Uperxi manages the growing data of Solana buyers

According to the volatility of the income, the Crypto entries listed in the Digital Asset Treasury (Initiative Treasury) sector are officially scrambled.

Recently, including their share of NASDAQ-disturbed UPEXI, they were allowed a share program of 50 million dollars in order to maintain a broader Solana, even if they continue to hold SOLANA CALTERSER.

Uperxi, a Solan-focused digital asset and consumer subsidiary operator, has been approved by the board to offer market participants “in the open market” based on market conditions.

The company emphasizes that the program reflects the confidence of its long-term strategy while maintaining a strong treasury position.

CEO Alan Marshall said it is a tool to enhance shareholder value and is a tool to kill the time it takes to make a return.

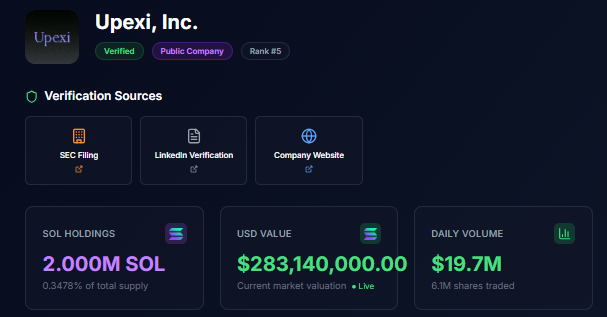

The company's treasury is valued at $283 million, representing 0.35% of Solana's total supply.

Although Solana's price was found to be between 143 and 134 dollars, the largest institutions in the UPEXI chain are among the holders.

CUNTS CUNTS CERPPO-STEROTE STOPE has seen heavy volatility in its own stock, falling more than $6.50 from around $3.400 last month.

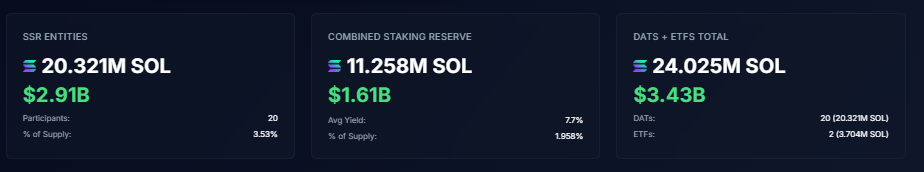

Uperxi's move comes at a time of turmoil for Solana-linked treasuries. According to institutional reserve data, the top 20 Sorena Grace and ESF holdings have a cap of $24 million, or $3.4 billion, or 3.5% of the total supply.

Half of these positions are left producing an average return of 7.7%, the rest is liquid for accounting purposes.

Future Industries (Ford) leads over $966 million, Solana Company (DSDT), Sharpies Technology (SPSD), and UPEXI top five.

These companies show how 76% of all companies use digital assets strategically.

Scania Treasury companies hold positions that have a business value below the asset value

According to market data, although Solana prices are up 7% in 24 hours, institutional positions are largely absent without significant differences.

Analysts see this stability as a sign of long-term confidence in the Solana network's fundamentals and its growing role as a lock-in for corporate treasuries.

Public market prices vary. Investor caution <ሶላና ግዞት> They are currently available at a discounted net asset value (MNAV).

The UPEXI MNOV remains with 0.68, while the external industry is placed at 0.82, despite the calcian mathematical epidemic sheets, are cautious feelings of deep holding.

The difference between treasury value and stock performance is the information sector.

After reporting Solan's unadjusted earnings of $66.7 million, a researcher with earnings of $78 million was reported, and was still bound by more introspective skepticism.

It is more than 600% more than 600% of the time Solana experienced the strategy earlier this year.

Other treasury use the same way. In the year On November 6, broadcast industries have confirmed a program program that will be shared with 1 billion dollars to change the dynamics.

Despite the short-term drag, the overall trend of corporate Solana holes remains upward.

The origins of Solana-focused brutality are an evolution of the Bitcoin Treasury strategies that dominated earlier cycles.

These organizations value Solana not only as a store of value, but also as an information-interest asset through the participation of cultivation and recovery.

The companies that belong to DFDV hold a total of 2.2 million mines, which is how active and revenue frequency is in Aripto.

Closing news news analysed, cryptographic predictions