Weekly price analysis: Annual sales prices are lower

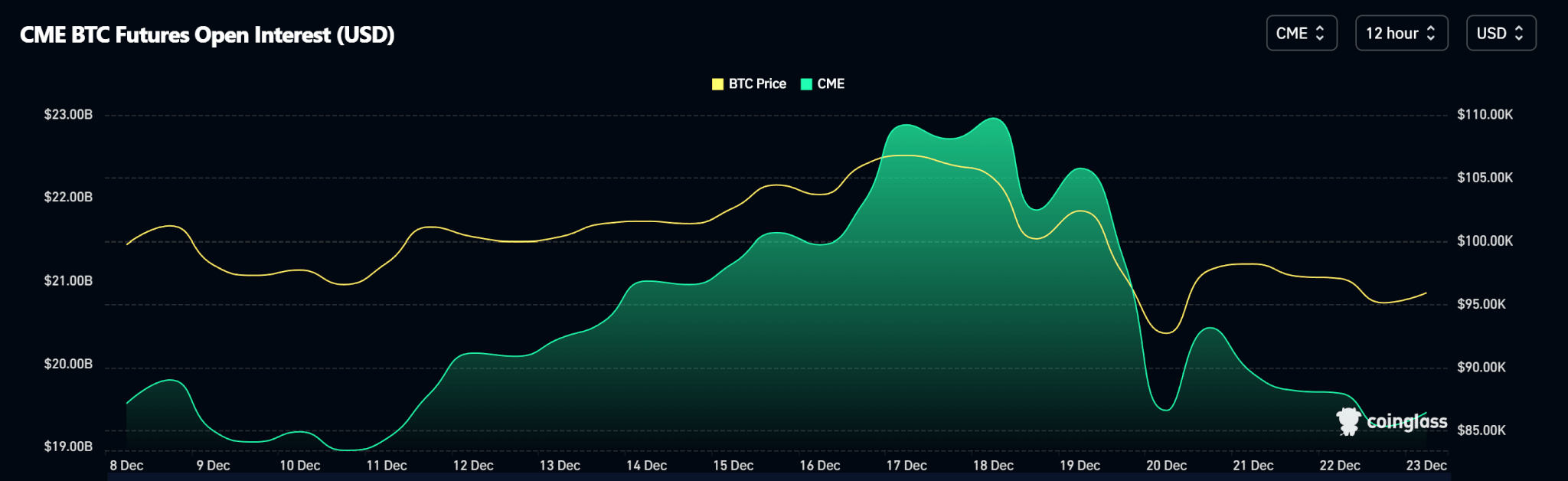

The crypto market spent the last week trading at a series of lows. Although the Fed's hawkish stance also played a role at the December 18 policy meeting, annual profit-taking was the main reason for the decline as institutions close positions for the year. Open demand in major cryptos showed weekly declines.

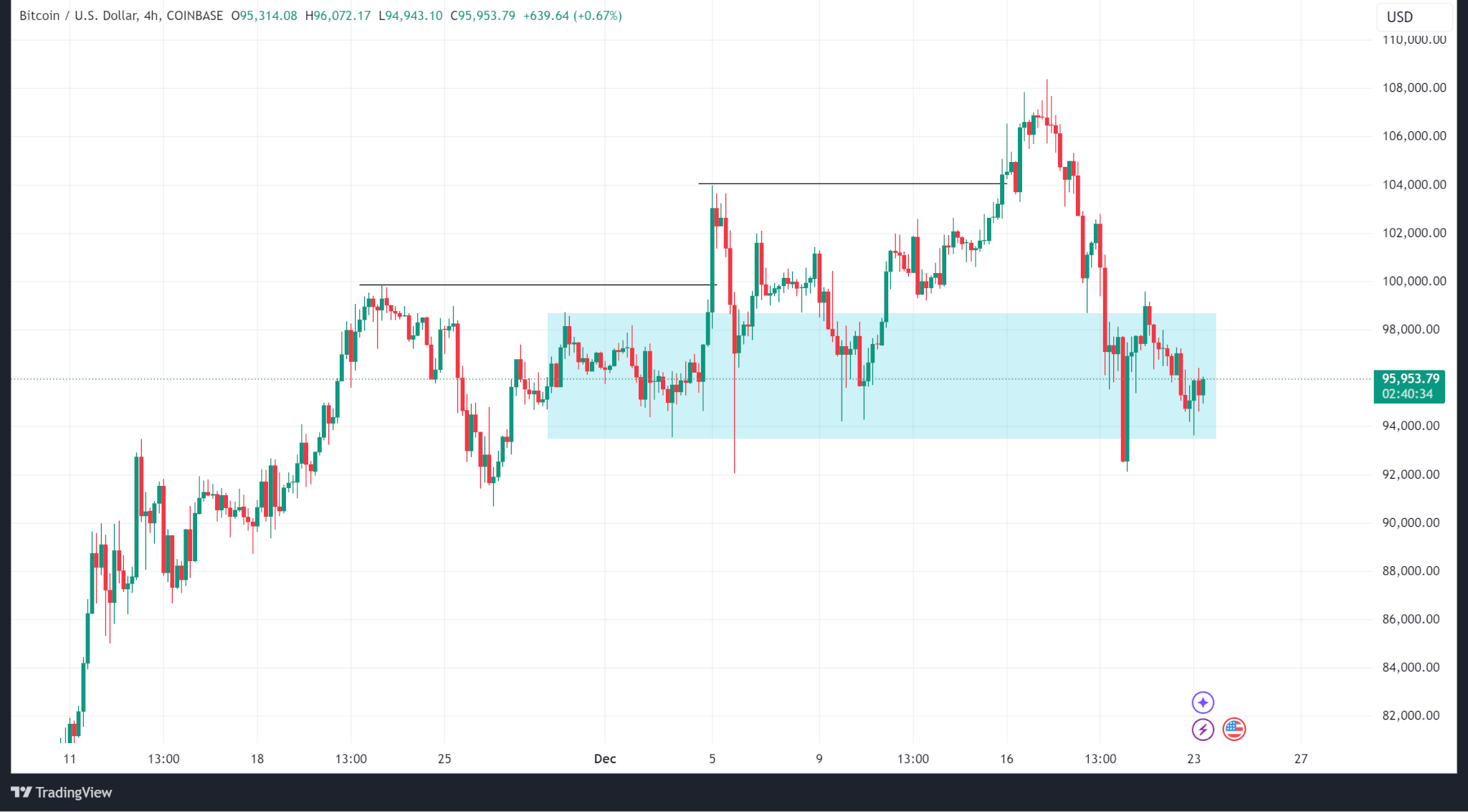

Bitcoin

Bitcoin price dropped to $92,555 from a weekly high of 108,372 on December 17 before closing the week at $97,700. However, despite the 9.7% decline, Bitcoin price has not changed its behavior to the downside.

Open demand data shows a decrease in open contracts in the CME which corresponds to a drop in prices.

The Fed's policy decision on December 18 favored a 25bps slash. However, Fed Chairman Jerome Powell expressed hawkish sentiments about suspending plans for next year, further exacerbating the selloff.

Meanwhile, Bitcoin spot ETF inflow data shows total inflows of $948.90 million on December 19 and 20. Net income from December 16 to December 20 was $447.00 million.

Bitcoin is trading at $95,700 as of publication.

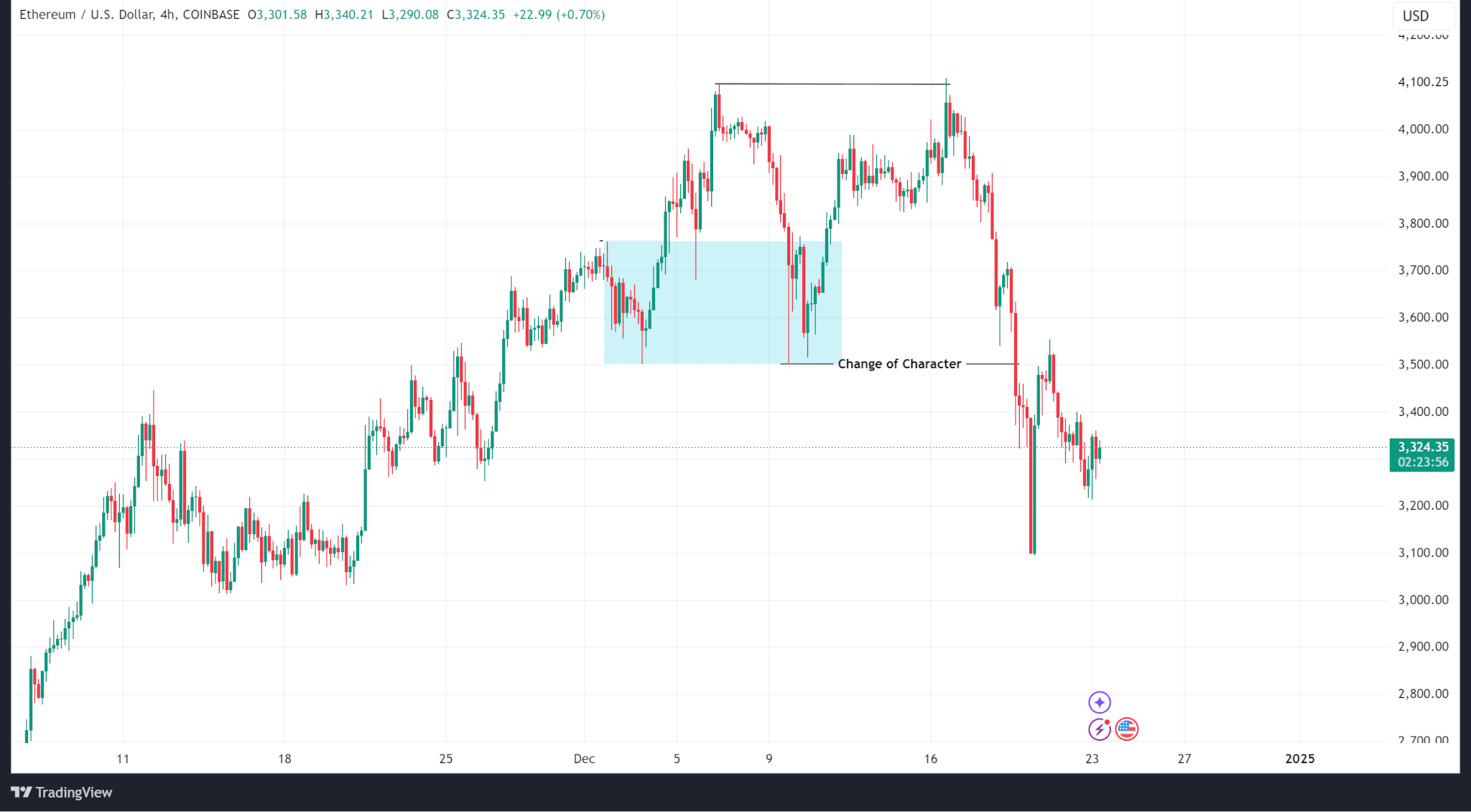

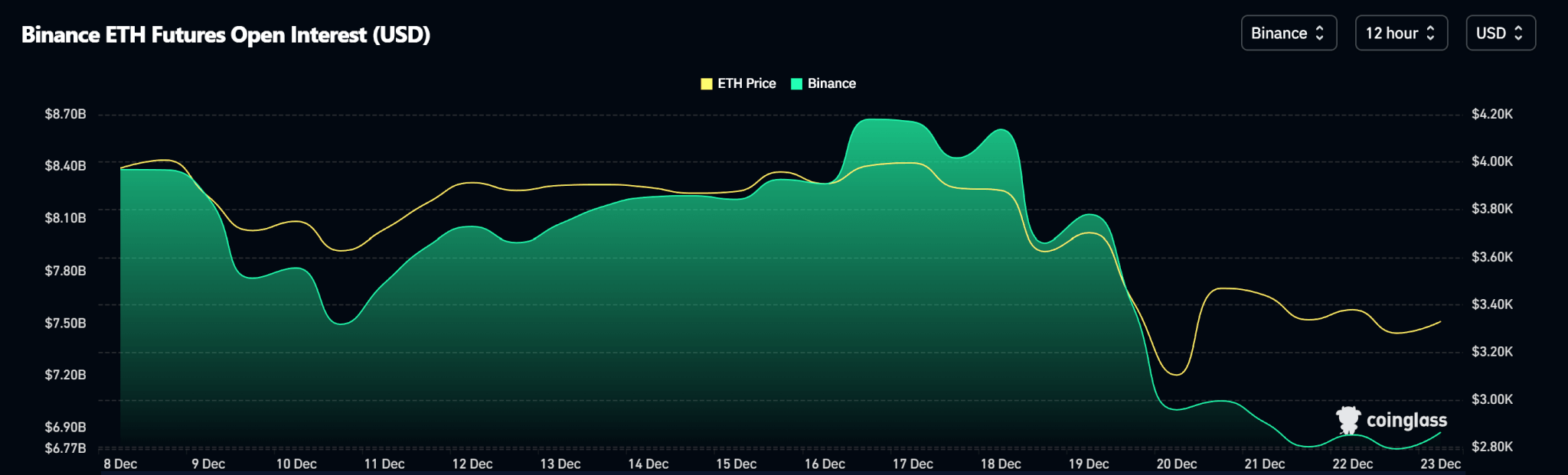

Ethereum

As expected of Bitcoin's structure, Ethereum price changed behavior on the H4 time frame and after testing (but failing to break) the local high at $4,096.50 turned into a lower trend.

Ethereum fell from a weekly high of $4,108.82 to a weekly low of $3,098.40 before finally closing the week at $3,470.44 (a 15.51% decline).

Ethereum spot ETF returns show a similar pattern to Bitcoin outflows over the last two days of the week.

Meanwhile, Ethereum's open interest shows a sharp decline in price.

Ethereum is trading at $3,330.78 as of press.

Solana

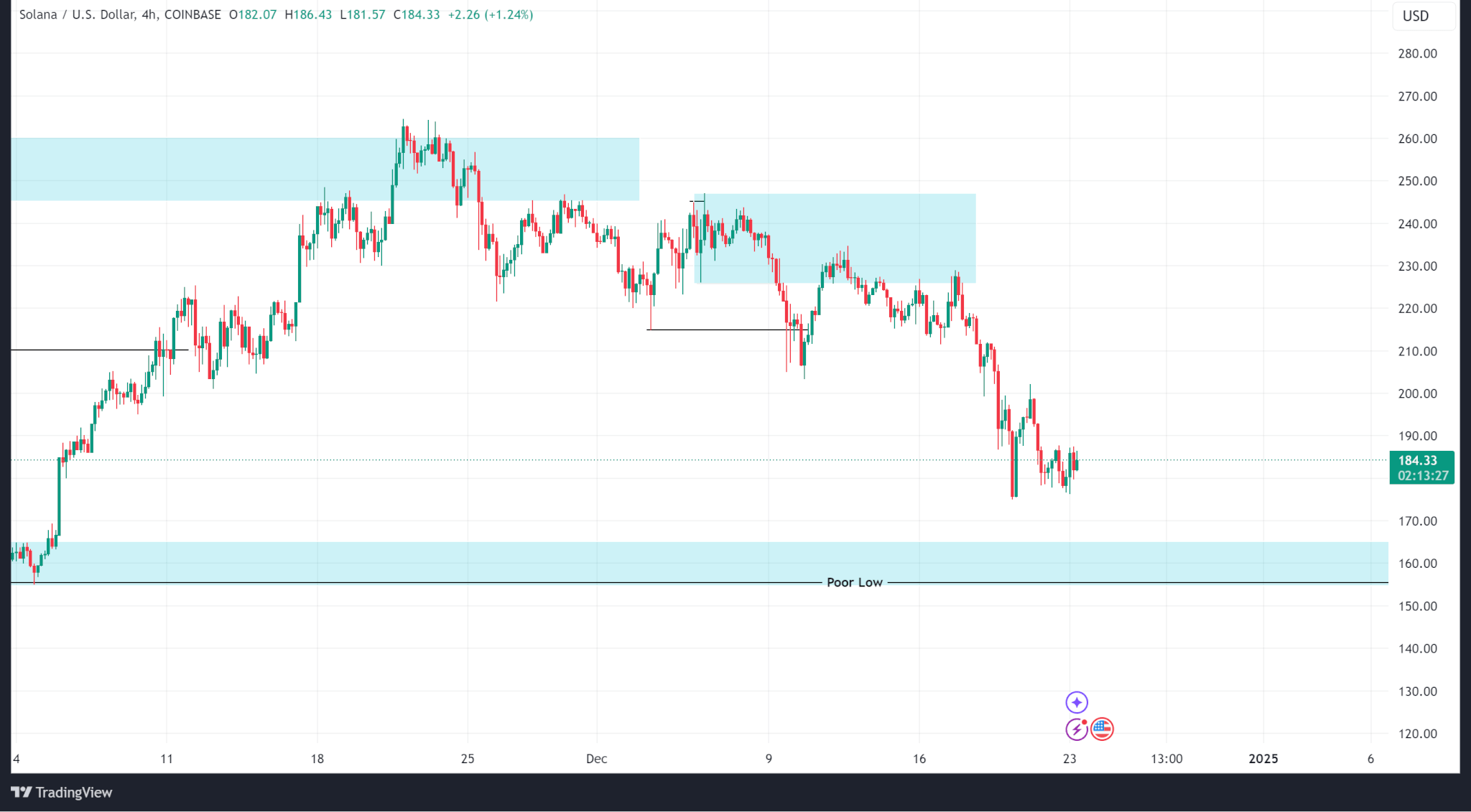

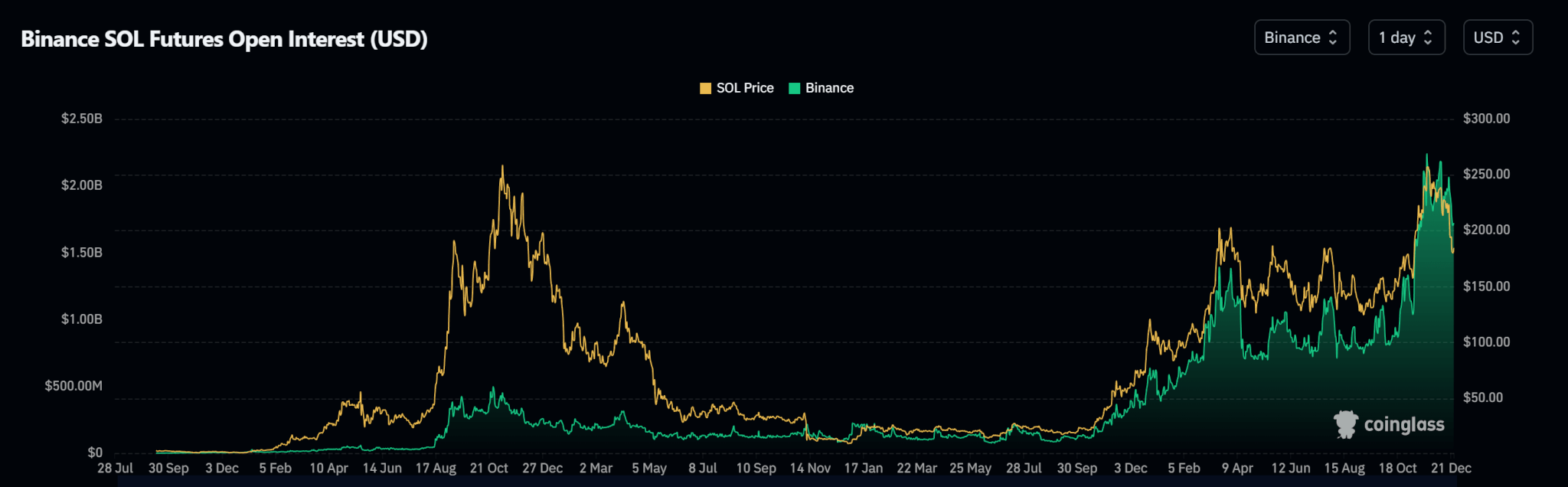

Solana's price action, which began two weeks ago, has continued its decline, failing to break above the all-time high of $260.02.

Last week, price action traded into an internal supply zone around $227.71, continued trading down to a weekly low of $175.12, and finally closed at $194.44 (down 15.07%).

The demand zone around $160 (mentioned last week) remains the first logical support zone as open demand is falling.

Solana is trading at $184.82 as of press time.

Ripple

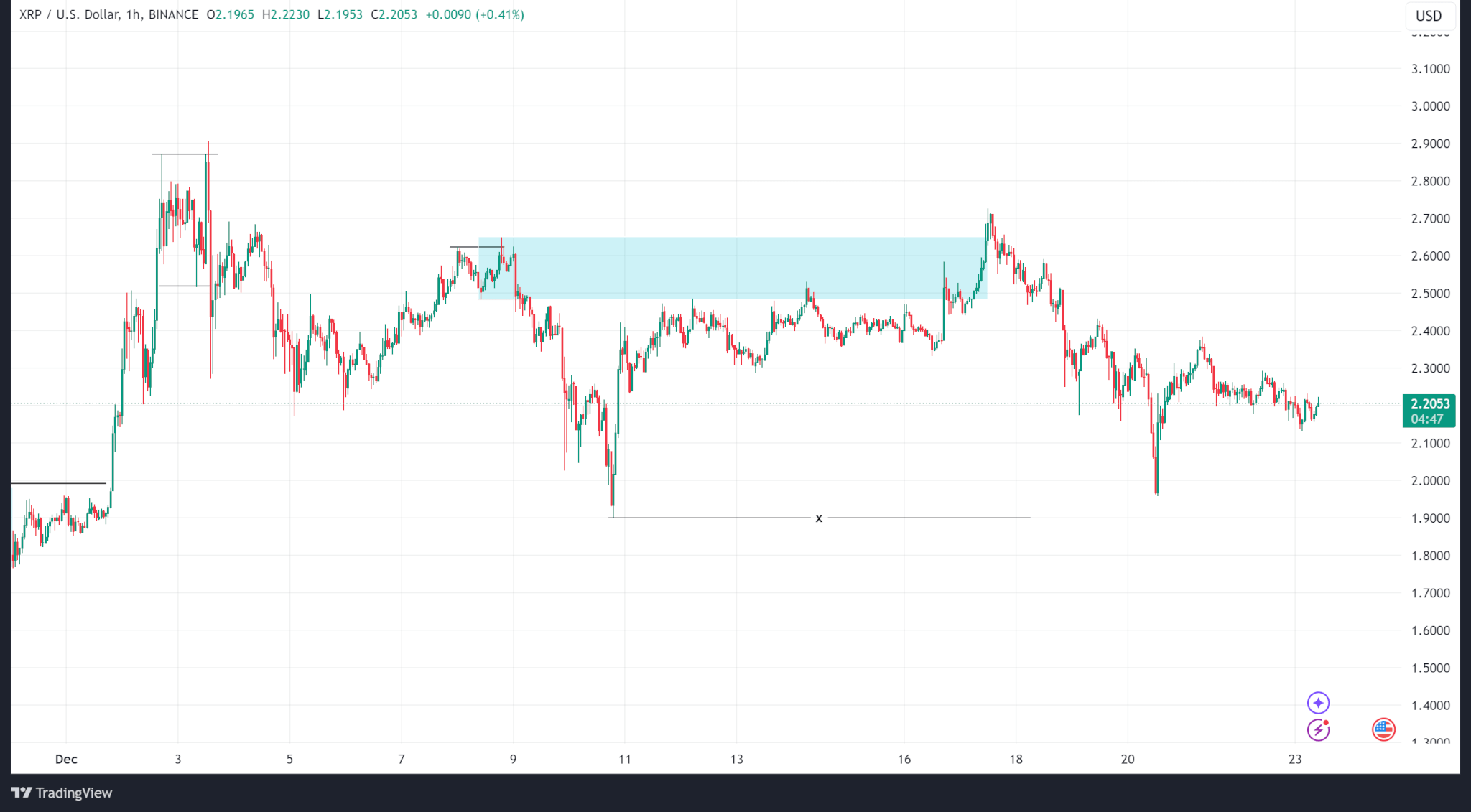

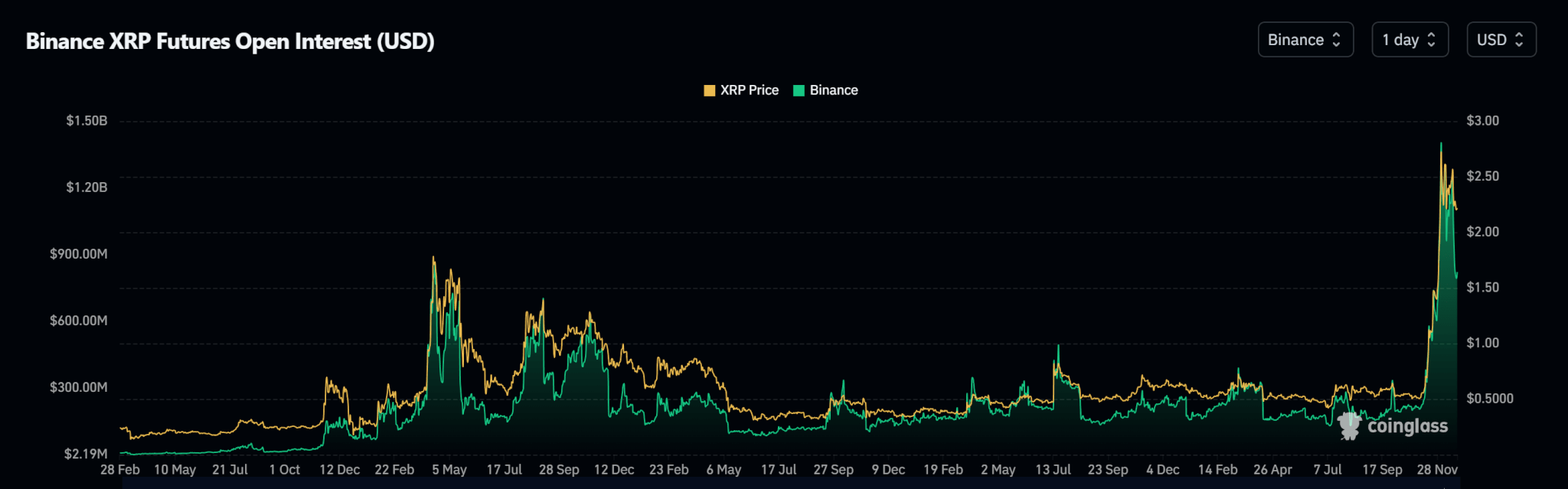

After breaching previous all-time highs two weeks ago, Ripple's price action has mostly ranged between $1.89 and $2.90. However, within this range, the price has recorded lower lows.

Ripple's price traded into the inner supply zone and broke above it on December 17, but melted to a weekly low of $1.95 before finally closing at $2.27 (a 16.42% decline).

Ripple's open interest data shows a decline in open contracts since December 3rd.

Ripple is trading at $2.21 as of press.