoin mining stocks before 2024 halving

This centralization is not only a technical issue, but a fundamental question about the nature and future of Bitcoin. It challenges the decentralized ethos that appealed to investors and consumers alike with the idea of a financial system free from traditional constraints.

So the call from Stadelman for a robust discussion within the Bitcoin community is timely and necessary.

Disclaimer

Following Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is committed to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its employees. Readers should independently verify information and consult with a professional before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.