This is why the price of Ethereum can fall below $3,000

Recently, Ethereum (ETH) showed signs of falling below $3,000, but bulls held firm as they defended the altcoin.

Now trading at $3,480, here's what's next for ETH.

Ethereum still has more room to grow.

One consistently proven metric for analyzing Ethereum is the Market Value to Real Value (MVRV) ratio, a tool that helps assess shareholder profitability and identify potential market tops or bottoms. The MVRV ratio compares the cryptocurrency's market value to its realized value, giving insights into whether the asset is overvalued or undervalued.

As the MVRV ratio increases, it indicates that more shareholders are in profit. However, if it rises to a higher level, it suggests that the asset may be overvalued, increasing the risk of a price correction. Conversely, the lower the MVRV ratio, the lower the profitability.

If the ratio is too low, it indicates undervaluation, giving investors an attractive accumulation opportunity. For ETH, the 30-day MVRV ratio rose to 11.89%. However, this ratio is nowhere near the top of the area, which is usually around 18% to 22%. Therefore, this development indicates the value of Ethereum.

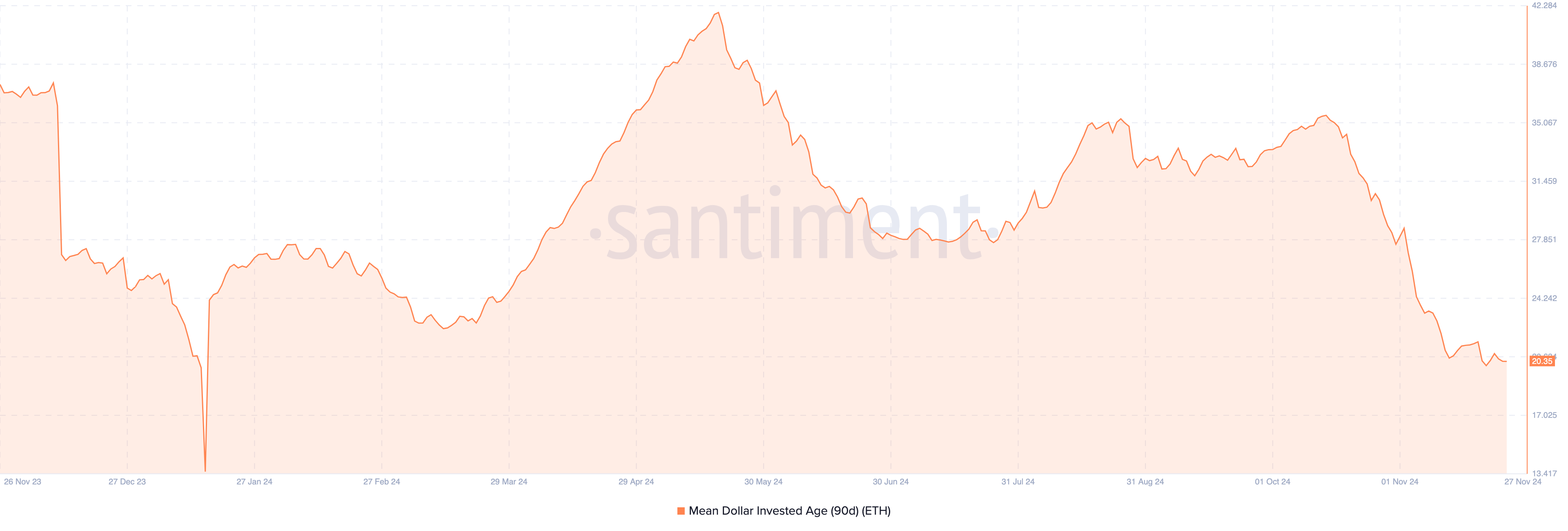

Beyond the MVRV ratio, the Average Dollar Invested Period (MDIA) also suggests that Ethereum will avoid further depreciation. MDIA measures the average age of all coins on the blockchain, at purchase price.

A rising MDIA shows that coins are becoming more stable, reducing the likelihood of a significant price increase.

On the contrary, the declining MDIA is moving previously dormant coins, which indicates an increase in trading activity, which is on ETH. If this trend continues, it could raise the possibility of Ethereum price rally.

ETH Price Prediction: $4,000 May Come.

On the daily chart, Ethereum price has formed a reversal head and shoulders pattern. This pattern usually emerges after a long downtrend, indicating a point of exhaustion for sellers.

The design consists of three key parts: the left shoulder, which represents the first contraction; of the head, indicating the end of the decline; And the right shoulder, again indicates the increase.

Trending in ETH, the cryptocurrency can rise to $4,000 in a short period of time. On the other hand, if selling pressure increases, this may change, and ETH may drop to $3,206.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.