This is why the price of Solana (SOL) has grown 500% YTD.

The Solana ecosystem is showing strong growth, overcoming the challenges of a bear market. SOL's price appreciation and distinct change in market sentiment indicate an interesting resurgence.

According to BeInCrypto data, Solana's SOL briefly touched the $60 mark earlier today, the highest level since May 2022.

Solana (SOL) price rallies 500% YTD

SOL has seen impressive growth, up over 178% in the past month and up nearly 500% year-to-date. This puts it ahead of other positive trends such as Bitcoin and Ethereum.

The influx of new users, increased liquidity, and growing interest in Solana's blockchain technology from major traditional institutions will drive this upward in value.

Read more: 7 must-have cryptocurrencies for your portfolio before the next bull run

Decentralized exchanges running on the Solana blockchain saw more than $2 billion in transaction volume in the first 12 days of this month, setting the stage for a record-breaking month, according to on-chain data. Additionally, the total value of assets locked on the network has exceeded $500 million as of press time.

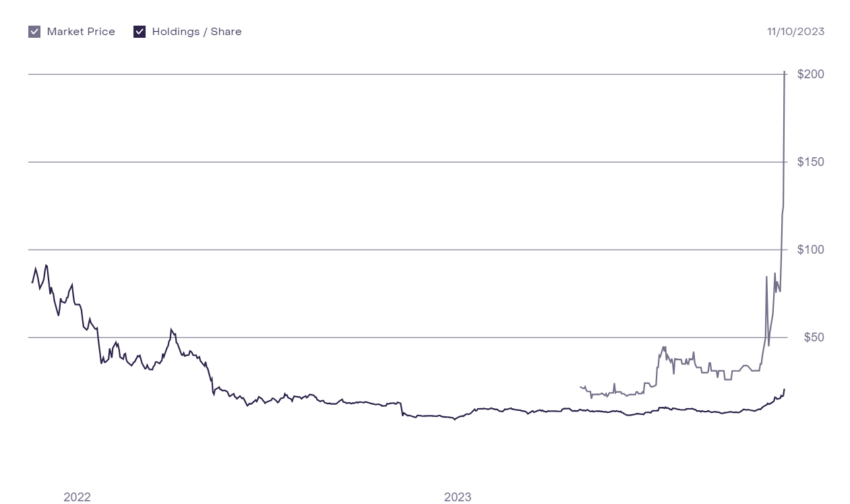

Grayscale Solana Trust at 800% premium

Bullish market conditions have had a significant impact on Greyscale's Solana Trust (GSOL). Data shows that GSL shares are trading at a staggering premium of over 800 percent.

Secondary SOL shares traded as high as $202 on November 10. This represents a significant increase from the initial sales estimate of $20 during the same period.

This increase highlights the desire among institutional investors to maintain exposure to Solana. The American Association of Individual Investors (AAII) says GSOL provides investors with a secure way to invest in ecosystems without natural risks.

Notably, GSOL's premium trading is in line with other gray stocks currently garnering significant investor attention. This heightened interest stems from widespread sentiment regarding the approval of bitcoin exchange-traded funds (ETF) in the US.

Read more: How to prepare for a Bitcoin ETF: A step-by-step approach

Currently, at least six of Greyscale's Trusts are earning more than 100% premium for digital assets, including Chainlink, Filecoin, Decentraland, Stellar Lumens and Basic Attention Token respectively.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content.