Weekly Price Analysis: Bitcoin Stays With Range As Altcoins Fly

Prices rose in the first week of the year as open interest on the CME improved. Altcoins have overtaken Bitcoin as the largest crypto out of range. Meanwhile, ETF flows remained net negative.

Bitcoin

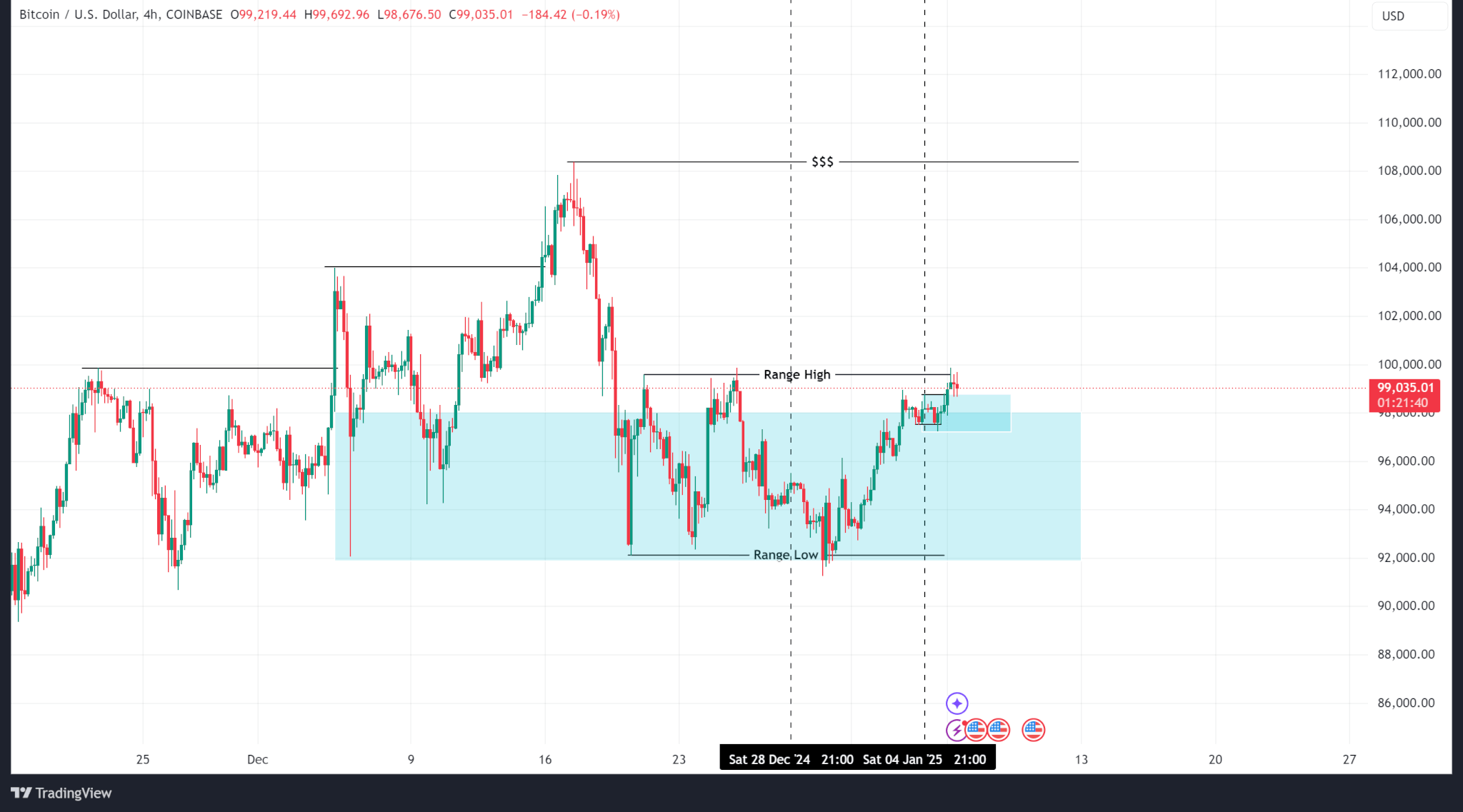

Bitcoin price improved last week but remained within the range established in previous trading sessions. BTC hit a weekly low of $91,271.19 and a high of $98,972.29. Bitcoin closed last week at $98,198.52.

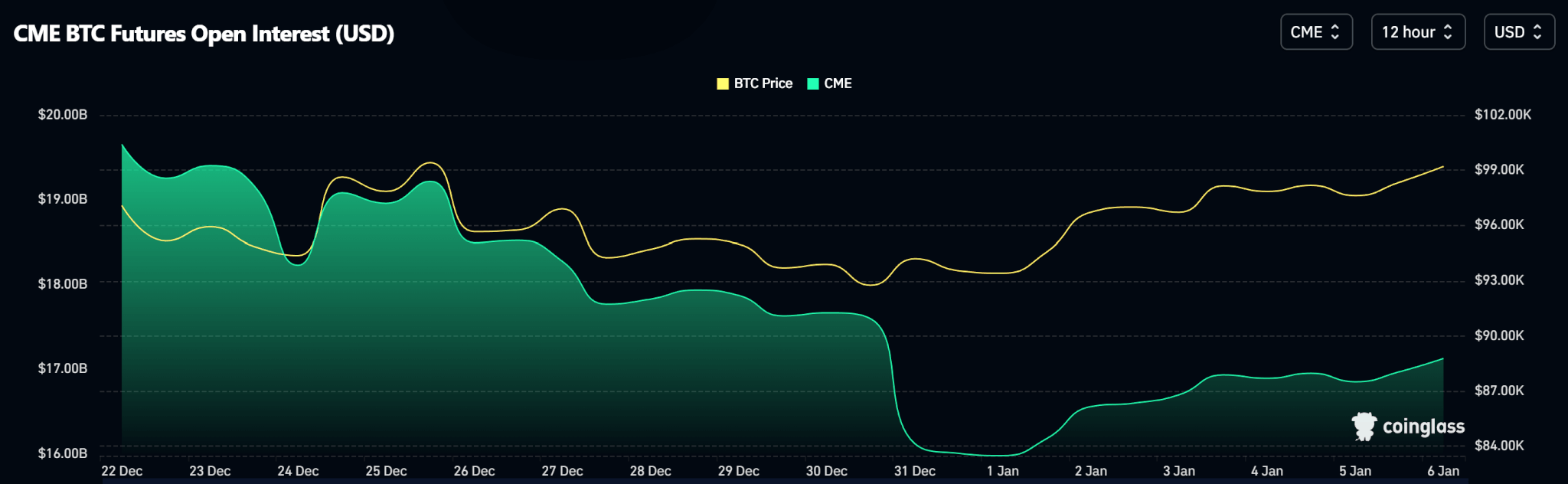

Open interest on the CME improved last week as more contracts were added. Contrasting that with price action suggests that many long contracts have been opened.

Meanwhile, the next week was negative as BTC ETF flows totaled $652.10 million.

Outlook

BTC has found support in the demand zone on the H4 time frame and is starting to rise (supported by new futures longs). BTC needs to break above the higher range at $99,596.57 first.

BTC is trading at $101,978.76 as of press.

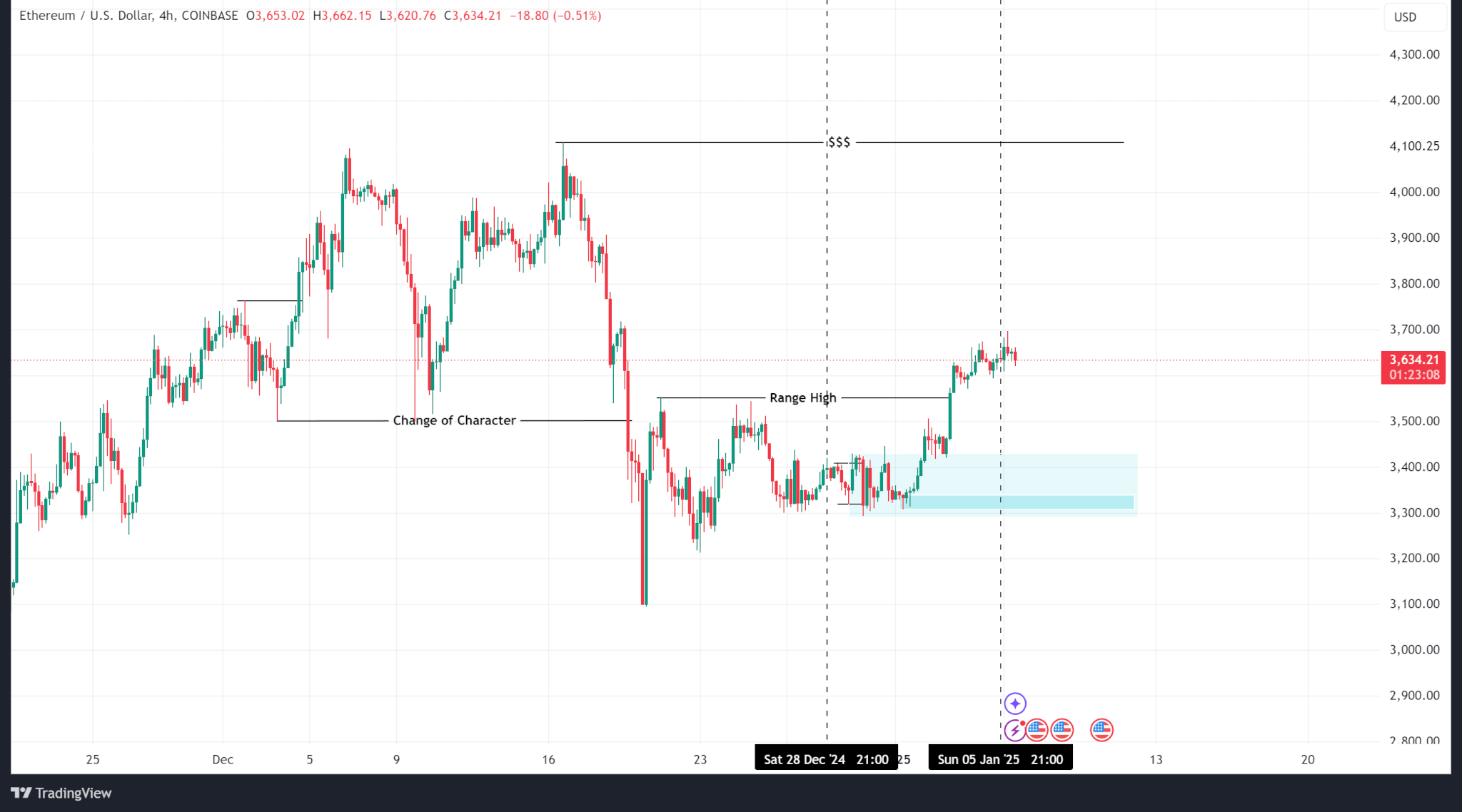

Ethereum

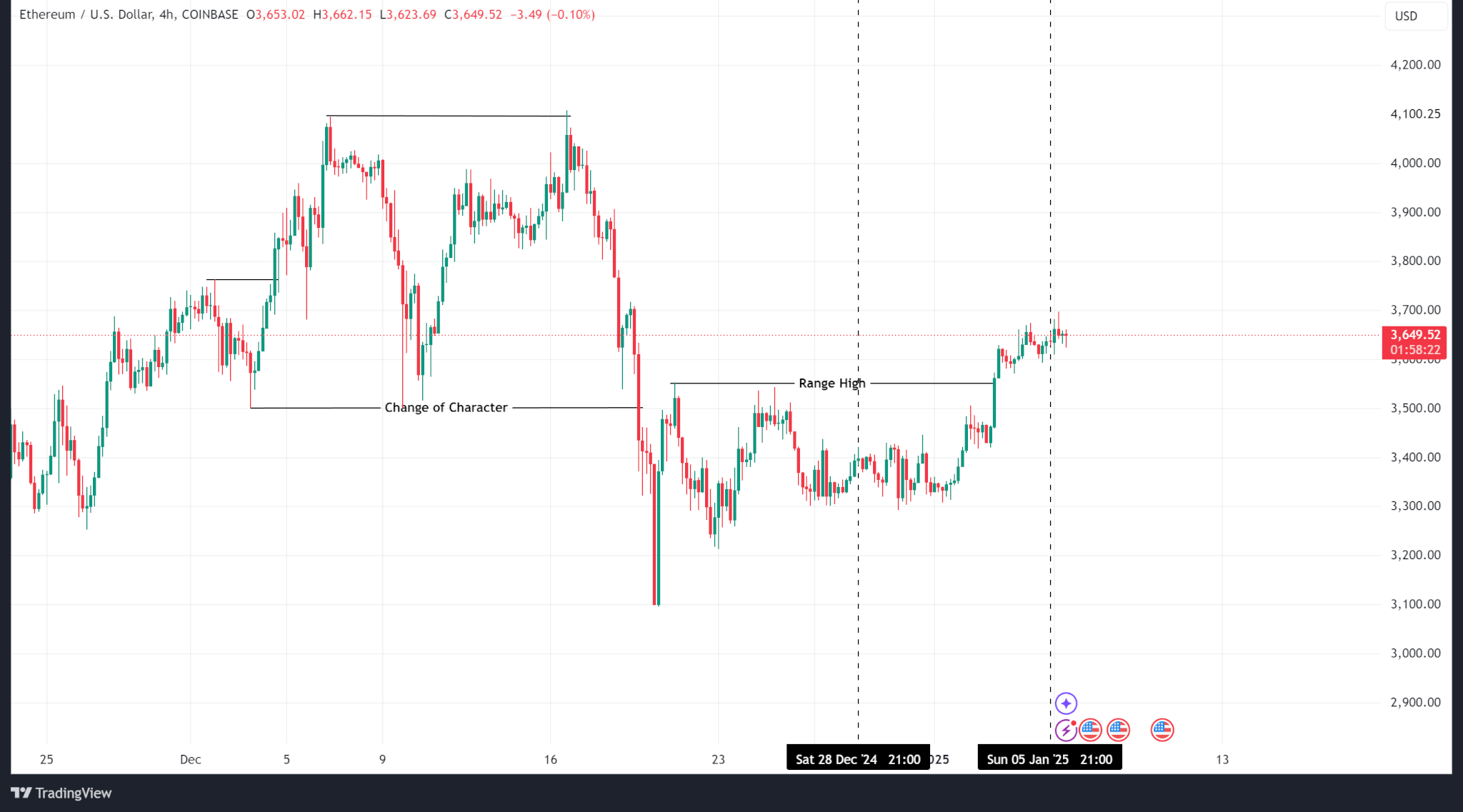

Ethereum's price action was more aggressive as it broke above the range created in the previous week's trading session. The weekly low and high were $3,293.19 and $3,675.77, respectively. ETH closed last week at $3,637.39.

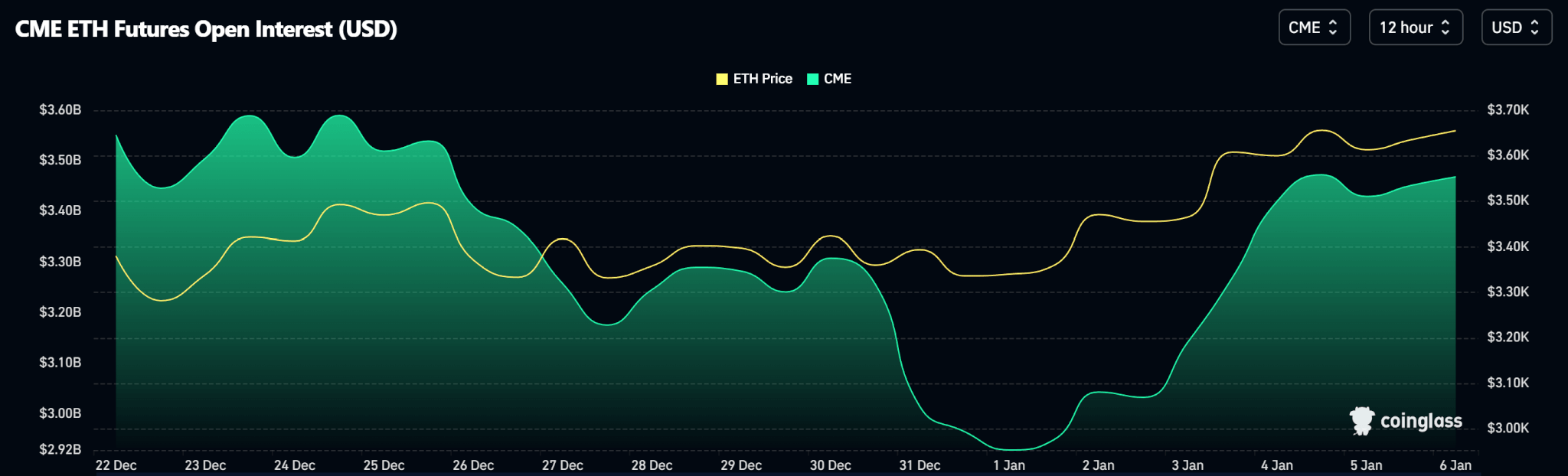

Like Bitcoin's open interest charts, Ethereum OI hit a weekly low on January 1st and is rising as new longs enter the derivatives market.

Meanwhile, ETH ETF earnings entered a negative week as $97.00 million was withdrawn from ETF earnings in the US.

Outlook

Even if the price breaks through the last high range, it will have to clear the recent high at the $4,096.44 level to continue the breakout trend. Temporarily, the level of interest at the $3,500.00 level could serve as liquidity to the upside.

ETH is trading at $3,679.36 as of press.

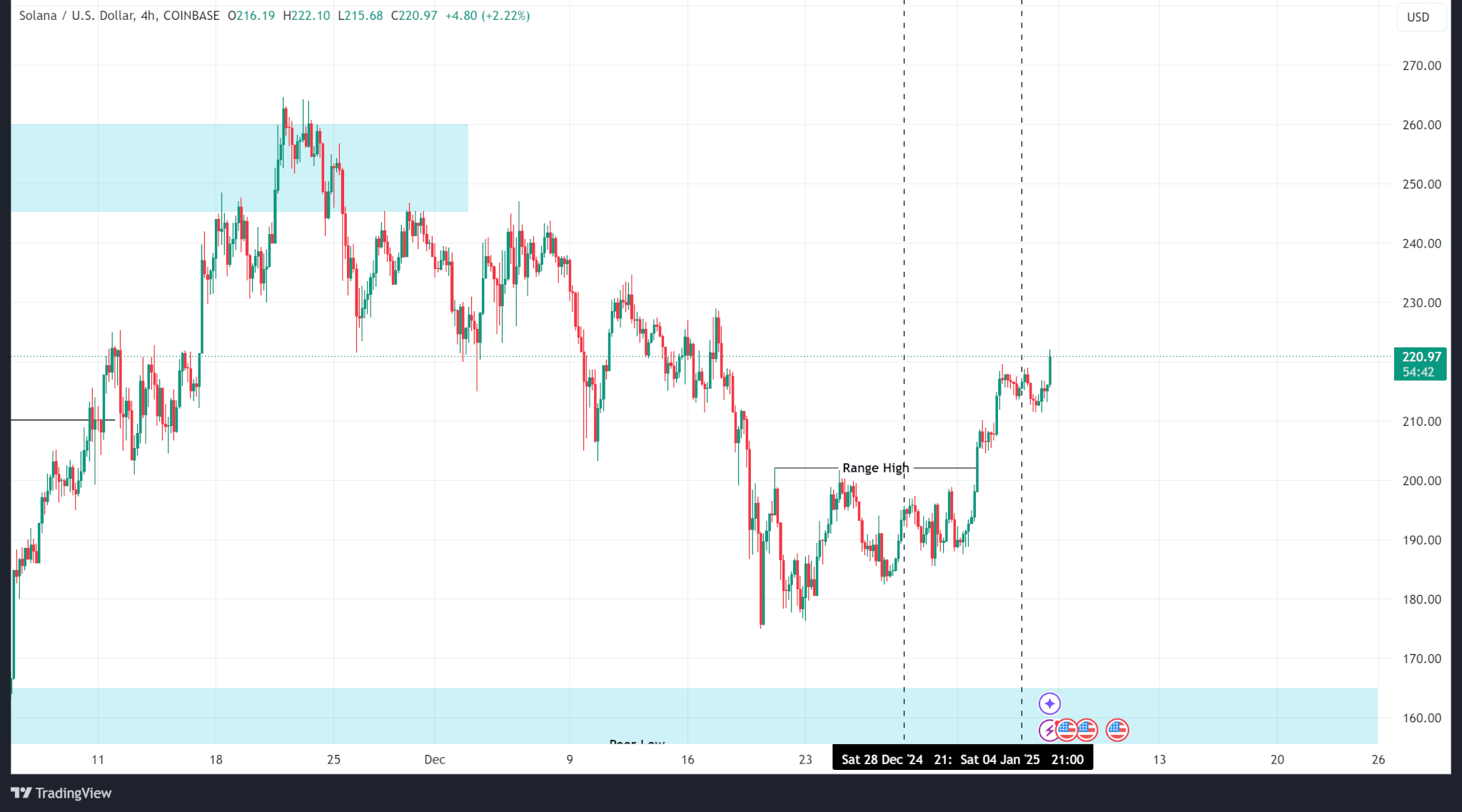

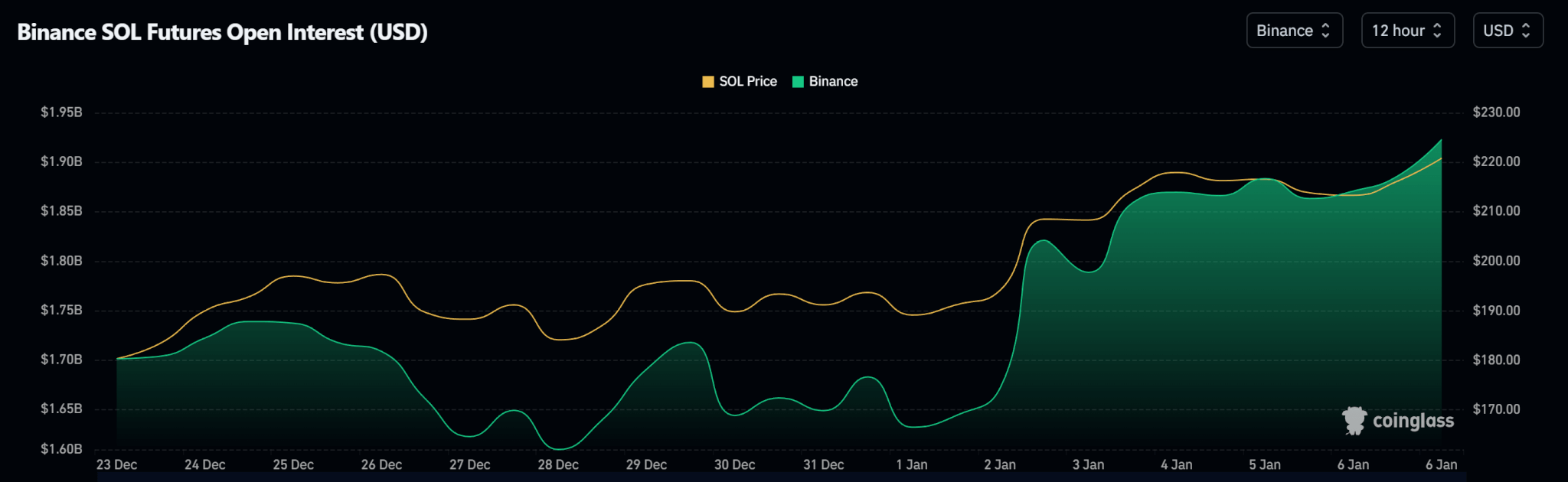

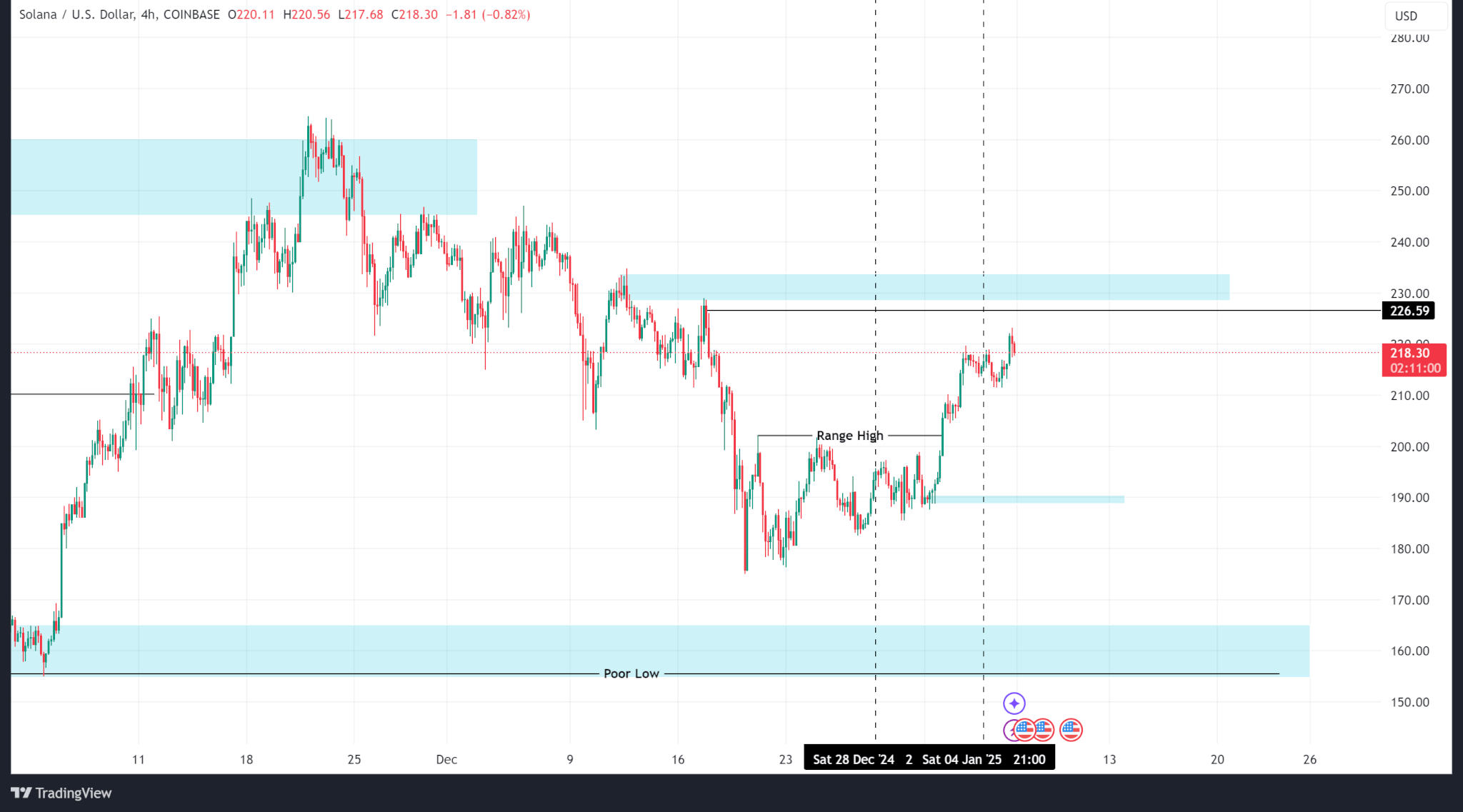

Solana

Solana's price action was particularly heavy last week as it broke above the local range from the previous week's trading session high. The weekly low and high formed were $185.55 and $219.67.

Solana's open demand has followed the same pattern as Bitcoin and Ethereum since January 1st.

Outlook

While Solana may not break the all-time high, the trend is promising. However, the price made a series of lows on the H4 time frame and needs to break the $230 level and the $260 level to continue the bullish trend.

SOL is trading at $218.28 as of press.

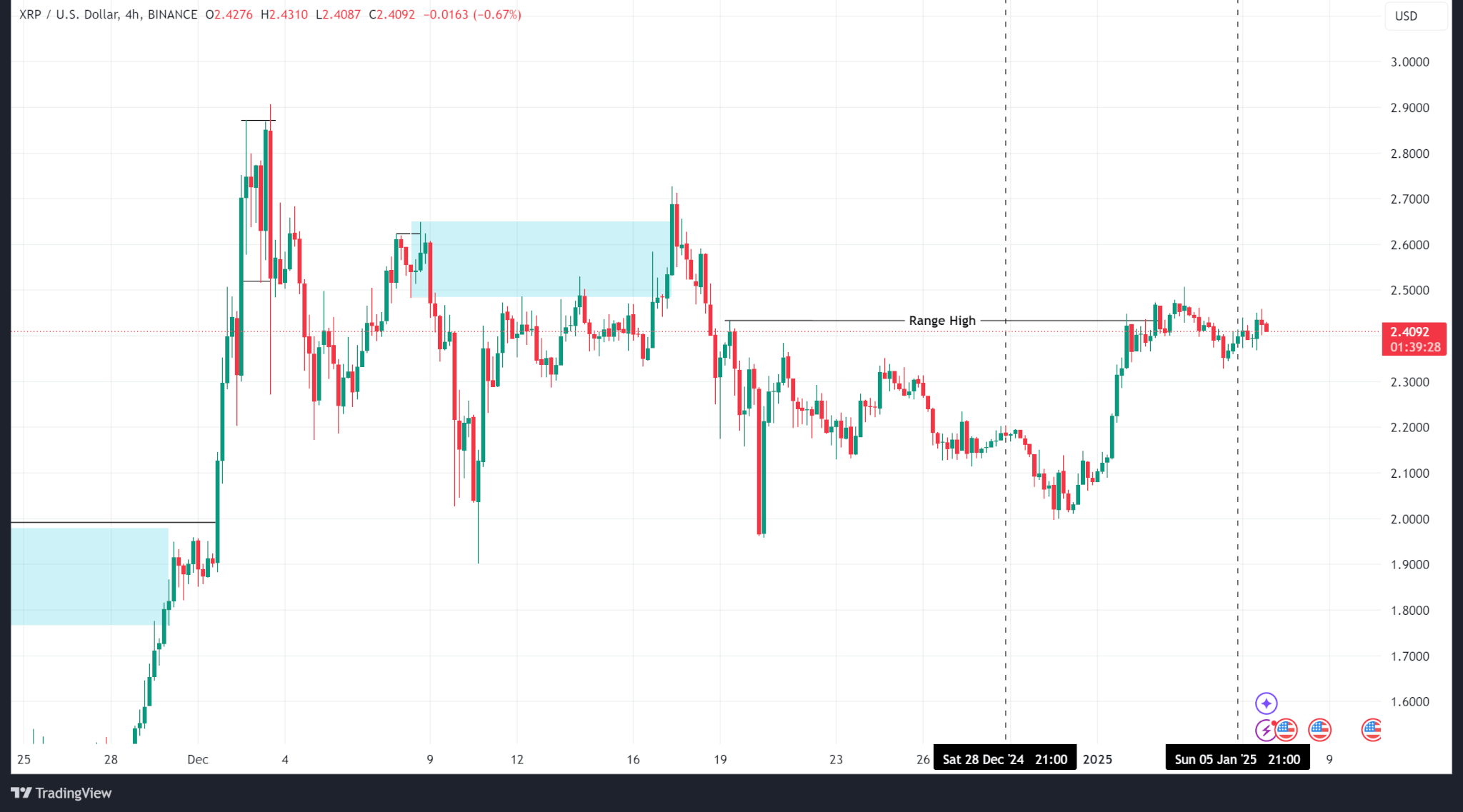

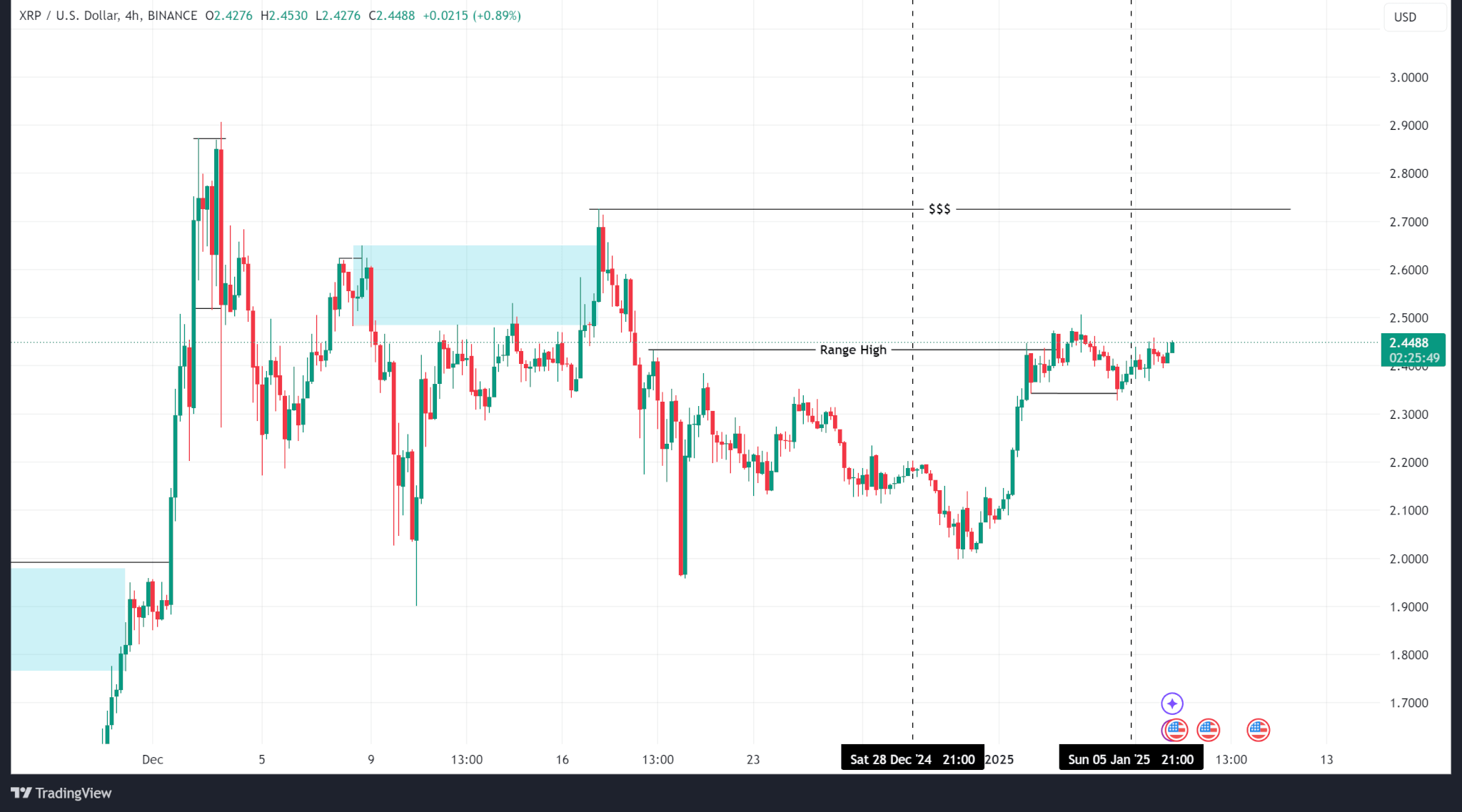

Ripple

After registering a low of $1.99 and a high of $2.50, Ripple's price action improved last week.

However, since the increase in long-term contracts did not buy the price, the price was inconsistent with private interest.

Outlook

Breaking above the range and pulling back for liquidity at the last high low at $2.34, XRP price recorded higher and lower lows, rising to the next supply zone around $2.72.

XRP is trading at $2.44 as of press.