US CPI data falls to 2.9%, Bitcoin price stabilizes above $61,000.

Bitcoin (BTC) prices held above $61,000 as US CPI inflation data fell to 2.9% in July, which was lower than expected.

CPI data measures price increases in consumer goods and services. After being muted for most of 2023, the impact of US macroeconomic data on Bitcoin and crypto markets is resurging.

CPI at 2.9%, falling below expectations

The US Bureau of Labor Statistics (BLS) released July's Consumer Price Index (CPI) inflation data, which came in at 2.9 percent. This is less than 3 percent recorded in June.

Markets had expected 3 percent, meaning headline inflation was slightly lower (0.1%). The CPI data indicated that headline inflation (excluding variable items) was slightly lower than expected, but as forecast. Also, inflation, which excludes volatile items, is as expected.

Read more: How to protect yourself from inflation using cryptocurrency

Both core and headline month-on-month (MoM) inflation figures were in line with expectations. The headline news is that year-on-year (YoY) profit will come in slightly below forecasts. A summary of BLS data on Wednesday is as follows and suggests that inflation data is broadly in line with market forecasts.

US CPI (MoM) (July) | Correct: 0.2% VS -0.1% previous; In the year 0.2% US CPI (YoY) (July) | Actual: 2.9% vs 3.0% Past; In the year 3.0% US CORE CPI (MoM) (July) | Actual: 0.2% VS 0.1% Past; In the year 0.2% US CORE CPI (YoY) (July) | Actual: 3.2% vs 3.3% Past; In the year 3.2%

“If the Fed expects 2% inflation we've been waiting for too long to reduce the rate,” Fed Chair Powell said.

Notably, this marks the first month of CPI inflation below 3.0% since March 2021. The first rate cut since 2020 could come next month.

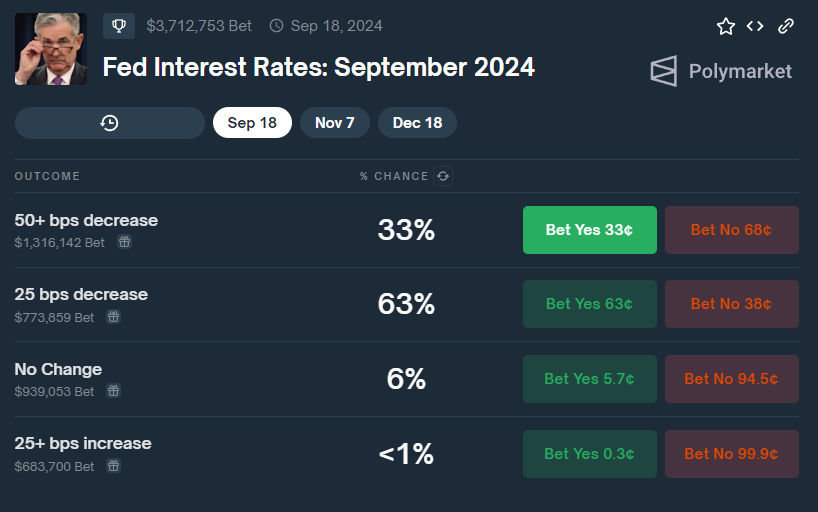

Last night's soft US PPI publication changed market expectations for a 50 basis points (bps) cut by the Fed in September, with the probability now 52.5% for 50 bps versus 47.5% for 25 bps.

Following this news, traders cut their Federal Reserve rate cut bets. This is on the assumption that below-estimated inflation data can influence economic policy to lower interest rates.

A decrease in the CPI may increase the purchasing power of consumers. This is positive news for Bitcoin and crypto markets as consumers can spend more as their purchasing power increases.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Immediately after its release, the price of Bitcoin extended its gains to over $61,000.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.