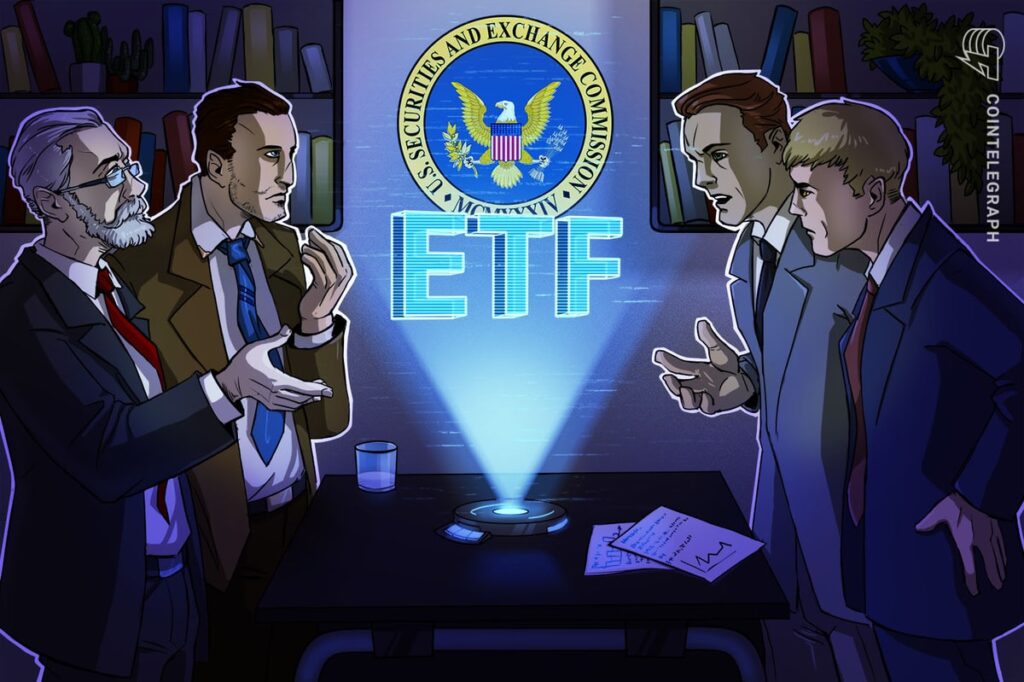

TRUMP, DOGE, BONK ETF Approvals ‘More Likely’ Under New SEC Leadership

The first is that memecoin-based exchange-traded funds (ETFs) are getting a lot of interest, thanks in part to new leadership at the US Securities and Exchange Commission.

Following the Trump family's launch of memecoins, the crypto industry saw a surge in memecoin ETF filings, which attracted significant retail attention.

The SEC has received initial filings for the official Trump (TRUMP), Dogecoin (DOGE) and Bonk (BONK) ETFs, Cointelegraph reported on January 21.

According to Dmitri Radin, founder of Zekret and chief technology officer of Fideum crypto regulatory and infrastructure firm, the approval of memecoin-based ETFs by new SEC Chairman Mark Uyeda, who replaced Gary Gensler, is more likely.

“Approval of TRUMP, BONK and DOGE ETFs now more likely with Trump's new crypto-friendly SEC picks,” said Cointelegraph. “This is a bold move, which could lead to greater liquidity and mainstream acceptance for memecoins.”

However, Radin cautions about the volatility of these signs:

But we must not forget that these memories ride on cultural progress and speculative madness, losing their original value and leading to extreme volatility.

The memecoin ETF filings follow the launch of the TRUMP token on January 18 and the official Melania token on January 19. These tokens are reported to have brought more than 200,000 new users onchain, according to Moonshot, a platform promoted by US President Donald Trump to buy his memecoin.

Related: 20% of Gen Z, Alpha sees crypto as retirement option: Report

Memecoin's crazy speculation is reminiscent of the GameStop saga

Despite bringing in many new users, the TRUMP token has struggled to gain momentum.

TRUMP/USD, all-time chart. Source: CoinMarketCap

TRUMP has fallen more than 14% in the 24 hours to trade at $35.81 at the time of writing, down 52% from its high of $75 on Jan. 19, CoinMarketCap data shows.

Related: Trump family memecoins may increase SEC investigation into crypto

While potential ETFs can bring more institutional investment and price volatility stabilize MemCoin's price, it still presents significant risks to investors.

Radin said memecoin's price action is based on trends and retail speculation.

“Investing in such products is more of a game for people who want to catch the upside, which is similar to betting on a small-cap stock before it goes out,” Radin said. “It's important to remember the lesson from the GameStop saga: when the hype fades, the drop can be heavy,” he added.

Although Radin called the memecoin ETF documents “an interesting experiment for crypto”, he warned that the price performance of these coins depends on cultural participation.

Meme-based investing capitalized on retail popularity during the first GameStop short squeeze in 2021, which sent GameStop's stock price up more than 1,000% in a month.

Magazine: Caitlyn Jenner Meme Coins ‘Mastermind' Celebrity Price List Released