US Bitcoin spot ETFs bleed $168 million amid market turmoil, Ether ETFs gain

Key receivers

Grayscale and Fidelity Bitcoin funds saw nearly $69 million in expenses on Monday. Ethereum ETFs recorded nearly $49 million in net inflows, a stark contrast to Bitcoin's heavy outflows.

Share this article

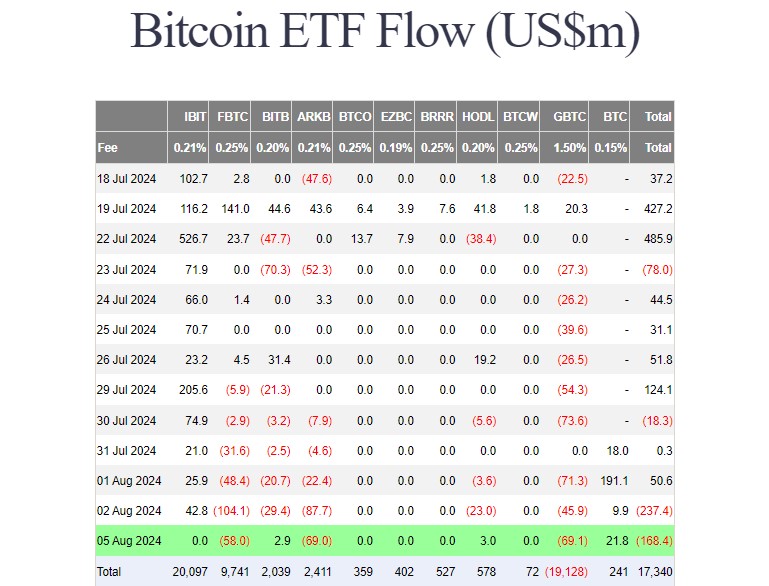

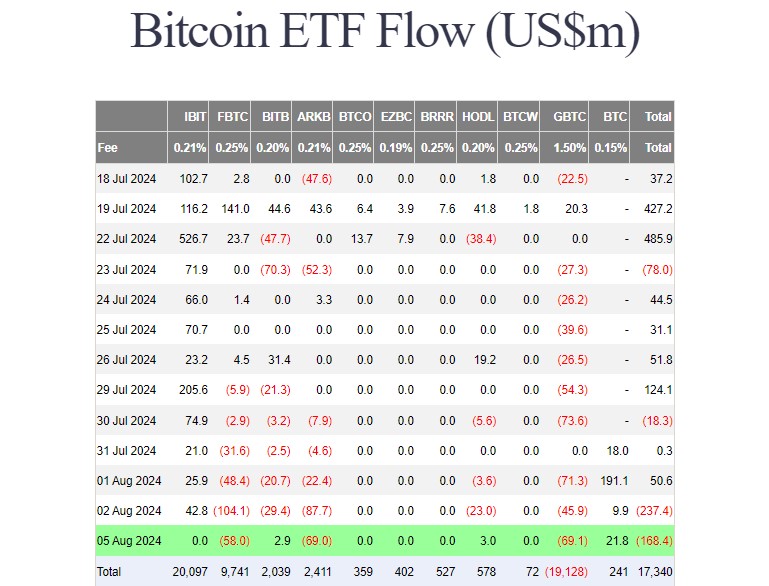

Investors pulled about $168 million from nine U.S.-based bitcoin exchange-traded funds (ETFs) on Monday, bringing total net outflows to $405 million for two straight days, data from Farside Investors showed. Meanwhile, spot Ethereum ETFs have brought in nearly $49 million in net income.

Traders dominated the daily outflows of Greyscale's Bitcoin ETF (GBTC) and Fidelity's Bitcoin Fund (FBTC), with about $69 million withdrawn from each fund.

In contrast, Greyscale's Bitcoin Mini Trust (BTC), the low-cost version of GBTC, took in nearly $29 million, making it the ETF with the highest daily flows. Two ETFs that posted gains today were Bitwise's Bitcoin ETF (BITB) and Valkyrie's Bitcoin Fund (BRRR), attracting nearly $6 million.

Other Bitcoin funds, including BlackRock's iShares Bitcoin Trust (IBIT), reported zero inflows.

Bitcoin and Ethereum ETFs have reached $6 billion in trading volume

According to data from Coinglass, US Bitcoin and Ethereum ETFs recorded nearly $6 billion in trading volume on Monday. Spot Bitcoin ETFs account for over $5 billion of total volume, with IBIT and FBTC being the dominant buyers.

The Spot Ether ETF contributed around $715 million to the total trading volume, led by Greyscale's Ethereum ETF and BlackRock's iShares Ethereum Trust (ETHA).

Bloomberg ETF analyst Eric Balchunas called the high volume “crazy volume during a market crash is generally a very reliable measure of fear.” On bad days, deep liquidity is valued by traders and institutions, indicating long-term benefits for ETFs.

Bitcoin ETFs have traded around $2.5b so far, a lot for 10:45am, but not too crazy (full story below). If you're a bitcoin bull, you don't want to see crazy volume today because on bad days, ETF volume is a very reliable measure of fear. When flipped, the deep liquid body on bad days… pic.twitter.com/TOQRjriqp

— Eric Balchunas (@EricBalchunas) August 5, 2024

BlackRock's ETHA held $47 million in net inflows on Aug. 5, followed by VanEck and Fidelity's Ethereum ETFs, according to Farside data.

These two funds accounted for approximately $33 million in revenue. Bitwise's Ethereum Fund and Greyscale's Ethereum Mini Trust also reported acquisitions on Monday.

The Greyscale Ethereum Trust (ETHE) received nearly $47 million in net inflows, the lowest since converting to an ETF. Over $2.1 billion was withdrawn from the fund in ten trading days.

Investors still hold about 234 million ETE shares. With the recent crypto market crash, those shares are now valued at around $4.7 billion, as updated by Grayscale.

The crypto crash began on August 4, following jump trading that saw large amounts of Ether moved to exchanges. This led to a sharp price correction in crypto markets, with Bitcoin falling below $50,000 by early US trading hours on August 5.

At the time of reporting, both Bitcoin and Ethereum prices were covered slightly. BTC is currently trading around $54,000, while Ethereum is up 6% to $2,400, CoinGecko data shows.

Share this article

![]()