What if the Altcoin season never comes? Analyst raises concerns.

Renowned crypto educator and analyst Duo Nine poses a question that no one wants to hear. “What if the altcoin season never comes?

The altcoin period is an informal term that describes the level at which investing capital in Bitcoin (BTC) can generate better returns.

Analyst Explains Delay in Altcoin Season

After the fourth Bitcoin halving, the next main focus of the crypto market, aside from the approvals and launches of Ethereum ETFs (exchange-traded funds), was the anticipation of the altcoin season. Several key events typically lead up to this stage.

First, fresh capital enters the cryptocurrency market, first flowing into a stable coin, Bitcoin or Ethereum. These assets are prioritized because of their stability compared to smaller market capitalization cryptocurrencies. Subsequently, this capital flow triggers a market rally.

Eventually, profits from these assets will begin to flow into altcoins, along with additional capital. This capital drive is what sets the altcoin season in motion. According to the altcoin season index, crypto markets are currently in a Bitcoin season.

Negative flows for Ethereum ETFs

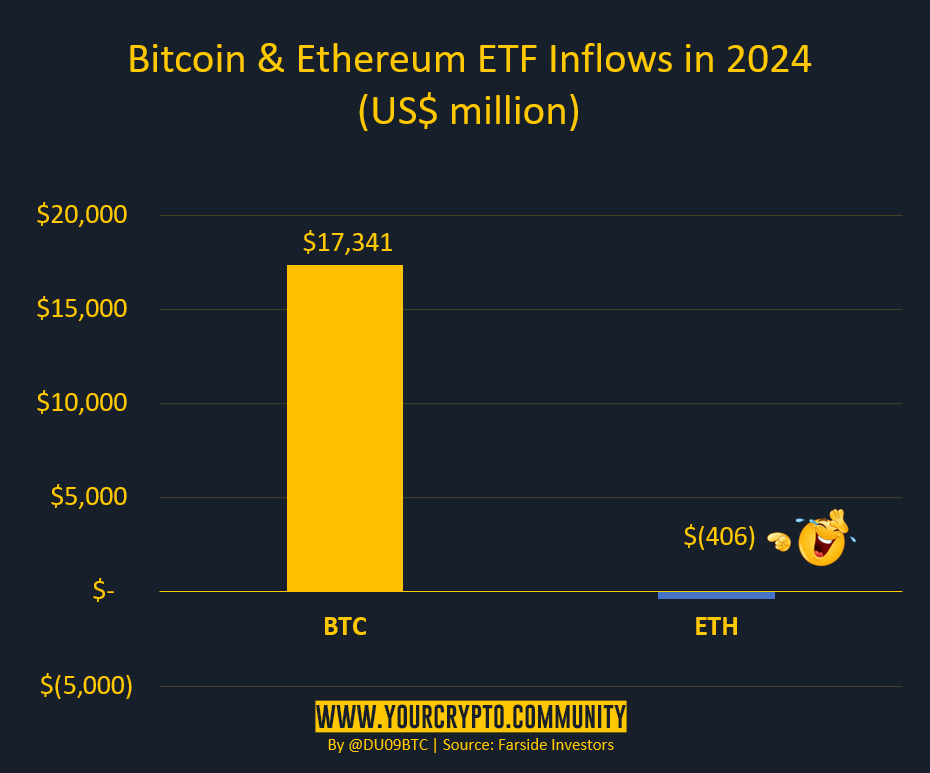

Duo Nine outlines the sequence leading up to the altcoin era that hasn't quite happened yet. It suggests that fully investing in altcoins could be problematic, which shows negative inflows for Ethereum ETFs as a worrying sign.

As of January 2024, Bitcoin ETFs have managed to attract more than $17 billion in net investments after grayscale sales. The Ethereum ETF went live in July. A net balance on that? – $406 million,” the analyst wrote.

Read more: What is Altcoin Season? General guidance

The negative flows of Ethereum ETFs come amid the ongoing recovery of Greyscale's clients after switching their faith to ETFs. Before spot ETFs were approved, the Greyscale Bitcoin Trust (GBTC) was allowing investors to buy shares in US dollar terms. Now, with the availability of BTC and ETH ETFs, clients are choosing to sell Bitcoin and Ethereum to take their holdings, contributing to negative flows.

According to the analyst, while Greyscale clients sold $2.3 billion in ETH since July, the ETF's buying pressure was not enough to offset this sale. If Solana ETF launches Duo Nine will see no difference to the altcoin season.

However, it is important to note that the ETH ETF market is still in its infancy. In this context, it is important to understand that while the short-term outlook for Ethereum ETFs may be weak, the medium- and long-term prospects are bullish.

Ironically, it took some time before Bitcoin rallied before the launch of the BTC ETF on January 11th. The pioneering crypto was slashed horizontally for over a month before heading north.

“The reason the investor's buying of the new Bitcoin ETFs did not increase the price of Bitcoin is that the outflow from the sale of GBTC and BTC exceeds the total income of the other ten Bitcoin ETFs. If initial demand for ETFs slows down, I expect more price cuts,” economist Peter Schiff said at the time.

In the year Just over a month has passed since the July 23rd launch of Ethereum ETF, giving ETH plenty of time for price discovery. Once Greyscale client redemptions ease, ETH ETF flows may stabilize positively, with capital flowing into Ethereum circulating into altcoins.

Bitcoin Dominance Breakout

The analyst also based his ‘no altcoin season' thesis on the crash seen in Bitcoin's dominance chart. This means that BTC is higher than altcoins, which suggests a lack of confidence in the latter. Based on CoinGecko's data, BTC dominance currently sits at 53.8%.

This engagement may be due to market volatility caused by global geopolitical tensions, political disillusionment in the US and fears of recession, among other volatility-threatening narratives. This prompts investors to rally behind Bitcoin, a flight to safety, as BTC is considered a better safe haven than altcoins.

However, some investors see Bitcoin's high dominance as an opportunity to stock up on altcoins at low prices. When Bitcoin's dominance is high, altcoins may be undervalued relative to Bitcoin, giving people who believe in the long-term potential of certain altcoins an opportunity to buy.

Read more: 11 Cryptos to Add to Your Portfolio Ahead of the Altcoin Phase

Based on the chart above, as Bitcoin's dominance continues to rise, it is approaching critical resistance, which altcoins may see its way through. However, in the skepticism of the altcoin season, some say it will fail to be as robust as 2017 and 2020.

“This narrative comes up every cycle with Bitcoin maxis and it never works. Eventually when dominance starts to decline, a portion of Bitcoin supply will flow to ALTs. There will come a time when dominance will drop below 45% and it will happen in this cycle,” another X user added.

Despite the delays in the altcoin season, analysts are looking at some altcoins this month, with some encouraging hope that a delay may not necessarily mean a total absence.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.