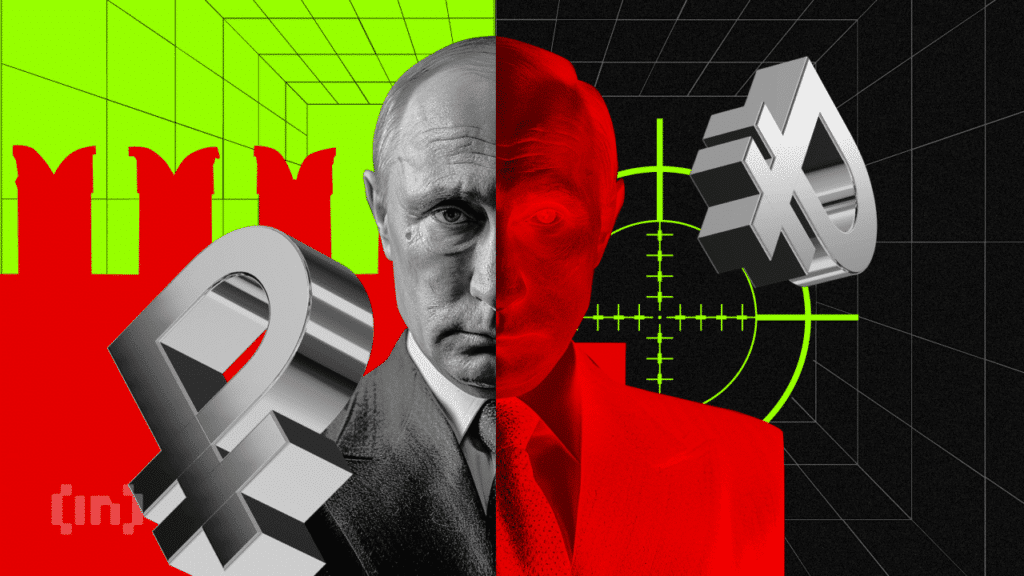

US Threatens to Block Crypto Assets Linked to Russia

Amid ongoing political tensions between the US and Russia, crypto addresses held by Russian traders may be locked out of the US market.

Meanwhile, Russia suspended trading of the dollar and euro on Moscow's main financial market, the Stock Exchange.

Russian-linked crypto addresses face US ban

United States politician Brad Sherman has proposed an amendment to the National Defense Authorization Act (NDAA). Filing with the US House Rules Committee, the California Democrat wants a specific clause in the NDA.

The U.S. Treasury Secretary is tasked with prohibiting digital asset trading platforms and trading facilitators in the U.S. from trading with Russian-linked crypto addresses.

“The Secretary of the Treasury may require any digital asset trading platform or digital asset transaction facilitator that conducts business in the United States not to transact or consummate transactions with digital asset addresses or, if the Secretary can reasonably be identified, with persons at the headquarters or residence of the Russian Federation. has a relationship,” read the article on the official record.

In particular, this is based on the Secretary's determination that the exercise of such authority is in the national interest. The decision is based on the Secretary's assessment of the broader implications for national security and public safety.

Read More: Top 3 Methods to Transfer Money Cross-Border Using Crypto

Brad Sherman has a rule allowing US taxpayers to move more than $10,000 worth of crypto out of the country. Under the proposed bill, they would have to register with the US Financial Crimes Enforcement Network (FinCEN).

“The Financial 21 Crimes Enforcement Network requires United States persons engaged in the transaction of digital assets valued at more than $10,000 in 1 or more accounts outside the United States to file the report described in section 1010.350 of title 31 of the 31 Regulations, using the form described in that section. , under section 5314 of title 31, United States Code,” the filing states.

Sherman also wants the Treasury secretary to expose crypto exchanges that are considered a high risk for illegal activities, including sanctions fraud and money laundering.

“It's a shame considering this actually came from Sherman. This guy is trying very hard to kill Krypton and these two things just make sure he understands that he's caught and not going away,” said investor Guinness Stache.

Specifically, Sherman compares crypto to drugs and organ harvesting, arguing that at one point crypto industry stakeholders don't want proper laws. He is also calling crypto a major source of tax evasion.

Russia has blocked US and Euro trade.

Reports indicate that lawmakers consider the NDAA a must-pass law, meaning they consider it critical and necessary to pass. They believe it is essential to the functioning of the government and the implementation of key policies. Because of their importance, bills that must pass are often more likely to pass than other types of legislation.

“What is important to note here is that the Annual Defense Bill is a piece of legislation that needs to be passed and slipping such seemingly innocuous amendments may not change anything in the past. “We'll see amendments like this as members try to attach other bills to the NDAA,” Fox Business reporter Eleanor Terrett said.

The Sherman Amendment was proposed after Russia moved to suspend trading of the US dollar (USD) on the Moscow Stock Exchange. This development represents a significant shift in Russia's financial strategy amid ongoing geopolitical conflict.

“Trade and settlement of exports in dollars and euros has been suspended due to restrictive measures taken by the United States against Moscow's exchange group,” Reuters reported, citing the Russian Central Bank.

Read more: Data privacy: 10 tips to protect your digital privacy in 2024

The move is aimed at influencing other countries' perception of the US dollar as a major reserve currency. First, it may force investors to diversify their use of currencies.

“We don't care, we have the yuan. It is almost impossible to get dollars and euros in Russia, “there is a person in a large and unsanctioned exporter of Russian products, economist Sasha Breger Bush.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.