US elections pushed Crypto investment to $2.17 billion

Crypto investment inflows surged to $2.17 billion last week, reaching an unprecedented annual inflow of $29.2 billion. This flow boosted total assets under management (AUM) in digital assets to over $100 billion, a level previously reached only in June 2024.

The increase comes on the back of renewed interest in Bitcoin, which accounted for most of the investment, up 67% to $19.2 billion in trading volume. This activity represents a significant 35% of Bitcoin trading on trusted exchanges.

The income of digital asset investment products reached 2.2 billion dollars

The latest CoinShares report details recent crypto earnings ahead of the upcoming November 5th US election. The prospect of a possible Republican winner seems to be building interest, as the GOP is often seen as more favorable to relaxed rules on digital assets.

“We believe that the excitement over the prospect of a Republican victory may be the reason for these gains because, as in the first few days of last week, when the polls changed, we saw small flows on Friday, which highlights how sensitive Bitcoin is to the US elections at the moment,” the report read. .

Read more: How to buy Bitcoin (BTC) and everything you need to know

Bitcoin dominated last week's inflows, with $2.15 billion showing investor confidence. A small but famous $ 8.9 million was poured into short-Bitcoin products, a hint of some hedging among investors in the midst of Bitcoin's strong price movement.

Meanwhile, Ethereum received a total of $9.5 million in revenue, showing a significant difference in opinion compared to Bitcoin and Solana, which received $5.7 million. Other altcoins including Polkadot and Arbitrum saw smaller investments at $670,000 and $200,000 respectively.

This development is not surprising given how the approach to the US election has fueled strong interest in digital assets over the past few weeks. According to BeenCrypto, October saw positive inflows of up to $2.2 billion in the previous week, reaching $901 million last week and $407 million in the first week of October.

In recent weeks, CoinShares's James Butterfill has said that positive flows for a Republican victory could support regulatory policies for digital assets.

The fate of Crypto investment flows after the US election

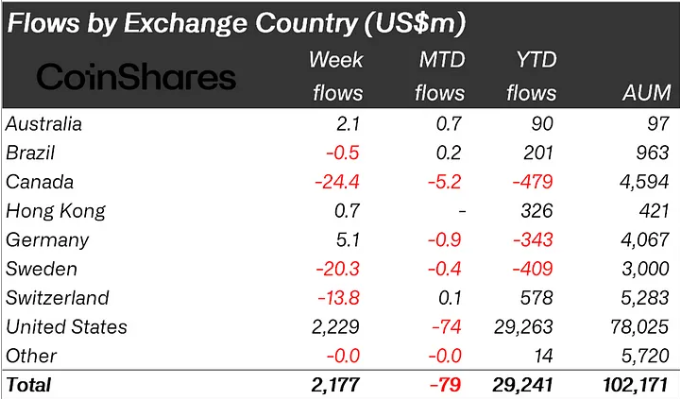

The record-breaking inflow coincides with a broader boom in US-based investments in crypto, as US investors accounted for the largest share of this year's $29.2 billion inflows. Meanwhile, Germany saw a modest $5.1 million in new investments. This reflects Europe's more cautious approach to crypto amid regulatory uncertainties.

While Bitcoin remains the main beneficiary of these investments, US elections could further intensify volatility in the crypto market this week. Investors are eyeing key battleground states as recent polls signal a favorable swing for Republicans. This has fueled speculation that it could lead to a more crypto-friendly stance in Congress.

Political analysts note that GOP control of Congress could ease regulatory pressures on digital assets. This could boost investor confidence and attract more inflows into Bitcoin and other assets in the days after the elections. Still, others, like Coinbase CEO Brian Armstrong, say a more “pro-crypto Congress” could emerge regardless of the election's outcome.

The outcome of the election may indicate a short-term direction for crypto investments. A Republican victory could boost inflows that could spark a new Bitcoin rally, while a Democratic victory could dampen expectations if tighter regulations are maintained.

Read more: What is Polymarket? A guide to the popular prediction market

As election day approaches, crypto markets are expected to remain volatile as Bitcoin and other digital assets react to changes in polling data and policy views.

“It's going to be an interesting week ahead, that's for sure. Be careful in use, they recommend not to touch it at all during this week. You may get cut off soon,” warns crypto analyst Diane Crypto.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.