This is why the approval of a Bitcoin ETF could fuel the biggest bull run ever.

The United States Securities and Exchange Commission's (SEC) recent extension of Bitcoin ETF (Exchange Traded Fund) rulings to 2024 has stirred the pot in the cryptocurrency market.

Industry experts see the delay as timing for the SEC's strategic action. This comes amid continuing delays in precedent and a push by Congress to speed up regulatory transparency.

Bitcoin ETFs to open floodgates for institutional capital

Current crypto market participants are likely to be shaken by the SEC's move to delay Bitcoin ETF decisions until 2024. They are no stranger to SEC tactics, and the market has historically ignored such regulatory hesitancy. However, the importance of the eventual approval of the Bitcoin ETF cannot be overstated.

The US-based Bitcoin ETF could open the floodgates for institutional capital that has been on the sidelines waiting for an entry point into the crypto market. Lucas Kiely, Chief Information Officer at Yild App, told BEncrypto that the seal of approval for Bitcoin ETFs would establish a feedback loop, increasing legitimacy and investment flow at the same time.

“An approved Bitcoin ETF has the potential to accelerate institutional investment and usher in a transformative era for crypto. Such an ETF provides institutional investors with a regulated and recognized investment vehicle, alleviating their concerns about liquidity, protection and regulatory uncertainty,” said Kiley.

The push by financial giants like BlackRock and Fidelity to endorse a spot Bitcoin ETF is a sign of growing institutional interest. Their support speaks volumes, showing Bitcoin's readiness to integrate into the traditional financial fabric.

Such endorsements could shake up the broader financial community, heralding a regulatory green light for new crypto investments.

“The increase in institutional interest has significant implications for the understanding and validation of cryptocurrencies in traditional financial circles. The participation of established financial institutions lends credibility to a crypto market that has long been considered volatile and speculative,” Keeley added.

Read more: 4 Best Crypto Brokers to Buy and Sell Bitcoin in 2023

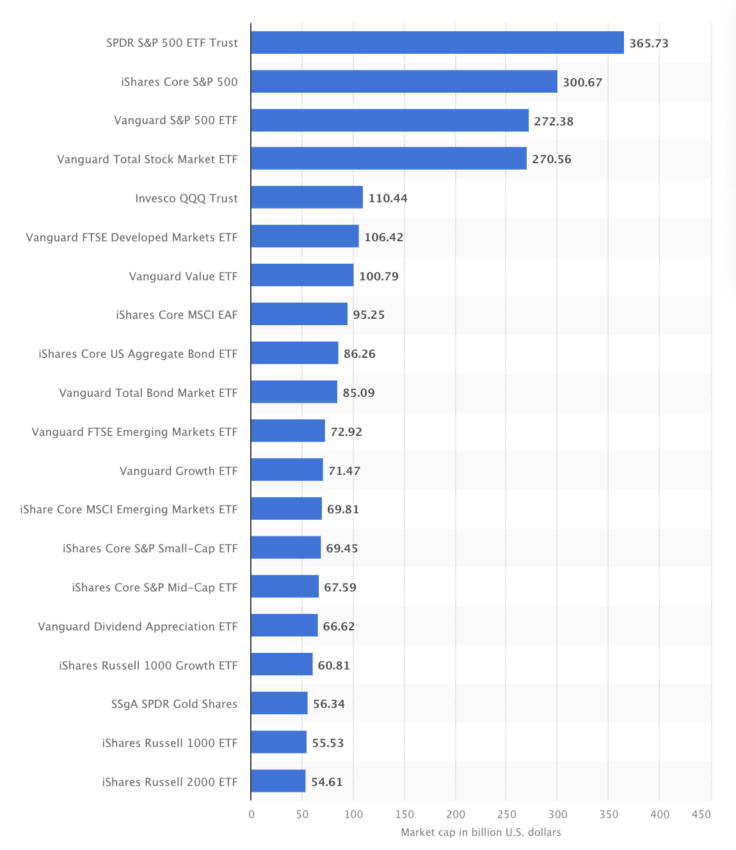

The growth potential of the US spot Bitcoin ETF market is impressive. Bloomberg Intelligence even suggested that it could tap into the $100 billion crypto industry. This development may cause the price of Bitcoin to appreciate further. In turn, it will probably spill over into the altcoin market, sparking an ecosystem-wide bull run.

The historical trend following Bitcoin's price rise has often seen altcoins rise from their slumber, suggesting the possibility of a broader market uptrend.

“When [BlackRock] presented [for a spot Bitcoin ETF]It was a whole different ball in my opinion. The truth is, they generally like to bring guns to knife fights. This is a firm that doesn't like to lose, knows what they are doing, and needs to see something. [in Bitcoin]Bloomberg analyst Eric Balchunas emphasized.

The difference between spot and futures based ETFs

Spot Bitcoin ETFs have the edge over futures-based ETFs, providing exposure to real-time Bitcoin prices. So it resonates with the actual supply and demand of the market. John Glover, Chief Information Officer at Led, told BeinCrypto that spot Bitcoin ETFs will improve the accuracy of price tracking, simplify investment processes and reduce fees for retail and institutional investors.

The low fee structure is particularly attractive as it can divert large amounts of capital into the crypto market due to the high costs associated with traditional crypto trading platforms.

“Spot ETFs track the actual market price of Bitcoin and avoid the high trading fees and the need to manage your own assets that come with regular exchanges. They provide retail investors and institutions with a more accurate and simple way to get direct exposure to Bitcoin. Futures ETFs, on the other hand, can be tied to the market and often are.” They may come with annual fees,” Glover said.

Read More: What Are Perpetual Futures Contracts in Cryptocurrency?

Moreover, speculative liquidity shifts from futures to Bitcoin ETFs may lead to restructuring of market volatility. This could increase Bitcoin's stability and weaken its notorious volatility. When institutional investors engage in less speculative long-term investment strategies, their participation adds a stabilizing influence to the market.

This is what CME Group Chairman Leo Melamed said in 2015. In 2017, the company agrees with the vision before the launch of the Bitcoin futures contract.

“We regulate, we keep Bitcoin from going wild. We will bring it to a standard trading instrument with regulations,” Melame said.

Wider acceptance of cryptocurrencies can lead to innovation and growth in the industry. As cryptocurrencies gain legitimacy, the flow of capital will fuel new projects, platforms and applications. Then move the industry to new heights.

“The more legal cryptocurrencies become, the more players will be involved. Many people watching from the sidelines may decide to take the plunge. This means not only more capital, but more innovation, more projects around crypto and, as a result, more products,” Glover added.

How will an increase in institutional interest affect the price of BTC?

The approval of a Bitcoin ETF could have a significant impact on the price of Bitcoin. This is mainly due to the inflow of institutional capital.

“We expect US-regulated ETFs to be a watershed moment for crypto, and we expect SEC approval by the end of 2023/Q1, 2024. After the halving, demand for Bitcoin points through ETFs will trade at a high of 6-7 times. Bitcoin ETFs issued in 2028 will sell for 9-10 times.” We expect % of space to be equal to Bitcoin, said Gautam Chugani, Senior Analyst, Global Digital at Bernstein.

Institutional investors, with their large financial resources, can move the market significantly. Inflows into Bitcoin via regulated ETFs could boost demand and consequently push the price of Bitcoin into a bull run.

In fact, approval signals regulatory approval that could further boost investor confidence, boost demand and prices.

“The first Bitcoin Futures ETF was launched in 2015. The October 2021 approval came before the previous market hit an all-time high the following month. However, it would be going too far to say that the ETF was the only reason for the price action. Still, the approval announcement of one or more of the space ETFs can help boost sentiment and drive buying in the days, weeks or months ahead,” Glover confirmed.

Read more: Why the Crypto Market Didn't Realize the Bullish Potential of Spot Bitcoin ETFs

Historically, exposure to ETFs in other asset classes has often increased asset prices. For example, the gold market experienced a significant appreciation in value after the first gold ETF was approved. Similarly, a Bitcoin ETF could unleash a wave of liquidity, sending Bitcoin to new price highs.

The new highs are likely to continue thanks to improved legitimacy and a stronger, more diversified investor base that Bitcoin ETFs are growing.

“Applying these historical precedents to Bitcoin ETF approval suggests that it could significantly shape prices in the crypto market. If approved, an ETF would provide institutional investors with an accessible and regulated way to invest in Bitcoin, resulting in significant price movements,” concluded Kiely.

While the SEC's decision hangs in the balance, the crypto market awaits what could turn out to be a watershed. The approval of the Bitcoin ETF stands as a sign of major acceptance, promising a potential bull run fueled by institutional capital, improved market stability and a new era of growth and innovation in the industry.

Disclaimer

Following Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is committed to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its employees. Readers should independently verify information and consult with a professional before making decisions based on this content.