Tron (TRX) Rally Coming Soon? 55.8% of top traders go long

While Tron (TRX) is down more than 10% in the past week, long positions and interest from top traders suggest the price is set to move higher. Along with all major cryptocurrencies, TRX experienced a price drop of over 1.8% in the last 24 hours.

Bullish Outlook for TRX

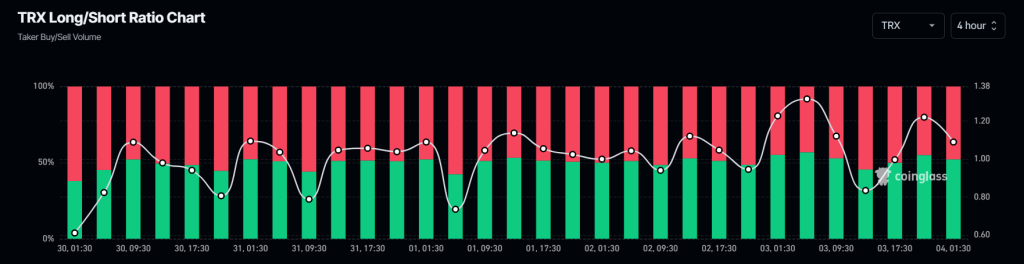

On-chain analytics firm CoinGlass's TRX Long/Short ratio chart shows a bigger picture for the token. According to the data, 55.8% of TRX's top traders are holding long positions, indicating a possible upward rally.

TRON technical analysis and key levels

According to expert technical analysis, TRX is still trading at a higher level as it is trading above the 200 Exponential Moving Average (EMA) on a daily time frame. However, after a strong resistance level breakout, TRX seems to be testing that breakout level.

Meanwhile, the $0.15 level is a strong support level for TRX and a price reversal is likely to occur from this level. On the other hand, if it fails to hold the $0.15 level and closes the daily shaman below this support, we will see a big sell-off in the coming days.

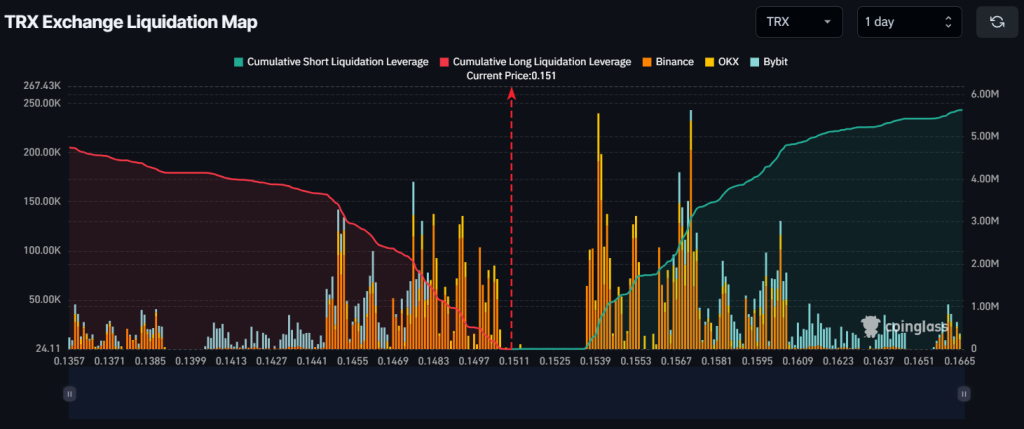

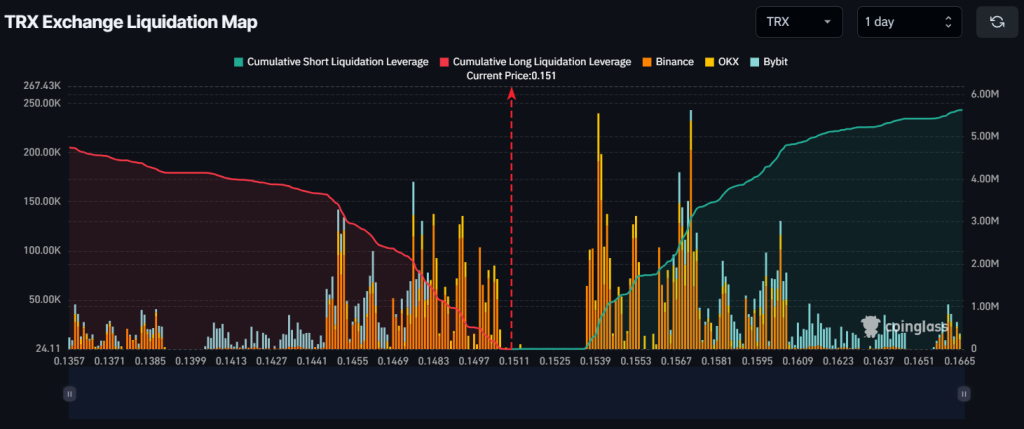

Main fluid levels

Currently, the main liquidity levels are $0.147 on the lower side and $0.157 on the upper side, as the data from CoinGlass indicates that traders are overextended at these levels.

If the market sentiment is weak and the price of TRX falls to the $0.147 level, about $2.06 million worth of long positions will be lost. On the contrary, if the sentiment changes and the price rises to the $0.157 level, short positions around $3.18 million will be argued.

This data indicates that in the higher timeframes, short sellers still dominate the asset and have the potential to liquidate long positions.

TRON price performance

At the time of publication, TRX is trading at $0.152 and has seen a price drop of over 2% in the last 24 hours. Meanwhile, trading volume also fell by 8 percent over the same period, indicating that trader participation is low amid low market sentiment.

Despite a significant price drop in the past few days, 57.60% of TRX holders remain profitable, 32% of holders are losing money, and 10% of TRX holders are on hiatus, according to data from chain analytics firm IntoTheBlock.