US Bitcoin ETFs See Historic Flows As Brute Selloff Rocks Crypto Markets

Key receivers

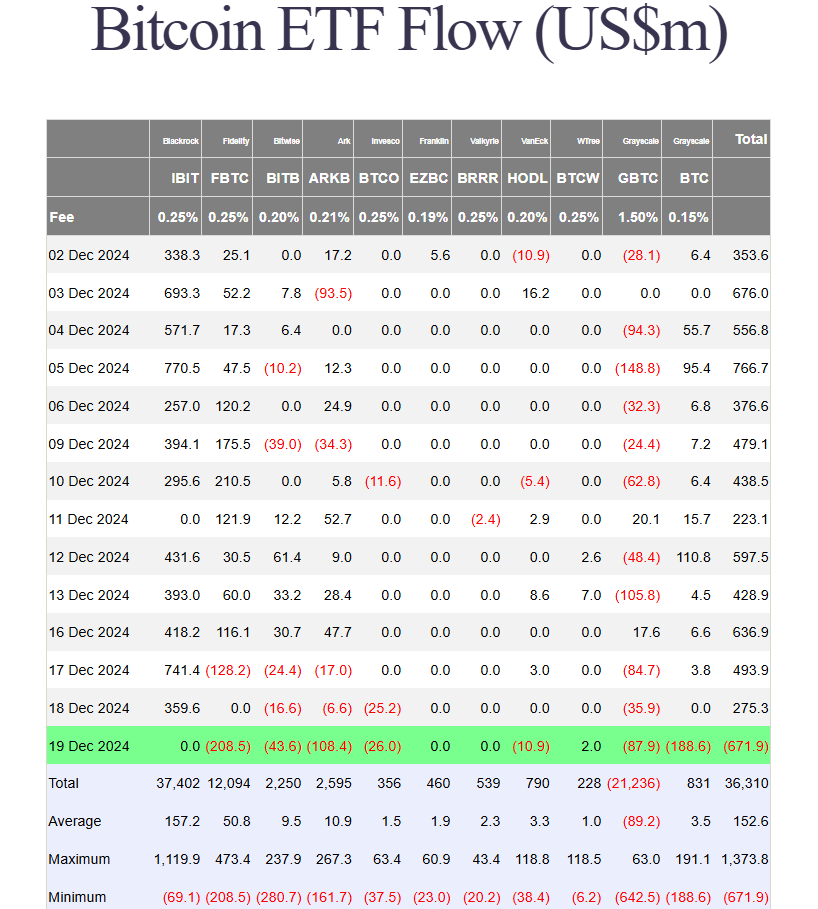

US Bitcoin ETFs experienced historic outflows, with investors withdrawing $672 million per day. Fidelity's Bitcoin fund led the outflow, followed by Grayscale and ARK Invest ETFs.

Share this article

U.S. spot Bitcoin ETFs experienced their biggest one-day inflows during a major crypto market selloff after the FOMC meeting. According to data from Farside Investors, about $672 million exited these funds on Thursday, ending a period of net outflows that began in late November.

The massive withdrawal eclipsed the record nearly $564 million set in May. 1, The spot group saw Bitcoin ETFs close to $564 million after falling 10% to $60,000 in a week.

Fidelity's Bitcoin Fund (FBTC) led outflows with $208.5 million in outflows, while Grayscale's Bitcoin Mini Trust (BTC) recorded the lowest score with net outflows of over $188 million.

ARK Invest's Bitcoin ETF ( ARKB ) and Grayscale's Bitcoin Trust ( GBTC ) also saw significant withdrawals, with ARKB losing $108 million and GBTC shedding about $88 million. Meanwhile, three rival ETFs managed by Bitwise, Invesco and Valkyrie lost a combined $80 million.

BlackRock's iShares Bitcoin Trust (IBIT), which posted $1.9 billion in net income this week and has been a major contributor to the group's recent strong performance, recorded zero inflows for the day.

The WisdomTree Bitcoin Fund (BTCW) was the sole beneficiary, attracting $2 million in new investments.

Bitcoin prices fell below $96,000 during the market crash and are currently trading around $97,000, down 4% in 24 hours, according to CoinGecko data. A steep decline across all assets triggered $1 billion in leveraged liquidity on Thursday, Crypto Briefing reported.

Market volatility followed the Fed's hawkish message after the cut decision. The Fed implemented a 25-basis-point rate cut on Wednesday but signaled fewer cuts in 2025.

Despite the continued price volatility, the Crypto Fear and Greed Index still shows a sense of greed at 74, down only one point from yesterday.

Share this article