Weekly Price Analysis: No Santa Rally as a price range.

Expectations for a “Santa rally” were dashed as prices of major currencies traded sideways during the holiday week. Spot crypto ETFs have entered mixed performance, with open interest continuing to fall in major cryptos.

Bitcoin

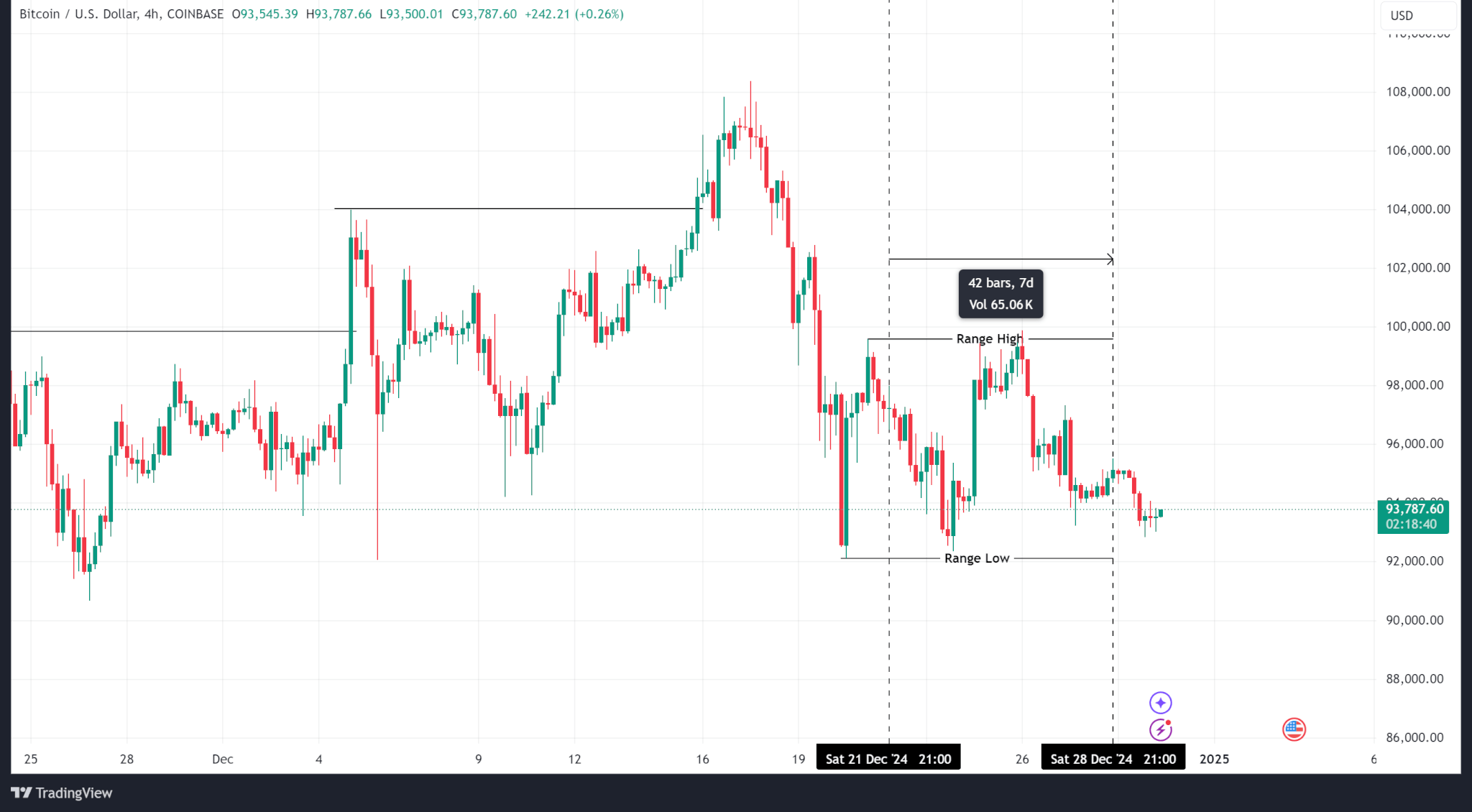

Bitcoin price fell from a weekly high of $99,859 to close at $93,449. However, the intermediate time frame analysis shows divergent movements that failed to break the previous week's highs or lows.

Meanwhile, Bitcoin spot ETF inflows entered Dec. 24 for four consecutive days of net inflows. Revenue for the week ending December 27 was a net negative of $89.70Mn.

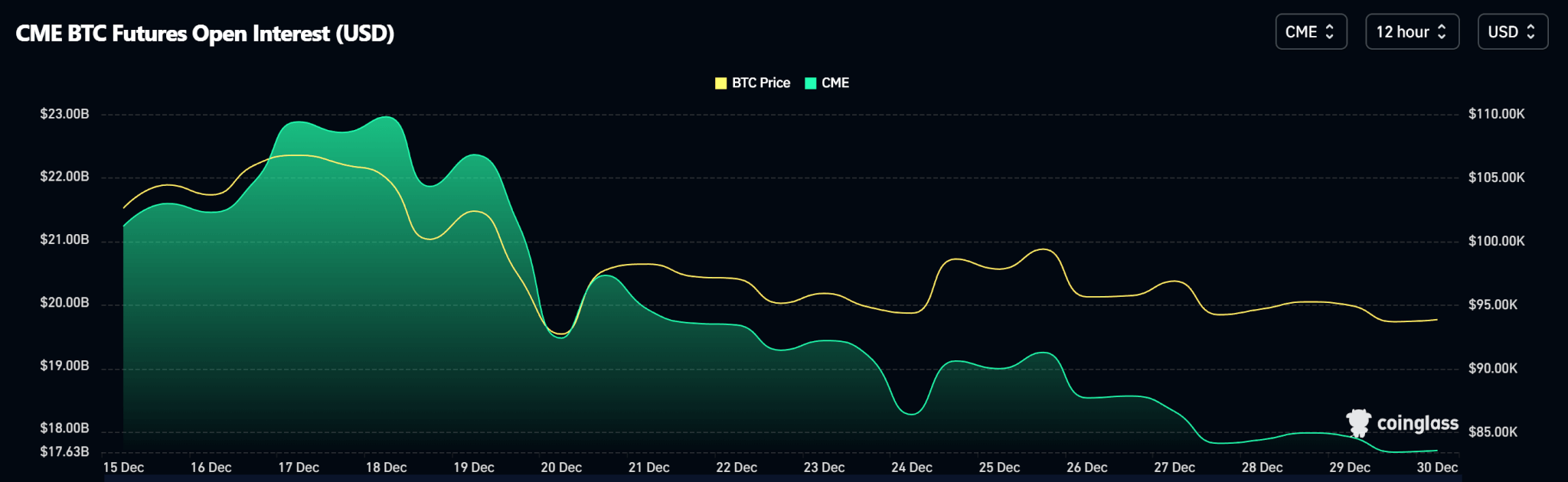

Bitcoin open interest on the CME continues to decline with strong price correlation as traders close out their positions for the year.

BTC is trading at $93,970.06 as of press.

Ethereum

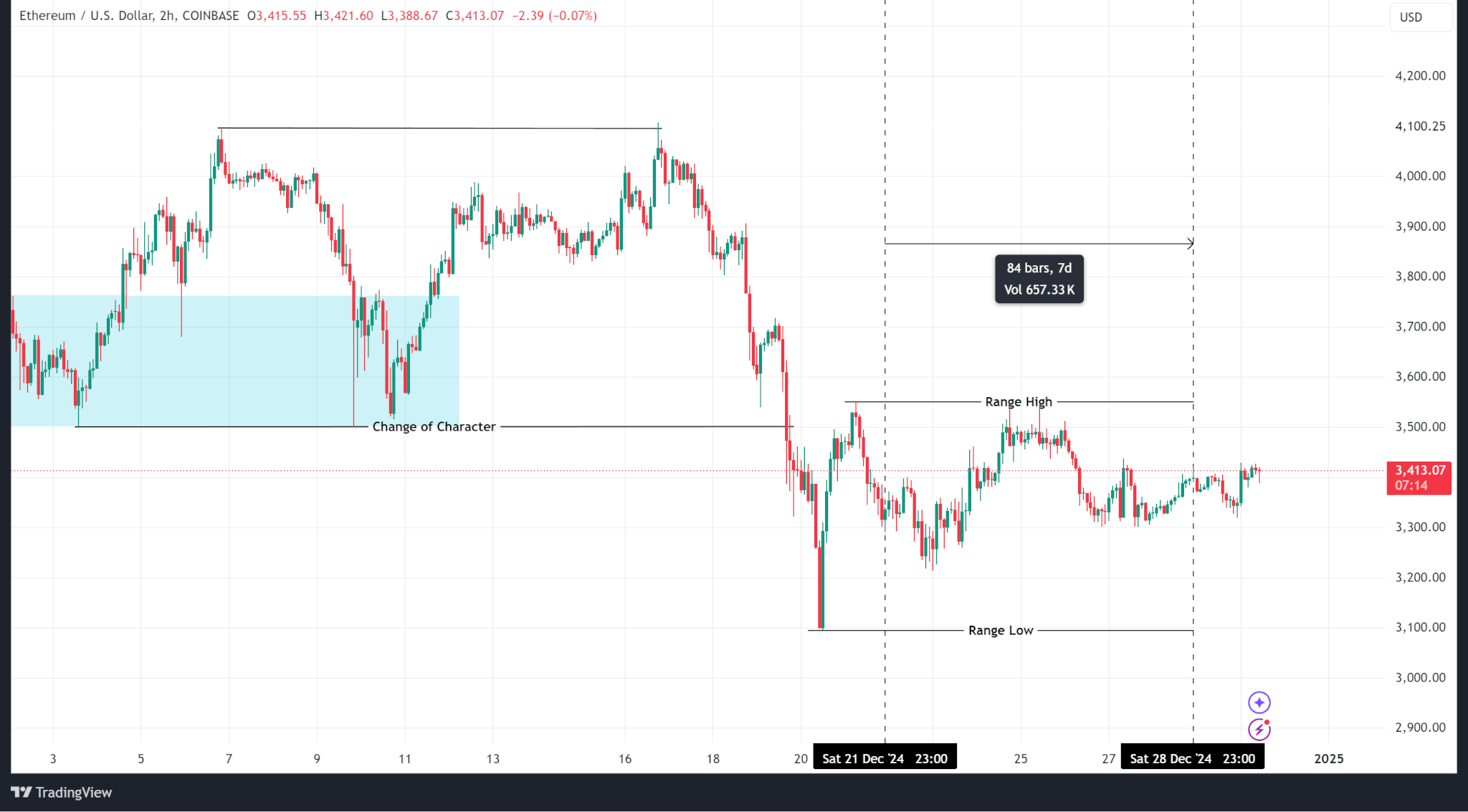

Ethereum's price action during the week showed low volumes and open interest on public markets and major exchanges. Like Bitcoin, the price of Ethereum fell below last week's low at $3,094.67 or $3,550.80 higher.

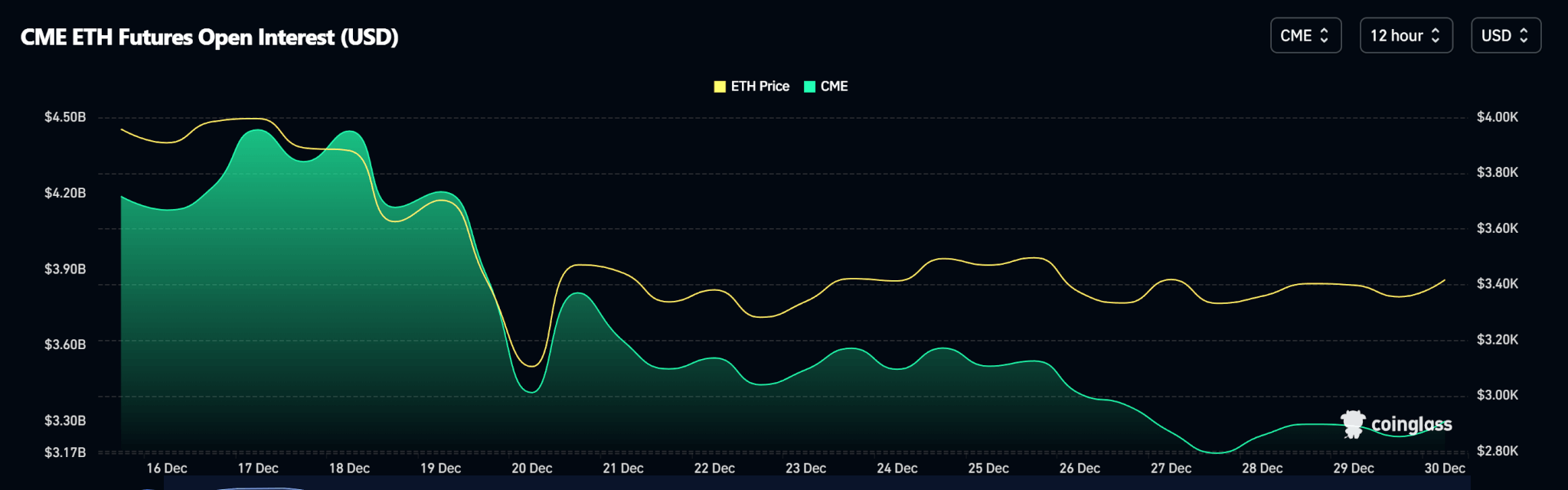

Spot ETH ETF flows show weekly net inflows of 349.3Mn after four days of positive inflows. On the other hand, open interest data shows that levels are declining as traders close out contracts at the end of the year.

ETH is trading at $3,418.21 as of press.

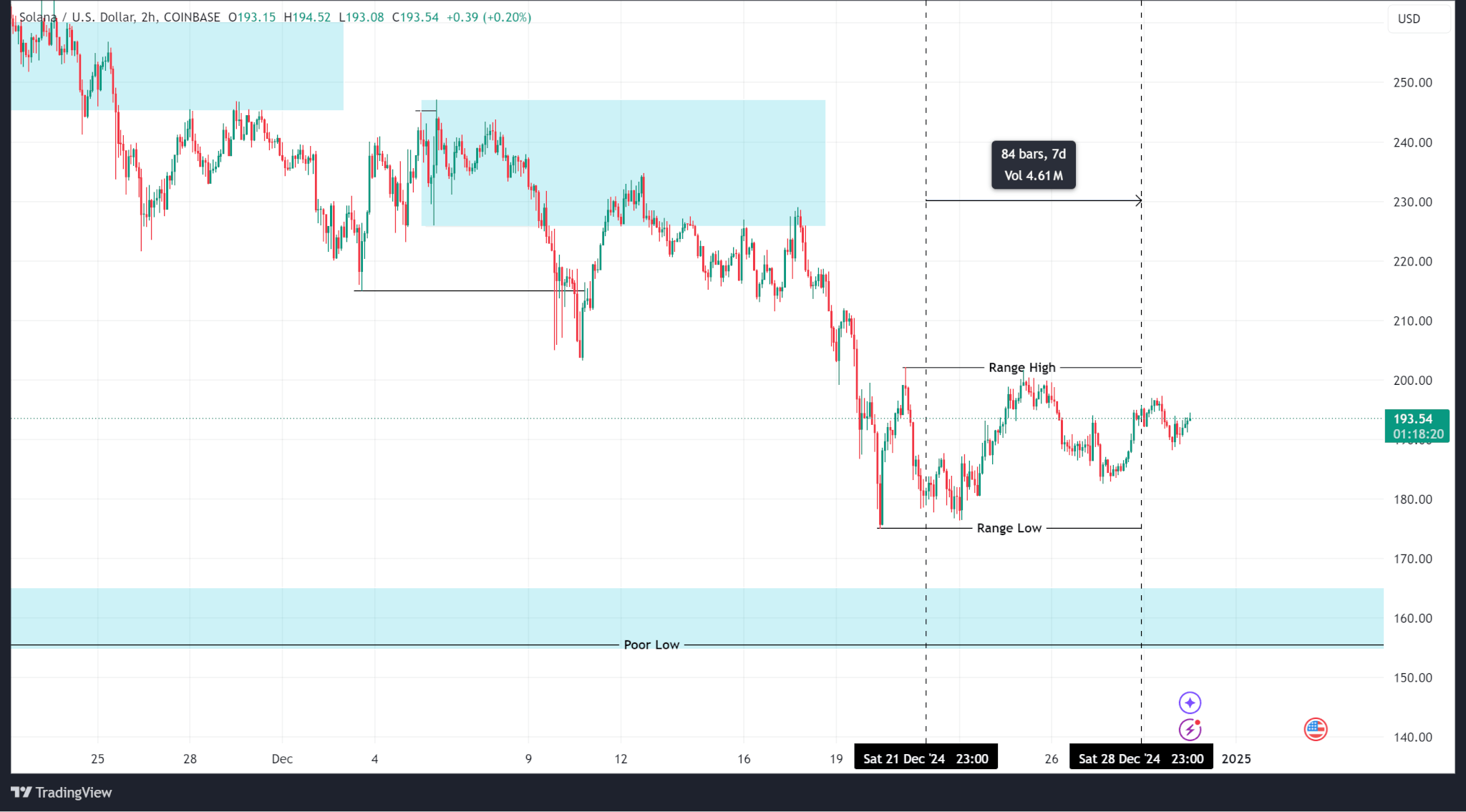

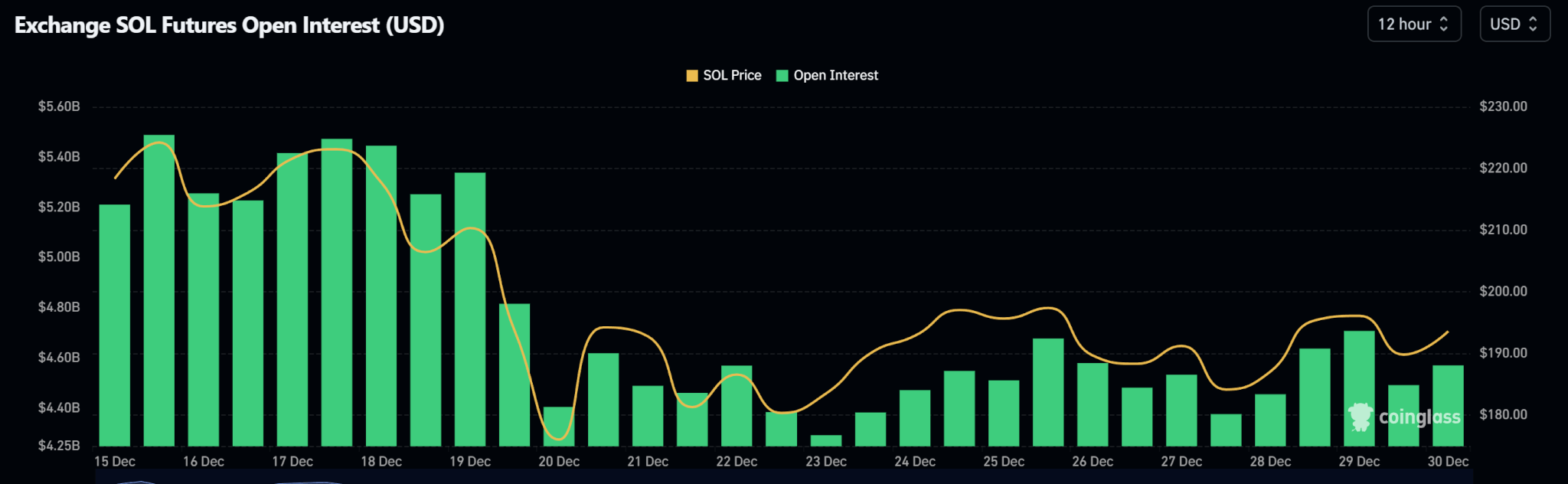

Solana

Solana's price action was between a regional high of $202.00 and last week's low of $175.10. The price tested the higher range on December 25, driven mostly by retail traders, but failed to break above.

Open demand data shows volatile levels but is generally lower than in previous weeks.

SOL is trading at $193.07 as of press.

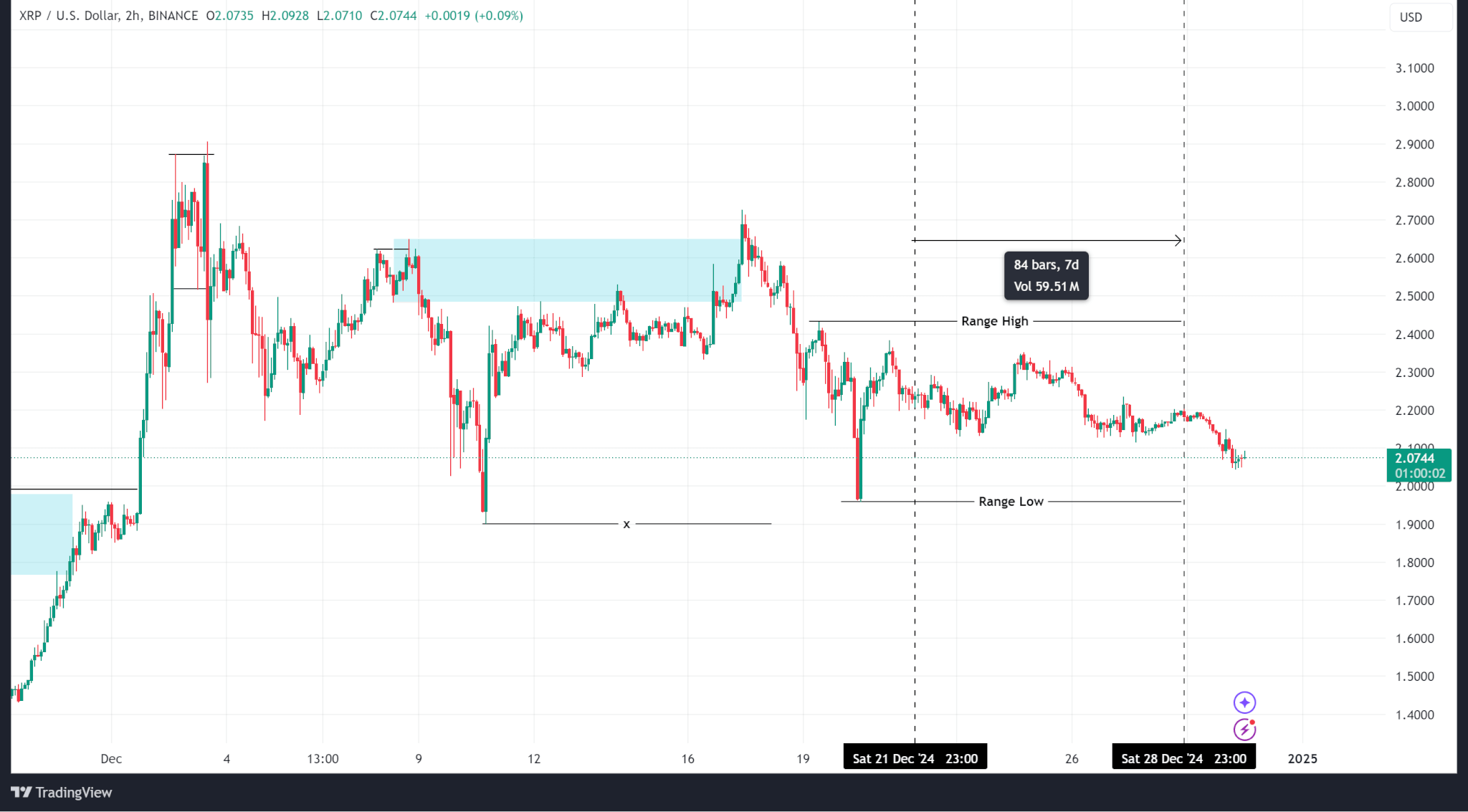

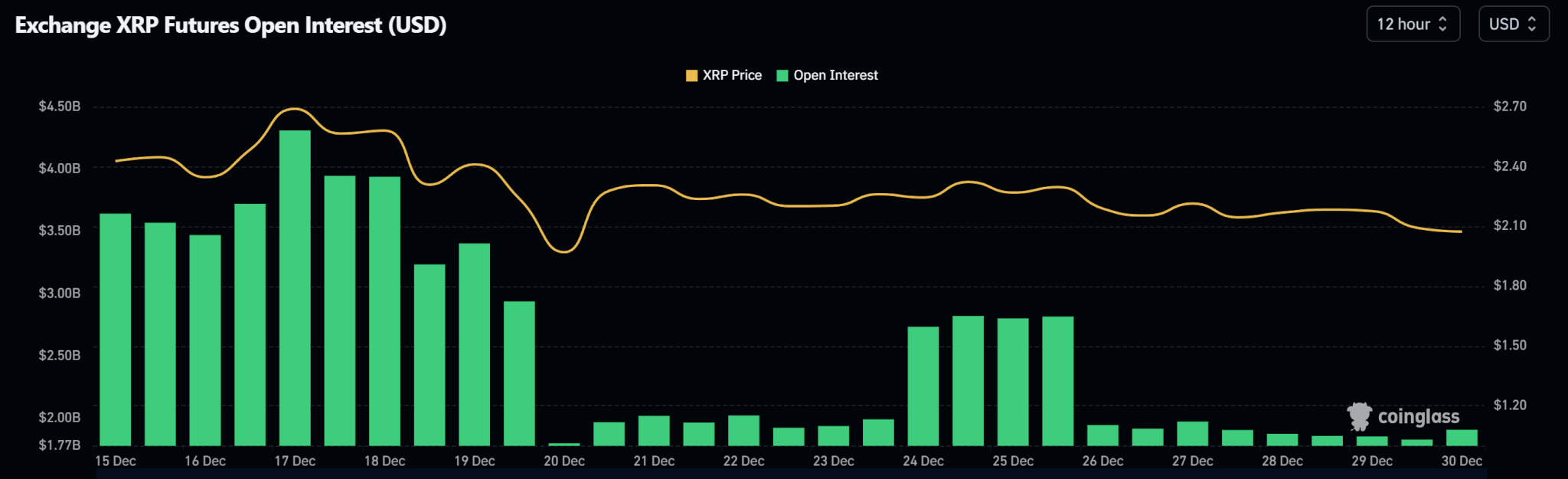

Ripple

Ripple's price action also reached a weekly high of $2.34 and a low of $2.11. However, in this region, price trends are lower.

Open interest data shows sporadic levels driven by pockets of retail traders.

XRP is trading at $2.06 as of press.