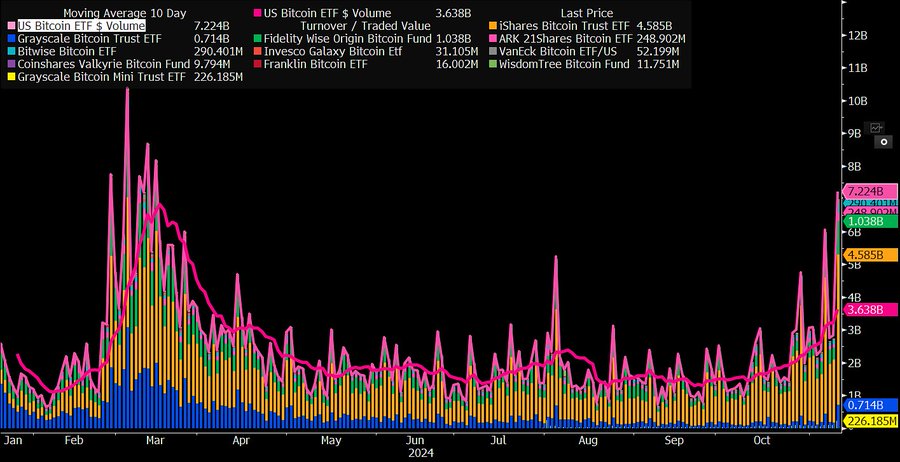

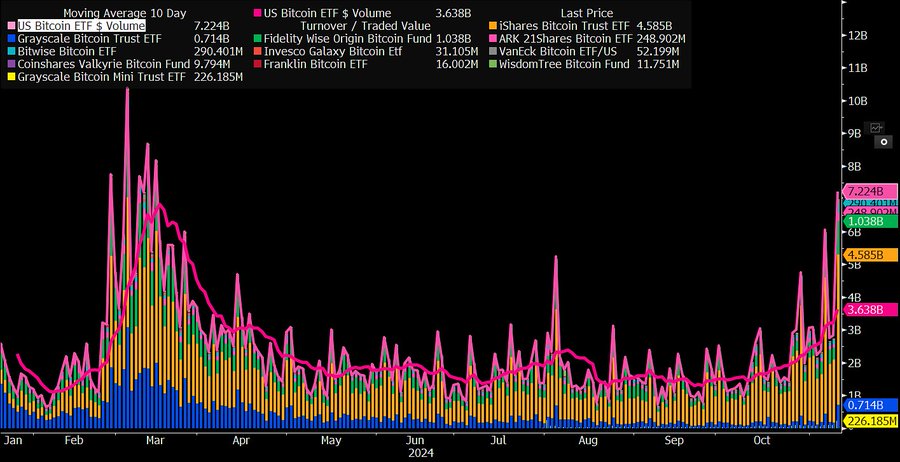

Trading volume for Bitcoin ETFs has reached $7 billion, the highest since March.

Key receivers

Spot Bitcoin ETF trading volume reached $7.2 billion on November 11. The BlackRock IBIT ETF led the market with $4.6 billion in trading volume.

Share this article

Institutional appetite for Bitcoin continues to grow as US spot Bitcoin ETFs see their biggest trading day in over 7 months. According to Bloomberg ETF analyst James Seifert, total daily volume reached $7.22 billion on Nov. 11, the 6th highest ever.

BlackRock's IBIT volumes were about half that – roughly $4.6 billion worth of shares traded today, followed by FBTC, which passed $1 billion.

The increase followed IBIT's record high on Thursday when it traded shares above $4 billion, the highest daily volume since its inception.

However, that day's activity resulted in net outflows of $69 million, followed by net inflows of more than $1 billion the following day—the largest single-day capital injection since inception.

ETF expert Eric Balchunas noted that higher trading volumes could indicate buying and selling activity. Market watchers may need several days to determine whether the recent volume increase translates into sustained net inflows.

The surge in Bitcoin ETF trading volume comes amid Bitcoin bullish momentum post-election. Following the victory of Donald Trump, which many believe to be favorable to crypto policies, there is a wave of optimism that could lead to a rise in Bitcoin prices and a corresponding increase in ETF trading.

Bitcoin overtook silver in market capitalization to reach $1.736 trillion and become the world's 8th largest asset, CryptoBraffing reported Monday. This achievement has come hand in hand with the increase in the price of Bitcoin, which has jumped 10% in one day to over $88,000. Meanwhile, silver prices fell 2 percent.

Bitcoin now only trails giants like Gold, Nvidia, Apple, Microsoft, Google, Amazon and Saudi Aramco.

Share this article