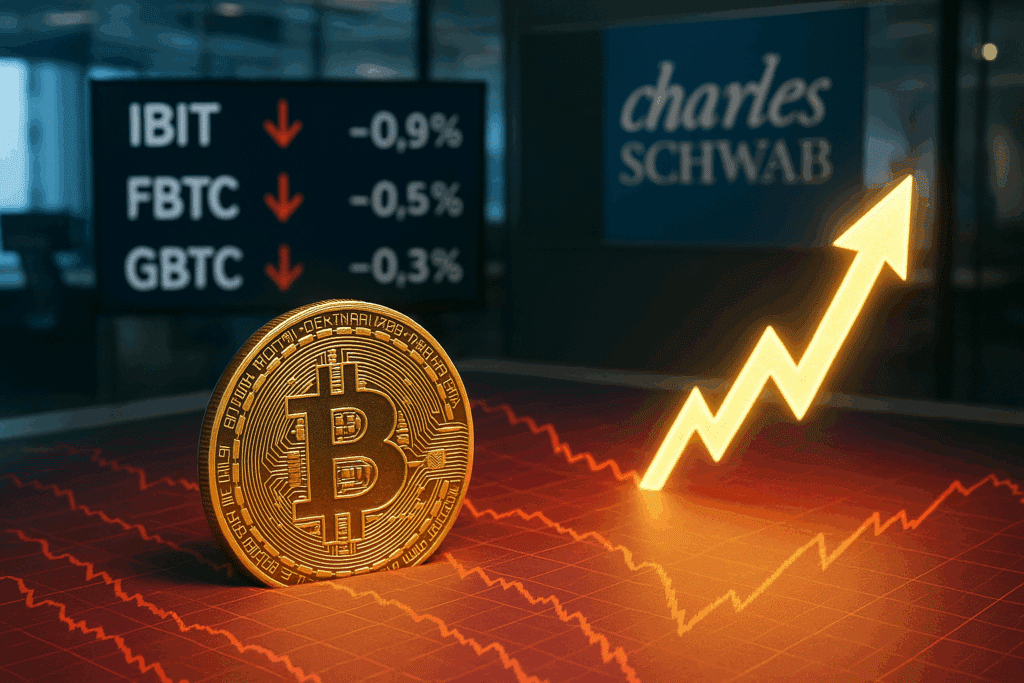

US Bitcoin ETFS See $1.2 Billion in Dispersions Every Week

American Biscuits etfs with 1.2B of $1.2B each week. Blackrock, Loyalty, and GreekKK are the main redemptions, mainly Billicon 10% weekly decline. Schwab is messy, and 20% of its clients hold US cryptos.

U.S. spot book exchange-traded funds (ETFS) were more than $1.2 billion in total inflows of more than $1.2 billion.

Despite the fines of Charles Shaba, the tunnels of institutions, the participation of investors in digital assets is burning, reflecting the growing criminal activity among retail and institutional clients.

Heavy criminals hit Bitcoin ETFs

According to Sovastol data, bitcoin at bitcoin at bitcoin at bitcoin at begs in total products and a broader scale market closed a negative week of $ 366.6 million.

The biggest drop came from Blocrock with $268.6 million in one day.

Patient Wise Fund (FBC) saw total redemptions of $67.2 million, while GRAYSCAL GBTC earned $25 million. The rest of the funds did not see any activity on Friday, the rest of the funds saw the Valkyrie Bitcoin ETF reported on Friday.

In the whole of the United States in the last week in the United States, one day – Tuesday – is only a small fraction.

Bitcoin price fell below $115,000, falling below $115,000.

The cut highlights that the price movements of Bitcoin will continue as long as the products of institutional institutions are the stimulus to the price of Bitcoin.

Charles' participation in the paralysis increases the participation

The ECACES SchWabs redeeming the ESF among some investors Regarding the feeling of cooling among some investors, there may be long-term potential of digital asset investment products.

Speaking on CNBC, CEO Rick Wick revealed that 20% of SChbab's customers in the US will be 20%.

The company's website is saved from 90 percent of visits that are interested in Crypto.

“Klepto es was very active,” he said, adding that the bronze continued to receive high participation from investors.

E.F.P.P. Analysis Nagraja said that it is good that SChbab's large platform will meet the future demand.

The company from 2026 In 2026, it offers clients plans to sponsor CREPTOTS ETFS and Bitcoin exits and long-term commitment to the sector, even for a short period of time.

Bitcoin Faces Professional

The month of October, in terms of history, is one of the strongest months of Bitcoin until now.

From Costelsssss Speccoins Sitccoin is as if he got ten out of ten out of twelve options, but this year the property is up to 6% month.

Despite the slide analysts, some market analysts hope that the “perspective” can return in the second half of the month.

Many this year may come as a cataclysmic demand for risky assets, including demand for distressed assets.

However, for current ETFs, price pressure, and macroeconomic uncertainty, investors may be penalized in the coming weeks of October.