Trump’s Commerce Secretary nominee, Cantor Fitzgerald, has reached an agreement to take a 5 percent stake in Tether.

Key receivers

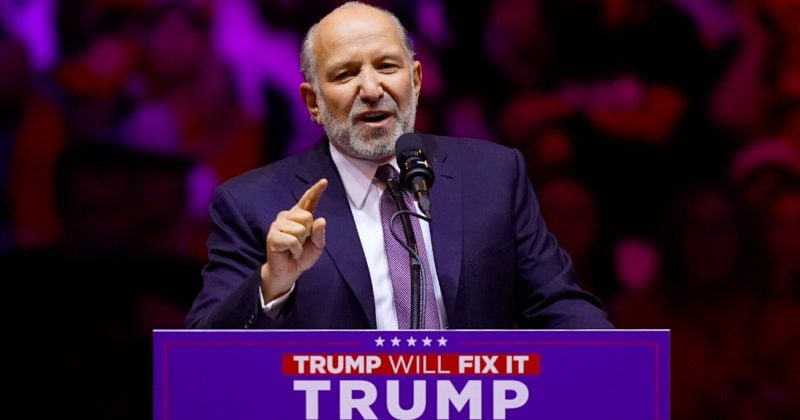

Cantor moved to secure 5% ownership of Tether in a deal worth about $600 million. The company's CEO, Howard Lutnick, will step down from Cantor Fitzgerald when he confirms as secretary of business.

Share this article

Cantor Fitzgerald, led by Donald Trump's Commerce Secretary nominee Howard Lutnick, has reached an agreement to acquire a 5% ownership interest in Tether, according to a Nov. 23 report from the Wall Street Journal, citing business partners.

The deal, valued at around $600 million, was announced after Lutnick was named the incoming Trump administration's top economic policy official. Cantor's CEO is a vocal supporter of stablecoins, particularly Tether's USDT and Circle's USDC.

“Dollar supremacy is fundamental to the United States of America. For us, it's important for our economy,” Lutnick said at the ChinalysisLink conference in April. “That's why I'm a big fan of properly backed stablecoins. I'm a fan of Tether. I'm a club fan.

Cantor Fitzgerald manages the largest portfolio of US Treasuries backing the USDT stablecoin, which has a market cap of more than $130 billion.

In the year The partnership, written in 2021, is a professional focused on managing stocks rather than regulatory influence, Tether spokeswoman Lutnick commented before being appointed Commerce Secretary.

“The statement that Lutnik's participation in the transition group is somehow interpreted [into] A Tether spokeswoman said it would be affected by regulatory measures.

Lutnick plans to step down from Cantor when the Senate confirms his role as U.S. Commerce Secretary. He said he would lose his interest in meeting the government's ethical standards.

Tether is under investigation for possible violations of money laundering and sanctions laws, the WSJ reported last month. The investigation focuses on whether Tether's USDT stablecoin was used by third parties to finance illegal activities.

The company has denied the allegations, calling them “unfortunate” and saying the claims are based on speculation without verified sources. CEO Paolo Arduino called the report “old noise.”

Share this article