Uniswap price surges 20% as UNI hints at major crash

Uniswap's price reached $10.99 on May 25, up more than 20% in 24 hours.

UNI finds itself in the midst of whale activity, developments in the Ethereum ecosystem, and Uniswap Labs' response to the SEC's announcement of Wells.

The technical chart shows a breakout that could push UNI's price to $15.40 and $2.

Uniswap's price jumped more than 20% in 24 hours to trade at $10.99, its highest level since early April.

A breakout view suggests that increased buying pressure could push UNI back to its March high of $15.40.

Uniswap price and ETH ecosystem

UNI is a native token of the leading DEX platform, probably one of the highest beta plays around Ethereum EFF approval.

On Friday, the price of Uniswap resisted the consolidation in the market, with the price of Ethereum (ETH) hovering above $3,700. As most altcoins looked to break out of key support levels, UNI price surged more than 20% to touch a multi-week high of $10.95.

This comes as whales increasingly withdraw UNI from the exchange. According to on-chain details shared by Lookonchain on X, one such whale withdrew $1.96 million in UNI from Binance when the price went up.

Uniswap's reverse activity also intensified when ERC-7683 was announced. This new token standard is a collaboration between Uniswap Labs and Across Protocol and aims to facilitate cross-chain transactions through a “unified framework for cross-chain systems.”

UNI rises after Uniswap responds to SEC

The breach of the crucial $10 mark came at a time of heightened uncertainty surrounding Uniswap's regulatory outlook.

Earlier this week, Uniswap Labs reiterated its readiness to fight a potential SEC lawsuit following Wells' recent announcement.

According to Uniswap, the SEC is “erroneous” in its declaration that the DX platform is an unregistered securities exchange and broker-dealer. The allegation that UNI is a security is also false, the SEC's theories surrounding it are “weak,” Uniswap wrote in its response to the regulator.

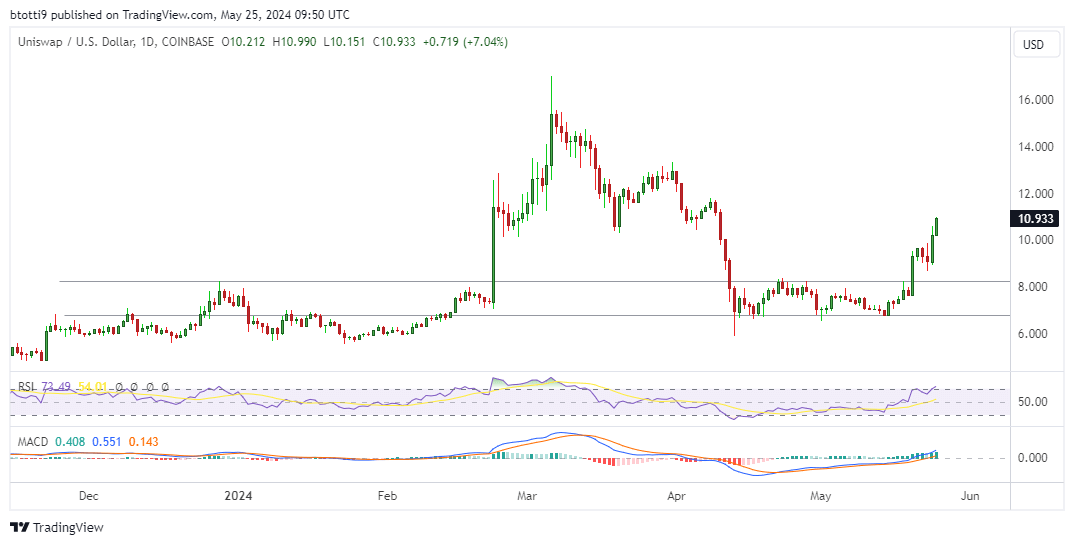

Uniswap price chart

Uniswap has seen a significant increase in the last 24 hours as UNI exited a phase of consolidation with the price below $8.

The increase in whale activity and the current forecast of the ETH ecosystem support the UNI bulls.

The technical chart supports an inverted continuation. In this case, the RSI and MACD indicators on the daily chart indicate that the bulls are under control.

If this view holds, UNI price could see key resistance levels at $12.96 and $15.40. An important short-term target is at $2.