US interest rate decision, SERMC meeting to determine Crypto trends

Cryptocuy Pube saw a big increase and a lot of buying activity after Donald Trump returned to the White House. “Crumptocuy has signed several executive orders that support the market, many people are interested in trading. Next week is important for the market, because it will come with another major economic news, interest rates and decisions that can affect future trends in the market.

Markets remain steady and massive under Trump's new policies

This week, everyone is focusing on US President Trump's policies in his office, and the markets seem to be holding up well so far. Instead of causing stress, they actually make people bigger. Artificial intelligence (AI) will bring about a big change in demand, reduce fuel prices, and control inflation. This encourages investors to take more risks, sending the S & P 500 to new record highs.

Also Read: Bitcoin Price Forecast 2025: BTC Breaks $109Kg

As we move into a new week, many important events can present the future trend of the Cryptoureatury market.

US 4Q earnings season

Next week, big tech companies such as Microsoft, Meta Platforms, Tela and Apple are set to report their earnings. Analysts predict that these major players, along with three other companies, will grow their revenues by more than 17% next year, compared to the 9% growth expected from the other 493 companies.

Because these companies are so admired, investors are probably looking for more than just ordinary profits and earnings.

US FOMC meeting

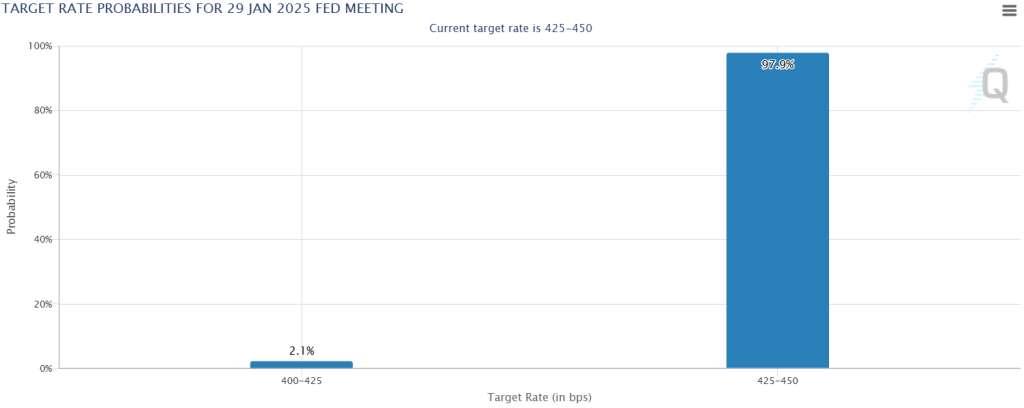

The Federal Reserve is widely expected to keep its core interest rate unchanged while waiting for more information on whether inflation is slowing.

Dr. Voes, in Switzerland, in the world but to calculate the ineffective pressure, he said that the prices of immediate demand should be cut immediately. At the beginning of his second term, Trump has already tightened immigration and announced plans to impose an import tax starting February 1.

This creates a strong doubt for them to plan for goals. The Fed is meeting soon, the latest data is expected to maintain the current interest rate between 425% and 4.50% in a gradual approach to reach the 2% inflation target.

It is challenging to determine how much the current monetary policy of FEDEO is related to the certainty of the future.

United States Consumer Expenditure (PCE) Price Index

In the year In November, the overall PEC price in the United States compared to 2.4% compared to last year, which is lower than 2.1% over three years. The main price index, which is used to measure the basic inflation, increases by 0.1% – over six months. This kept the annual core PECE rate steady at 2.8 percent in December, below expectations of 2.9 percent.

Looking ahead, the overall PCE is expected to increase by 2.6% year over year, which will be presented on Friday. The core PROCT inflation rate is expected to remain stable at 2.8%.

European Central Bank (ECB) interest rate decision

E.C.B.B.B.B.B. It is expected that the next meeting of 0.25% will bring the rate to 2.75%. This is the fifth graduation from June 2024 to support economic growth.

Summary

Hold on, ECCL. Associated with cutting rates, the Trump professor market still appears hot, the CRESPTO market is reserved for the upcoming front in the package. However, traders should be prepared for the announcements of the promoter and the release of key corporate earnings.