What caused Bitcoin’s price to fall below $42,000?

The price of BTC has struggled significantly since the US Securities and Exchange Commission (SEC) approved the position of Bitcoin ETFs (exchange-traded funds).

Still, ETFs attracted a lot of investors, resulting in heavy trading during the first two days of trading.

See Bitcoin ETFs trading volume

According to available data, Bitcoin ETFs have collectively seen a trading volume of nearly $8 billion. On its opening day, its volume rose to about $4.6 billion and on its second day of trading, it gained over $3 billion.

Greyscale's GBTC ETF turned out to be the most actively traded Bitcoin ETF during this period. Remarkably, the total transaction volume has exceeded $4 billion, cementing its position at the forefront of the market.

New issuers such as BlackRock, Fidelity, Bitwise and others also saw big trading moves within days. In particular, BlackRock CEO Larry Fink said he views the top cryptocurrency as an asset class rather than a currency, appreciating the early success.

However, some analysts say this early trading activity was a flop because most of it came from grayscale exits. But Bloomberg analyst Jeremy Seifert countered that such arguments are “clickbait” based on “unrealistic God-candle assumptions.”

“We continued to talk about how a large amount of money in these things comes from Bitcoin and other crypto-related exposures. And we went on to talk about the long-term impact these could have as a bridge. Any talk of this being a flop or a horror was either clichéd or had unrealistic “Goddess candle” hopes, Seifert added.

The price of BTC fell after selling pressure

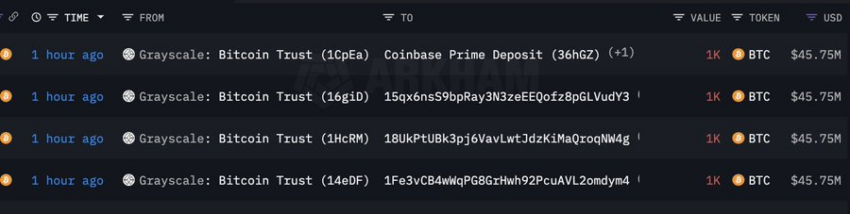

In the midst of heightened trading activity, Grayscale transferred 4,000 BTC worth $183 million to Coinbase. This transaction, which took place in four batches of 1,000 BTC each, took place on Coinbase Prime, a significant participant in the recently launched Bitcoin ETF.

It is worth highlighting that Coinbase acts as a broker and custodian for Greyscale. Therefore, these BTC transfers could be deposits from the sale of Greyscale's ETF.

Read more: Has Bitcoin reached a market peak? Smart Whale sold 2,742 BTC

In addition, on-chain analyst JA Martunn pointed out the potential for increasing sell orders in the Bitcoin market. It indicated that two sell orders involving 1,900 BTC were triggered at certain price points. The first 894 BTC at $44,000 and an additional 1,071 BTC when the asset reaches $45,100.

“At the moment, there is a long period of strong selling pressure. At this point, the price may start to return to its average,” said crypto analyst Martin.

These transactions had a significant impact on the price of BTC. Bitcoin fell more than 7% to below $42,000.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.