Visa Research 90% of Stablecoin Transactions Are Done by Bots and Big Traders

Share this article

![]()

Recent research by Visa and Allium Labs suggests that most stablecoin transactions are initiated by bots and large traders, not real users.

The dashboard, which is designed to identify transactions made by real people, found that only $149 billion of the total $2.2 trillion in statistical coin transactions in April came from “organic payment activity.”

The same study found that USDC, the stablecoin issued by Circle, outperformed Tether's USDT stablecoin. Specifically, an on-chain analysis from Nansen showed that the overall stablecoin outperformed Visa 2023's monthly average.

Visa's research directly counters the argument of stablecoin proponents who say it is revolutionizing the current $150 trillion payments industry.

Despite the support and optimism from financial technology firms such as PayPal and Stripe, data suggests that adoption of these tokens as a true means of payment is still in its infancy.

“[…] Stablecoins are still at a very nascent stage in their evolution as a payment instrument,” says Pranav Sood, General Manager EMEA at payments platform Airwallex.

Sod said the stablecoin may have “long-term potential,” but commented that its short- and mid-term focus should be “ensuring existing railroads work better.”

According to Glassnode data, the total market circulation of 3 trillion dollars allocated to digital tokens at the peak of the 2021 bull market is actually closer to 875 billion dollars, which shows the difference between nominal and “real” value of digital assets.

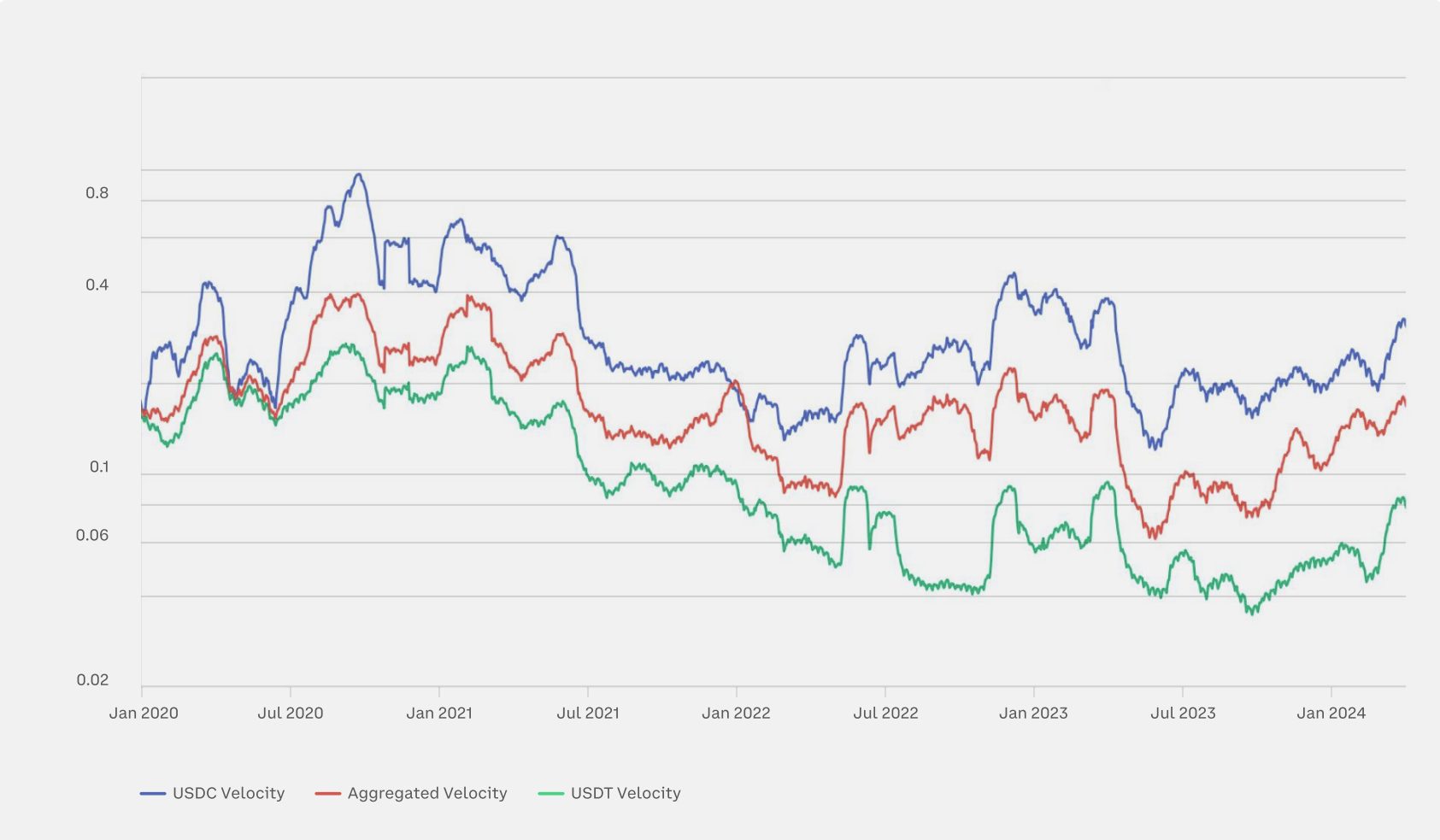

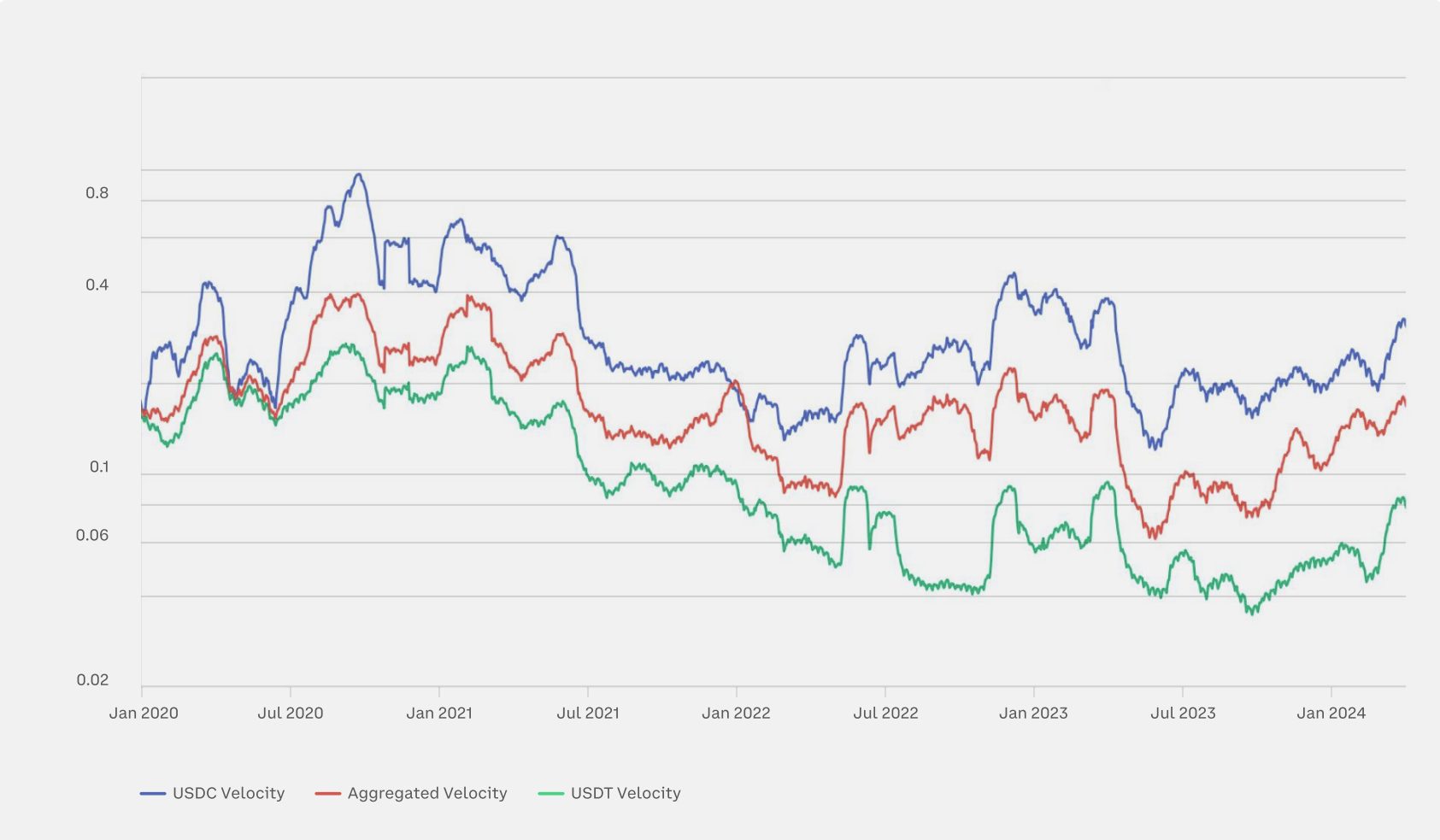

Glassnode published a Q2 report showing that the stablecoin's network speed, a measure of how quickly value moves around the network, is approaching 0.2 on a cumulative scale. This means that 20% of the total fixed coin supply is transacted daily.

The issue of double-counting stablecoin transactions is also a concern. Key Sheffield, Head of Visa Crypto, explained that converting decentralized currency $100 Circle USDC to PayPal PYUSD will result in Uniswap's total stablecoin volume registering $200 on chain.

Visa, which handled more than $12 trillion in transactions last year, is among the companies that stand to lose if stablecoins become a widely accepted payment method. Bernstein analysts predict that the value of all stablecoins in circulation could reach $2.8 trillion by 2028, an 18-fold increase from their current combined circulation.

Share this article

![]()

The information on or included in this website is obtained from independent sources that we believe to be accurate and reliable, but we make no representations or warranties as to the timeliness, completeness or accuracy of any information on or accessible from this website. . Decentralized Media, Inc. Not an investment advisor. We do not provide personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may be out of date, or may be incomplete or incorrect. We may, but are not obligated to, update any outdated, incomplete or inaccurate information.

Crypto Briefing may also include articles with AI-generated content created by Crypto Briefing's own proprietary AI platform. We use AI as a tool to deliver fast, useful and actionable information without losing the insight – and control – of experienced crypto natives. All AI-added content is carefully reviewed, for accuracy, by our editors and writers, and we always draw from multiple primary and secondary sources to create our stories and articles.

You should not make an investment decision in an ICO, IEO or other investment based on the information on this website and you should never interpret or rely on any information on this website as investment advice. If you are seeking investment advice on an ICO, IEO or other investment, we strongly recommend that you consult a licensed investment advisor or other qualified financial professional. We do not receive compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities or commodities.

See full terms and conditions.