This is why retail investors are ditching cryptos

Retail investors are currently showing significant caution for the crypto market. This behavior is in contrast to previous cycles where their involvement had a significant impact on market trends.

Understanding the reasons for this hesitancy is critical to predicting future market movements.

Retail investors are not here yet

Retail investors are showing reluctance to engage with the crypto market, a trend experts say could affect the direction of the market. Gustavo Faria, founder of Noci, highlights key metrics that indicate low retail engagement.

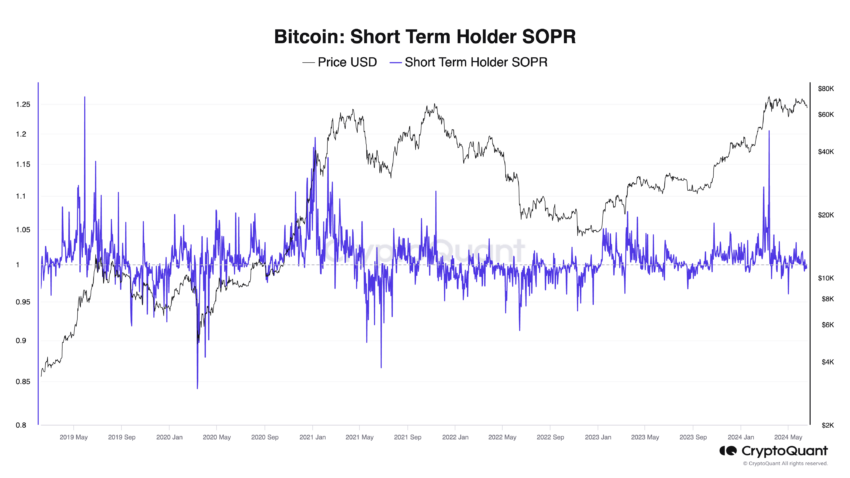

“A central feature of Bitcoin cycle peaks is the predominance of coins with maturities of less than 3 months,” says Faria.

Currently, short holders account for about 35% of the capital available, up from 70% at the previous market peak. This indicates that long-term Bitcoin owners, often referred to as “smart money”, will protect their positions and provide a more stable market base.

Historically, short-term holders' cost-to-profit ratio (SOPR) has exceeded 1.10 during market peaks. In this cycle, the highest SOPR recorded was 1.05, which indicates a more neutral market position.

“This structure shows that we have not yet reached the climax of this cycle,” Faria added.

He believes the current market is strong, reducing the likelihood of an immediate bear market and showing potential for further growth.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Moreover, Anthony Sassano, an independent Ethereum educator, referred to the unique nature of the current bull market, calling it “extremely strange.” It is expected that the four-year cycle is disrupted, market behavior is driven by crypto natives rather than retail investors.

Sassano highlights the lack of broad market growth, particularly driven by retail participation.

“Retail and new money were here and still aren't – all crypto natives are doing high PvP,” he noted.

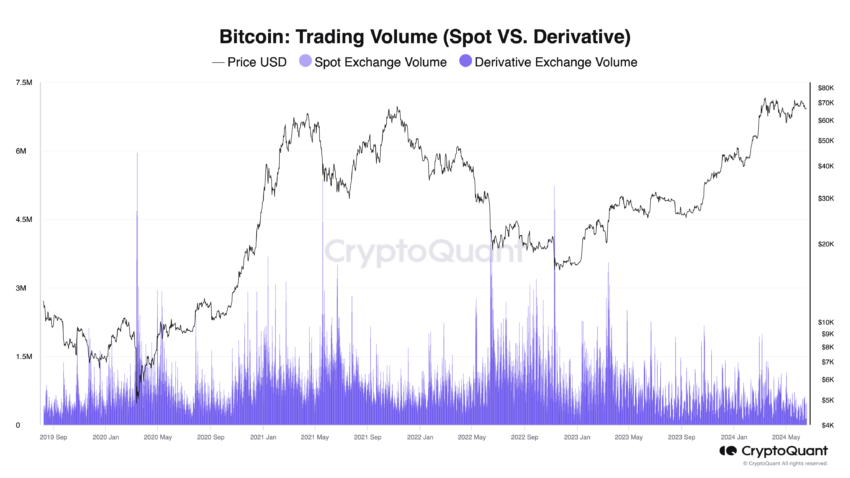

Adding to this view, crypto analyst Cyclops highlights the lack of retail enthusiasm. He pointed out that current transaction volume is significantly lower than it was in 2021, despite Bitcoin's high value.

Cyclops suggests that this lack of retail participation means the market has yet to experience the speculative frenzy seen in previous cycles.

“Standard rules are still not in the crypt. My friends don't send me messages on WhatsApp. My mother never knew Bitcoin would be at an all time high,” he commented.

These insights suggest that retail investors are cautious, perhaps due to the volatility of the crypto market. This hesitancy, coupled with current market volatility and the dominance of current crypto participants, may limit the market's potential for growth.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.