Toncoin price set for 20% rally, buy signal on chain parameters

Amid ongoing market volatility, Telegram-linked Toncoin (TON) has experienced a breakout from a long consolidation zone, with on-chain metrics now flashing a buy signal. Prior to this rally, Ton had been consolidating between $5.38 and $5.80 near the $5.75 resistance level for the past two weeks.

Momentum of the price of a ton

However, today's spectacular rally broke out of that zone and changed the overall market sentiment. At press time, Ton is trading at $5.90 and has seen a price increase of over 4.5% in the last 24 hours. During the same period, the trading volume increased by 6.5 percent and increased from time to time, showing renewed interest from traders and investors.

The potential reason behind the price rally is high market sentiment and the upcoming air drop in October 2024.

Toncoin technical analysis and upcoming levels

According to expert technical analysis, the ton looks bullish and is now trading above the 200 Exponential Moving Average (EMA) daily time frame, indicating a bullish trend. The 200 EMA is a technical indicator that traders and investors use to determine whether an asset is in an uptrend or downtrend.

Based on the historical price progress, there is a good chance that following the breakup, a ton could rise by 20% to $7 in the coming days. However, this bullish thesis will only hold if the ton closes the daily candle above the $5.90 level, otherwise it may fail.

Bullish On-Chain Indicators

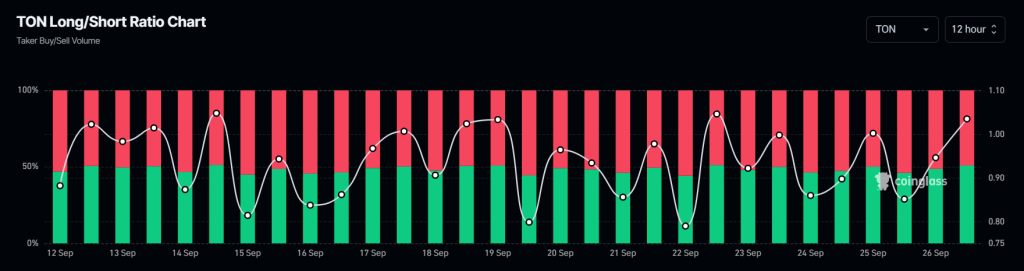

So far, the tone distortion view is more supported by chain parameters. Coinglass Ton's long/short ratio currently stands at 1.035, indicating strong bullish market sentiment among traders.

Additionally, the futures open interest increased by 5.7% in the last 24 hours, indicating that traders may build long positions compared to short positions.