What $2.2 billion means for the market.

The discontinued crypto exchange Mt. Gox, once the most important player in the Bitcoin trade, moved $2.2 billion worth of Bitcoin on Monday. The transfer marks one of the biggest transactions since the 2014 crash.

Blockchain analytics firm Arkham Intelligence identified the movement of 32,371 BTC, this transaction sent waves in the crypto market.

Mount Gox moves 32,371 bitcoins

Arkham Intelligence's analysis shows that the popular wallet address “1FG2C…Rveoy” moved 30,371 BTC, while an additional 2,000 BTC was initially transferred to Mt. Gox cold wallet before being moved to another, unmarked address.

Spotonchain confirms the report that in the last four days, Mt. Gox indicates that the value of Bitcoin has moved 2.22 billion dollars. Of these tokens, 296 BTC worth $20.13 million were transferred to B2C2 and OKX. Such significant transfers are noteworthy because they often indicate arrangements for creditor distributions.

Read more: Top Crypto Losses: What You Need to Know

As BeInCrypto reports, Mt. Gox has introduced small-scale lenders using exchanges like Bitstamp and Kraken. The exchanges facilitated easy transfers for people affected by the exchange crash a decade ago. Meanwhile, analysts predict continued volatility, particularly as the US election cycle adds uncertainty to global markets.

“The recent $2.2 billion in Bitcoin activity and the extended payment period from Mt. Gox will inject some volatility into the market in the short term. With such a large amount of Bitcoin entering circulation, there is bound to be short-term inflation as receivers decide to hold or sell.” ” Peter Watson, CEO of Velar Market, told BeinCrypto.

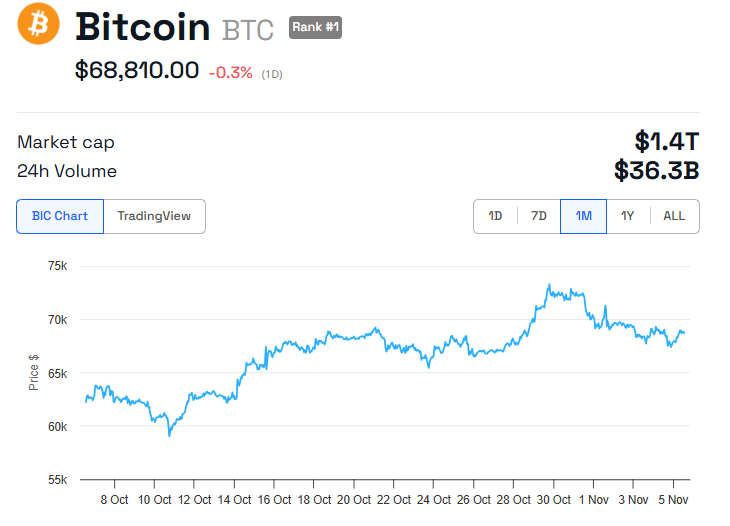

In fact, following the transfer, Bitcoin's price temporarily dipped below $68,000 during Asian market trading, briefly dampening investor confidence. However, the property quickly returned to trading at $68,810 as of writing.

However, Watson said the impact may be less than some fear, especially since many lenders have had years to consider their strategies. He also noted that this could benefit market confidence.

“For many, seeing the Mt. Gox saga finally come to a close may reinforce the belief that Bitcoin is better suited for continued growth and stability.

The ongoing saga of repayment and recovery

The move comes a week after Gox extended its payment deadline to creditors by a year, much to their chagrin. The decision was partly due to logistical and technical difficulties in coordinating payments from thousands of creditors.

“Many rehabilitation creditors have not yet received payment because they have not completed the necessary procedures to receive payment. Additionally, a large number of rehabilitation creditors have not received payment for various reasons such as issues in the payment process,” explained Matt Gox.

This process is a painful journey for lenders and is fraught with delays, legal complications and financial uncertainty. Rumors of a payout continue, fueling concerns about market volatility. However, analysts suggest that the extension process could delay the potential sale.

One user shared on X that “$4 billion sales pressure has now shifted to 2025.”

Read more: Who will own the most Bitcoins in 2024?

According to the data on Arkham, Mit Gox still holds 44,378 BTC, which is approximately $3.05 billion. As the market moves, events like MT Gox's transfers serve as reminders of the industry's volatility. For lenders, however, the protection remains, already extending nearly a decade.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.