US Bitcoin ETFs poured in $277 million last week amid the market crash

Key receivers

US Bitcoin ETFs saw a total of $277 million spent last week. BlackRock's iShares Bitcoin Trust reported a rare net inflow over the weekend.

Share this article

Bitcoin exchange-traded funds (ETFs) out of the US space hit $277 million last week as the crypto market slumped, with bitcoin remaining below $60,000 and most altcoins continuing to decline.

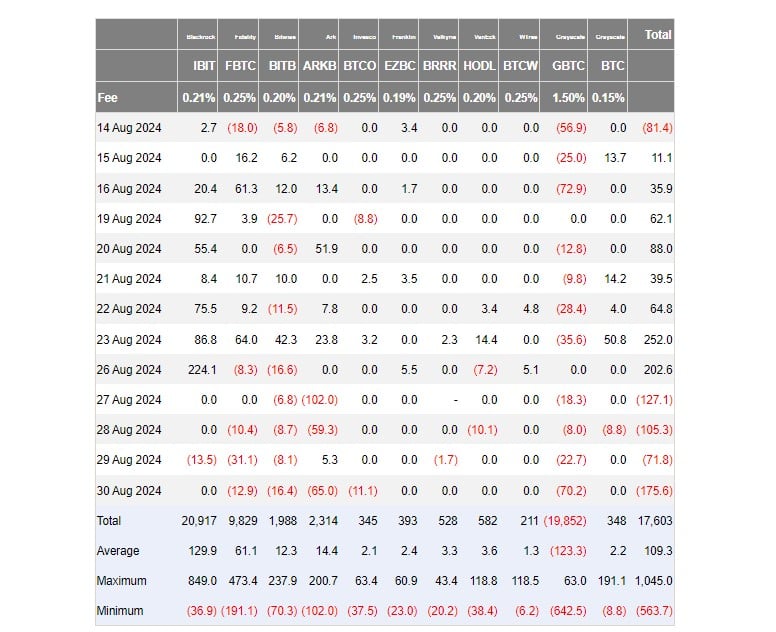

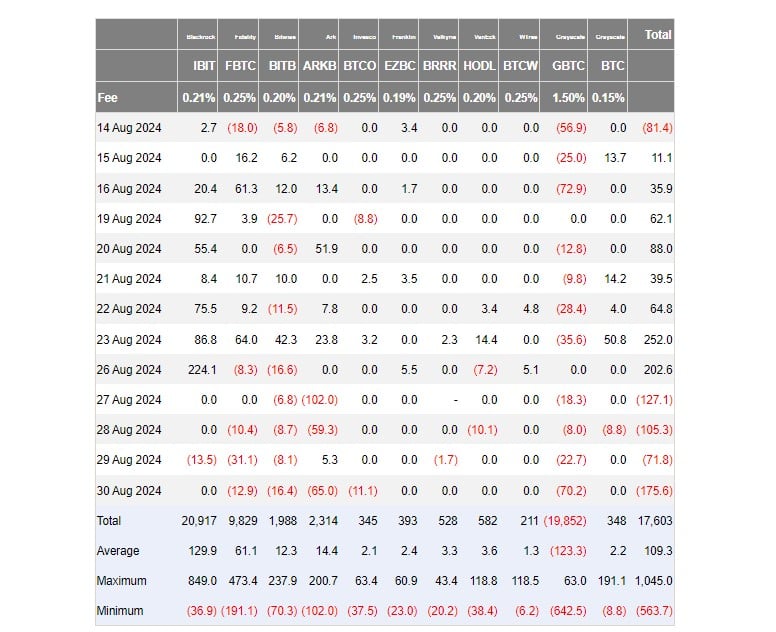

According to data from Farside Investors, a group of U.S. bitcoin funds recorded around $202 million in new investments on Monday, with BlackRock's iShares Bitcoin Trust (IBIT) accounting for the majority of daily inflows. On that day alone, IBIT recorded over $224 million in net capital.

After a strong start to the week, spot Bitcoin ETF flows turned negative on Tuesday and extended their losing streak into Friday.

According to data, investors have withdrawn nearly $480 million during this period. On Friday alone, US Bitcoin ETFs saw more than $175 million in outflows, the largest outflow since August 2.

Within a week of the market crash, BlackRock IBIT, a fixed income fund, experienced its second outflow since its inception. However, strong inflows on Monday allowed it to end the week with net inflows of around $210 million.

Last week, Ark Invest/21Shares' Bitcoin Fund (ARKB) and Grayscale's Bitcoin ETF (GBTC) experienced the largest net outflows among Bitcoin spot ETFs, with ARKB losing $220 million and GBTC losing $119 million.

In the same period, Bitcoin (BTC) fell 9%, around 64,500 on August 26 to $58,000 on August 30. The main crypto is currently trading around $57,700, TradingView data shows 10% in the last week.

Bitcoin's retreat has dragged down the broader crypto market. Ethereum, Solana, Ripple and Dogecoin all suffered losses, with Dogecoin falling the most by 5.6%.

The global crypto market capitalization decreased by 2.4% to $2.1 trillion, according to CoinGecko. Most altcoins have followed Bitcoin's downtrend, with four showing gains over the past 24 hours – Helium (HNT), Monero (XMR), Starknet (STRK) and Fetch.AI (FET).

Memecoins led the altcoin decline, with DOGS, BEAM, BRETT and Dogwifhat (WIF) experiencing the most significant losses.

Share this article