What 500K BTC Holdings Mean for Crypto

BlackRock's iShares Bitcoin Trust (IBIT) now holds more than 500,000 BTC, according to chain data. This places BlackRock as the third largest holder of Bitcoin globally, trailing only Bitcoin's anonymous creator Satoshi Nakamoto and crypto exchange giant Binance.

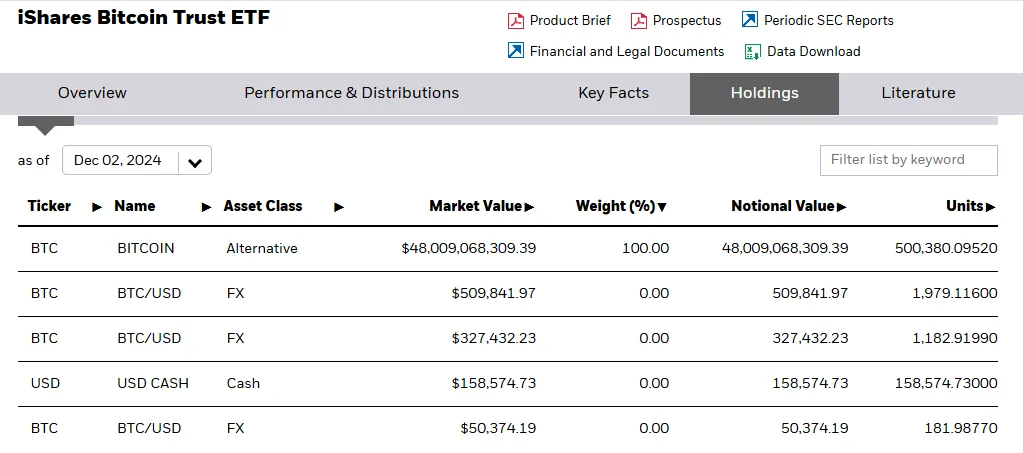

With an estimated holding of $48 billion, BlackRock's influence on the crypto market is expanding rapidly.

Blackrock Aggressive Bitcoin Accumulation

In the 233 trading days since IBIT launched, BlackRock has acquired 2.38% of all Bitcoin. This traction shows the confidence in Bitcoin as a financial asset. His series of purchases reflect this momentum, with BlackRock's total Bitcoin holdings reaching 500,380 units as of Monday, December 2.

Recently, the firm made headlines with its $680 million purchase of bitcoins in a cumulative effort. The purchases have strengthened the strength in the market. BlackRock's pivot to Bitcoin aligns with CEO Larry Fink's shift-oriented outlook. Once a skeptic who dismissed bitcoin as speculative, Fink now describes it as a “neutral asset” with transformative potential.

This change has pushed BlackRock's deeper involvement in the crypto markets. The firm's head of US thematic and active ETFs, Jay Jacobs, recently said that Bitcoin could become a $30 trillion market. As reported by BeInCrypto, he cited more room for BTC adoption.

BlackRock's flagship product, the iShares Bitcoin Trust (IBIT) is a central component of its Bitcoin accumulation strategy. IBIT reached $40 billion in AUM (assets under management) earlier this year, breaking speed records in the ETF industry. In the first day of options trading alone, the fund recorded over $425 million in sales, reflecting strong interest from institutional investors.

Four weeks ago, IBIT outperformed BlackRock's Gold ETF, a testament to Bitcoin's growing popularity in traditional finance (TradFi). According to data from SoSoValue, IBIT continues to lead the charge in the Bitcoin spot ETF market.

The financial instrument recorded a revenue of nearly $340 million on Monday. Its cumulative net income as of Dec. 2 was $32.08 billion, followed by Fidelity's FBTC at $11.48 billion.

BTC Institutional Adoption Drives Decentralization Issues.

BlackRock's Bitcoin strategy extends beyond ETFs. The firm also increased its exposure to Bitcoin through investments in MicroStrategy, Bitcoin's largest corporate owner. This move demonstrates BlackRock's belief in Bitcoin's long-term value proposition and its desire to institutionally control the Bitcoin market.

Among other TradFi players, the company's initiatives have legalized Bitcoin as an asset class. However, not everyone respects it.

Critics in the crypto community argue that institutional dominance is at odds with Bitcoin's decentralized system. As BlackRock accumulates such valuable holdings, the company risks consolidating control in a space designed to empower individuals over institutions.

“Once upon a time bitcoin was a dream…not this,” lamented one user on X.

For some critics, the growing institutional buying of Bitcoin defeats the whole purpose of decentralization, with the likes of BlackRock vying to become the biggest hoarder.

Nevertheless, BlackRock's rise as a major bitcoin holder marks a significant shift in the cryptocurrency playing field. On the one hand, it highlights Bitcoin's mainstream acceptance and potential as a global financial asset. On the other hand, it raises questions about the role of large financial institutions in a space traditionally associated with grassroots financial sovereignty.

With IBIT leading the charge and setting the benchmarks, the company is poised to remain a key player in the crypto industry. However, the debate over whether this benefits or harms Bitcoin's fundamentals is likely to subside.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.