Triple Top at BNB, eyes at 18% discount

Following an impressive price increase of over 25%, Binance Coin (BNB) is now looking weak and a price drop may be seen in the coming days. A negative outlook for BNB may be due to the formation of a bearish price action pattern on the daily chart and the benchmarks on the chain.

BNB technical analysis and upcoming levels

According to CoinPedia's technical analysis, BNB has formed a triple price action pattern on the daily chart, which investors and traders consider a negative sign. Based on the data, when an asset forms an extended triple-high pattern, it is typically followed by a significant decline in price.

In addition to this pattern, BNB is forming a bearish night star breakout pattern near the $605 resistance level. The Evening Star depression is a reversal pattern that indicates a possible reversal from a downward trend. This combination of bear pattern and night star on the property is starting to change market sentiment among traders.

Based on the historical price rate, there is a strong possibility that the price of BNB will decrease by 18% to reach the level of $480 in the coming days. However, this false thesis only holds if BNB breaks below the $620 level, otherwise it may fall.

BNB's Bearish On-Chain Metrics

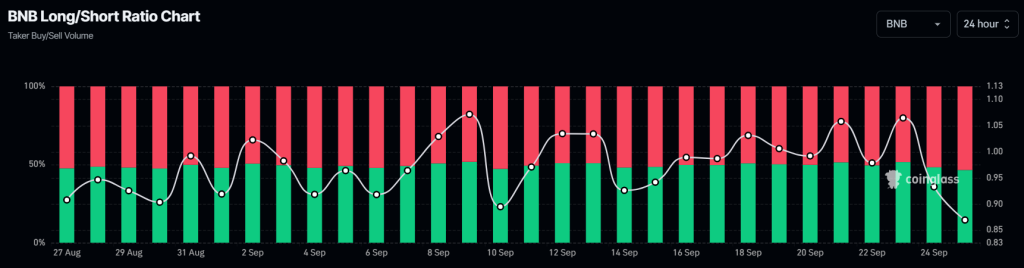

In addition to this technical analysis, the current negative outlook is further supported by the chain metrics. BNB's long/short ratio is currently at 0.869, the lowest since August 27, 2024, according to on-chain analyst firm CoinGlass. This indicates strong bearish sentiment among traders.

Additionally, open demand has decreased by 7% in the last 24 hours, indicating increasing fear among traders, possibly due to a lower price action pattern. Currently, 53.71% of top traders hold short positions while 46.29% hold long positions.

Combining all of BNB's on-chain metrics with the price action, it looks like the bears are dominating the asset and are likely to see significant price declines in the coming days.

Current price momentum

At press time, BNB is trading near $590 and has experienced a price drop of over 2.75% in the last 24 hours. Meanwhile, the trading volume has decreased by 12 percent, which shows that the participation of traders and investors is low.