Trump speech sparks $24 million long run in Bitcoin 2024 amid market volatility

Trump Speaking on Bitcoin 2024. Source: Bitcoin Magazine Livestream.

Key receivers

Trump's speech at Bitcoin 2024 led to a sharp rise and then a drop in the price of Bitcoin. About $24 million worth of Bitcoin longs were liquidated during the speech.

Share this article

![]()

Bitcoin prices experienced significant volatility during former US President Donald Trump's speech at Bitcoin 2024 in Nashville, where he announced plans to establish a “strategic national bitcoin reserve” if re-elected.

Bitcoin (BTC) price saw dramatic swings as traders reacted to Trump's comments. Before the speech, Bitcoin rose above $69,000. However, according to data from CoinGecko, the price subsequently dropped to $66,700 from over $68,000.

Plans to create a national bitcoin reserve are in line with market expectations until Trump's announcement. The former president's comments sparked trading activity, wiping out nearly $24 million in long positions during his speech alone.

Liquid data

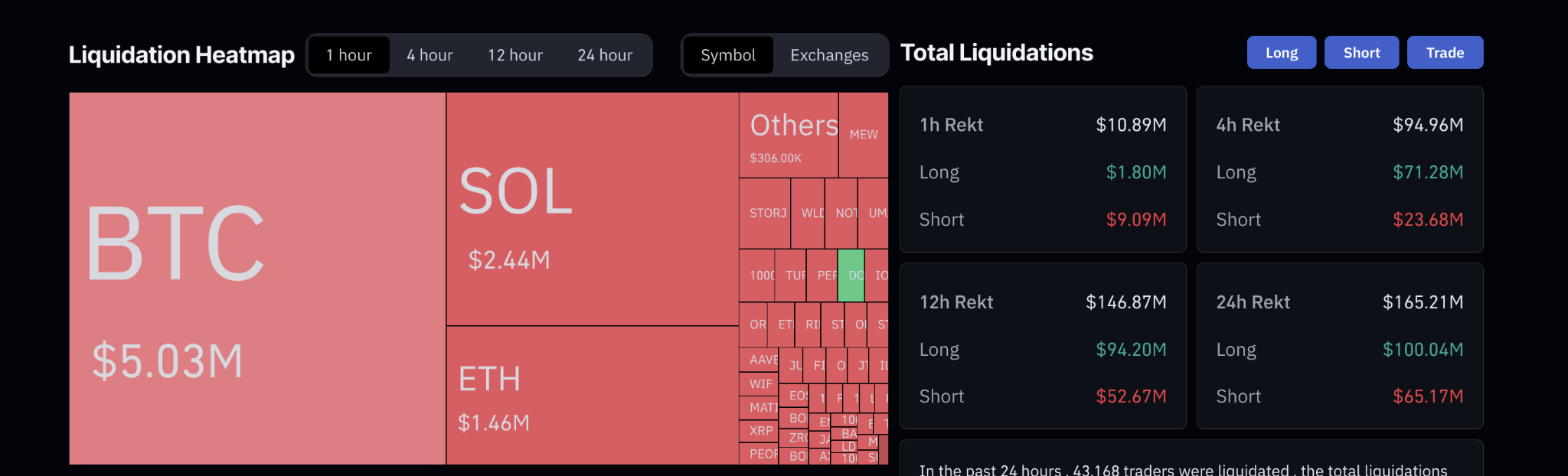

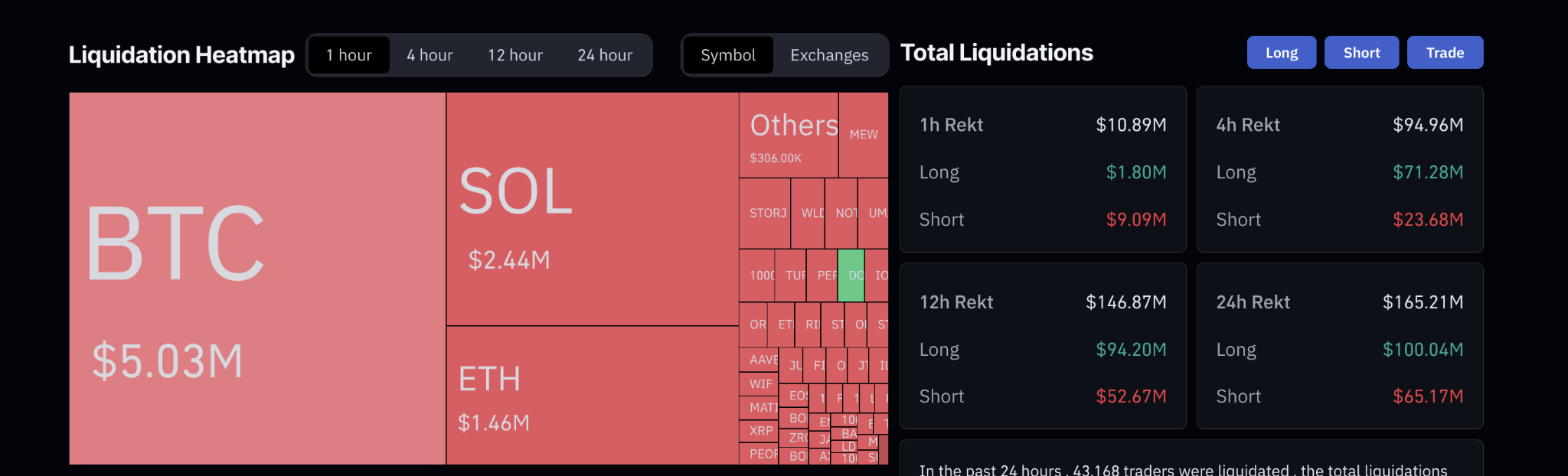

According to data from Coinglass, BTC had the highest liquidity at $5.03 million, followed by SOL at $2.44 million, and ETH at $1.46 million in the selected timeframe. This shows a large amount of forced selling in these cryptocurrencies, with BTC being the most affected.

On the right, the sheet lists the total flows for different periods. Last hour, total liquidity reached $10.89 million, with $1.80 million in long positions and $9.09 million in short positions. Over four hours, the liquidity was $94.96 million, with long positions at $71.28 million and short positions at $23.68 million.

The 12-hour liquidity was $146.87 million, with $94.20 million in long positions and $52.67 million in short positions. During the 24-hour period, liquidity totaled $165.21 million, with long positions at $100.04 million and short positions at $65.17 million. These statistics highlight the greater importance of long positions in all timeframes, indicating significant losses for long traders.

The broader crypto market mirrored Bitcoin's price movements during the event. This volatility shows the significant influence that high-profile political figures and policy announcements can have on crypto markets.

Rapid price fluctuations and high liquidity highlight the sensitivity of cryptocurrency markets to regulatory and political developments. Trump's proposal for a national bitcoin reserve represents a potential disconnect between traditional government institutions and digital assets, if it comes to fruition.

Earlier this month, Donald Trump advocated for all Bitcoin mining in the US to oppose central bank digital currencies and promote national energy dominance.

Bitcoin options have seen significant gains in implied volatility as analysts speculate about Trump's significant announcements at the upcoming Bitcoin 2024 conference.

Donald Trump's proposed policy for a weaker US dollar has been analyzed for its potential to boost bitcoin values if re-elected, marking a departure from traditional strong dollar policies.

Share this article

![]()