Traders alert! Tron (TRX) is set for a 10% price increase, here’s why

After a series of over 12% declines in recent days, Tron (TRX) is now poised for a rally as its price action and on-chain metrics suggest volatility. Following the breakout of the $0.145 strong resistance level, it rallied more than 16% and was not retested.

Tron successful breakout retry

In the recent market decline, it has successfully tested the breakout area and is now showing a reversal movement with a strong daily candle.

At the time of publication, TRX is trading at $0.151 and has seen a price increase of over 3% in the last 24 hours. Meanwhile, the volume of business has decreased by 17 percent. This decline in trading volume may be due to the highly volatile market and depressed mood.

Tron price prediction

According to expert technical analysis, unlike the major cryptocurrencies, TRX looks bullish and is trading above the 200 Exponential Moving Average (EMA) in four time frames, indicating an uptrend. Additionally, the formation of a doji candle at the support level and the 200 EMA suggests further bullishness.

TRX has successfully broken out of the descending trend line and is currently facing a minor resistance level near $0.152. Based on the historical price progress, if TRX closes the candle above this resistance level, there is a high probability that it will rise by 10% to $0.167.

Bullish On-Chain Indicators

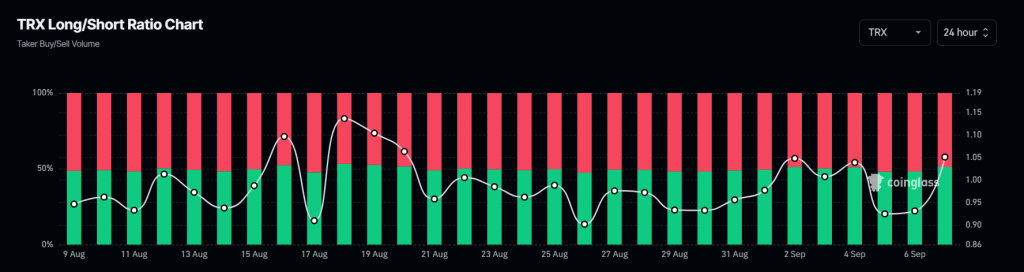

CoinGlass TRX's long/short ratio shows bullish sentiment. According to the data, the ratio is currently at 1.0509, which indicates bullishness (a value greater than 1 indicates this). Meanwhile, 51.24% of traders have long positions and 48.7% are short positions.

On the other hand, TRX's open interest increased by 8% in the last 24 hours, indicating that more long positions have been built during this period. Combining the bullish long/short ratio with elevated open interest suggests a strong buying opportunity. Traders often combine this information when building long/short positions.